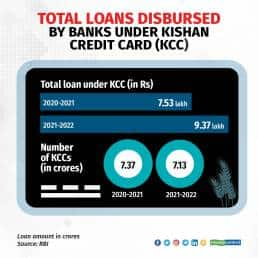

Bank loans given through Kisan Credit Cards (KCC) have registered sharp growth of around 24 percent in the last year. According to the latest data available from the Reserve Bank of India (RBI), total outstanding loans through KCCs grew to Rs 9.37 lakh crore in March 2022 from Rs 7.53 lakh crore in March 2021. This 24 percent increase is an unusually sharp jump in what the banking industry perceives as high-risk loans.

Take a look at these numbers: In the preceding year, i.e., from March, 2020 to March, 2021, KCC loans had grown just 1.3 percent, from Rs 7.43 lakh crore to Rs 7.53 lakh crore. In the previous year, the yearly growth was just 6.5 percent (2019-2020) and in the year before (2018-2019), it was at around 4 percent.

Why did KCC loans rise so much in the last year? KCC Loans

KCC LoansOne reason for the increase could be the continuing pressure on state-run banks by the government to push more agriculture credit to farmers. Every year the central government sets an agri-credit target for banks while announcing the Union Budget. This target has been rising every year. In Union Budget 2022, the Government raised the agriculture credit growth target to Rs 18 lakh crore from Rs 16.5 lakh crore. In the latest Budget i.e., Budget 2023, the target was increased to Rs 20 lakh crore.

According to RBI data, banks’ total loan outstandings to the agricultural sector stood at Rs 15.16 lakh crore in March 2022 as against Rs 13.84 lakh crore in March 2021 and Rs 12.39 lakh crore in March 2020.

Banks, mainly state-run banks, have to fulfil these targets within the year. For state-controlled banks in particular, this is often a big burden. The buck stops with branch-level bankers, who then try to push agri loans through the KCC route, often knowing that the money may not come back on time.

Agriculture loans are also a part of banks’ 40 percent priority sector lending (PSL) target. PSL is mandatory lending by all banks to economically weaker sections. Of the PSL, 18 percent is directed towards farm loans. Hence, lending to agriculture is a compulsion for banks under the PSL rules as well.

What are KCC loans?KCC loans have a long history in India. The scheme was introduced in 1998 for the issue of Kisan Credit Cards to farmers, basis their holdings, so that the farmers could use them to readily purchase agricultural inputs.

Farmers eligible under the KCC scheme include small farmers, marginal farmers, sharecroppers, oral lessees, and tenant farmers. Self Help Groups (SHGs) or Joint Liability Groups (JLGs) are also eligible for benefits under the said scheme.

For a farmer, it is relatively easy to get the loan. The scheme provides an ATM-enabled RuPay Card and one-time documentation. It operates mostly like a credit card and offers funds at cheaper rates compared to other loans. The limit of the loan rises by 10 percent every year, based on assessments by banks. The repayments on such loans are done mostly through part-payments, which keep the loan active and performing technically. But, the liability for the bank goes up in subsequent years since full repayment of the loan doesn’t happen in many cases.

Monitoring end-use a problemThe biggest problem with KCC loans is that these loans aren’t necessarily used for farm-related activities that may result in cash flows. Hence, monitoring them is almost impossible.

Going by the structure, KCC loans can be used for consumption activities as well, along with covering post-harvest expenses and working capital requirements. According to senior bankers, in many cases, these loans end up as consumption loans for activities such as purchase of two-wheelers, television sets or for wedding expenses in households. This means, these loans do not necessarily result in productive assets and hence the ability of the borrower in making timely repayments is impacted.

“KCC borrowings are often used as consumption loans rather than productive agri-input purposes,” said Naresh Malhotra, former banker at SBI, and a Mumbai-based banking consultant. “The consequent reduction in repayment capacity ultimately leads to the burgeoning sectoral GNPAs,” Malhotra said.

Even otherwise, agriculture is a high-risk area for banks due to crop failures caused by unseasonal rains and seasonal shocks. In a report, Emkay Global Financial Services, a research company, said that since 1994, India has faced seven instances of El Nino, which led to lower agri production and higher NPAs in the subsequent three-four quarters. These factors have already been reflected in banks’ balance sheets. Across the industry, major banks have seen a rise in stressed assets from the segment.

The curse of loan waiversUnlike other loans, banks have immense political pressure while dealing with farm loans. KCC loans have been a source of pain for state-run banks in the past with high default rates. A big jump in the quantum of such loans ahead of an election year is a worry for banks.

Repeated instances of farm loan waivers announced by political parties ahead of every major state election causes the credit quality of the banks to go down.

A loan waiver simply means the ruling government asking the banks to waive or write off the loans of a large number of borrowers in one go. The government then promises to compensate the banks from its own coffers for the amount that is waived.

A farm loan waiver is an easy tool. It is a promise by the politician to farmers that their loans will be written off in exchange for votes. The winning politician then uses taxpayer money to repay these loans to banks, thus straining the fiscal positions of state governments.

What is the damage caused by the loan waivers? It immediately takes a toll on the credit discipline of a large section of borrowers. Once the waiver is announced even honest borrowers stop repayments to banks, resulting in a spike in overall bad loans. On the other hand, such exercises don’t really help marginal famers, as studies have shown..

The numbersAccording to the Financial Stability report by the RBI, released in December 2022, agricultural loans comprised 8.6 percent of the total bad loans of banks. Although this is a slight improvement from 10 percent a year earlier, experts said the El Nino weather phenomenon, which adversely impacts agricultural production, could have implications for the banking system.

“Loan waivers, mostly prior to legislative elections, dilute credit discipline in the borrowing community. Hence, the reluctance to repay,” Malhotra added.

Earlier, in an exclusive interview with Moneycontrol, former State Bank of India (SBI) chairman Rajnish Kumar had called for reforms in the KCC loan scheme. “A relook at the Kisan Credit Card scheme is required. The scheme is old-fashioned and leads to high NPAs,” Kumar said.

As Moneycontrol reported in this story, experts have raised red flags on the sharp spike in KCC loans.

Unless banks exercise supreme caution with their KCC loan portfolios and the government reforms the KCC loan scheme, this segment could end up as a ticking timebomb for Indian banks in the coming years.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.