BUSINESS

Banking Central | Why cooperative bank regulations must get a structural makeover

For a common customer, a cooperative bank is no different from regular bank as both type of entities are dealing with public money. Hence, regulations cannot be different for both sides

BANKS

Banking Central | RBI cracks whip on unsecured loans again. Will digital lenders get the message?

With the latest move, the RBI has given a clear cue to all digital lenders to get their act together

BUSINESS

Why RBI cracking whip on consumer loans is no surprise

A Moneycontrol Banking Central column on October 9 highlighted the central bank’s concerns regarding sharp growth in unsecured loans. On November 16, the RBI cracked the whip

BUSINESS

Banking Central | Bank books look cleaner now, thanks to massive loan write-offs

While there is significant improvement on the reported NPA numbers, much of this is due to large-scale write-offs

BANKS

Banking Central | Who's telling the truth in the BoB World mess?

Contradictory statements on BoB’s former digital head’s exit indicate not all was well within the bank

BUSINESS

Banking Central | Coop banks finally get the right cure for wounds of corruption

These banks have faced major governance lapses over years ranging from loose audit practices, vested interests and unprofessional boards. There are signs of change from this status-quo

BUSINESS

Banking Central | As Uday Kotak’s successor, Ashok Vaswani has big shoes to fill

Vaswani coming on board will enable the Mumbai-based bank to progress on its digital journey and set eyes on global markets. But there are immediate challenges as well..

BUSINESS

Banking Central | It's trust that's under threat. Banks should read fine prints in RBI missive to BoB

More important question is why are bank employees resorting to unprofessional practices to boost customer volumes? The answer is internal pressure from top executives to acquire business.

BUSINESS

Banking Central | What does RBI know about unsecured loans that we don't?

The central bank’s warning has come in the backdrop of a sharp rise in personal loans in the recent past.

BUSINESS

Except the Chanakya entry, Das’ inflation-fighting script remains the same

The RBI will likely wait for more signs of sustainable easing of retail inflation print before reversing the rate stance and thinking about a rate cut. That’s still some time away.

BUSINESS

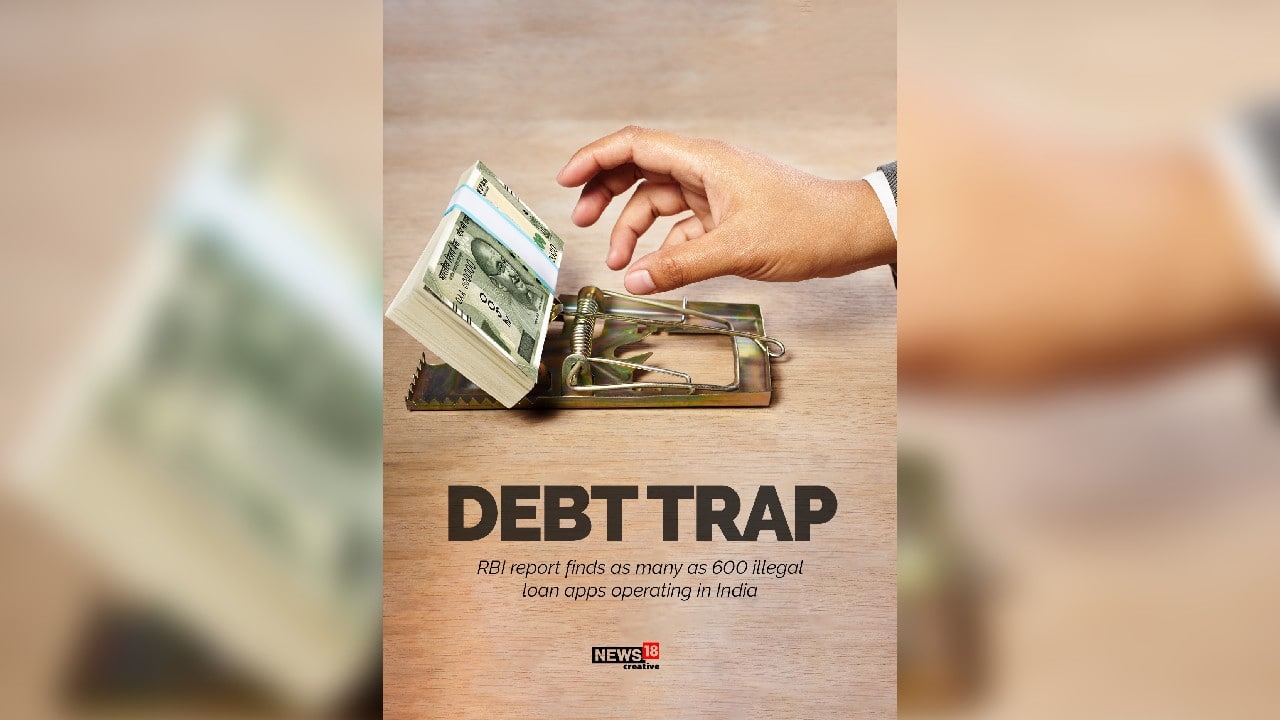

Banking Central | From debt trap to death trap, thanks to small loan apps

Quick money at your fingertips is recipe for disaster. Stay away from illegal loan apps.

BUSINESS

Banking Central | Wilful defaulters are nothing but financial criminals

These borrowers have gamed the system and for long, escaped the rule of law, using fraudulent tactics. The RBI proposed rules promise to plug the loopholes in the system

BANKS

Banking Central | Why have big bank CEOs gone silent?

The communication strategy of top bank CEOs has changed in recent years. They have become more guarded and remain somewhat cut off from the media, leaving their communication specialists or subordinates to do the talking. And those specialists believe no news is good news.

BUSINESS

Will RBI’s rap on knuckles force banks to be fair to their customers?

There have been countless disputes against banks on delayed release of collateral documents even after paying up full loan. That will change now.

BUSINESS

Inflation is falling but don't uncork the bubbly yet

The MPC is determined to bring inflation back to the 4 percent target and is unlikely to flinch with short-term variations in the print

BUSINESS

Banking Central | Why Uday Kotak's era is far from over at Kotak Mahindra Bank

Kotak, along with his relatives and enterprises in which he has beneficial interest, held 25.95 percent of the equity share capital of the bank and 17.26 percent of the paid-up share capital of Kotak Mahindra Bank as on March 31, 2023.

BUSINESS

Meet Dipak Gupta who will succeed Uday Kotak as interim chief at Kotak Mahindra Bank

Gupta will need to also assure investors and depositors of smooth handling of the bank till the leadership transition is complete.

BUSINESS

Banking Central | Do we really care about cooperative bank depositors?

There are many cases of bank failures where depositors are still waiting for their money. Kerala-based Karuvannur co-operative bank is a big example.

BUSINESS

Interview | I think there are substantial risks to both the growth and inflation outlook: MPC member Jayanth Varma

In its latest meeting, the MPC has kept the repo rate unchanged at 6.5 percent and said future actions will depend on incoming data.

BUSINESS

Banking Central | When will banks start listening to the regulator and treat customers fairly?

Fairness in customer transactions is a virtue banks have ignored for long. Consumers cannot taken for granted

BUSINESS

View| Will inflation shocker push MPC for a rate hike in October?

The MPC is likely to remain on a cautious note but may not hike rates yet. It would want to look at how the vegetable prices behave in the months ahead.

BUSINESS

Banking Central | Rs 2,000 notes; did these bills do more harm to us than good?

The Rs 2,000 notes have been used rampantly by the fake currency mafia ever since the bills introduced. Besides, going by the data from the IT department, these notes have constituted a major chunk of the black money seized in recent years.

BUSINESS

In fight against inflation, MPC caught between a rock and a hard place

The factors fuelling food inflation are largely supply driven, where the RBI rate action may not help much. The central bank has already acted on the rate front and through liquidity measures. Over to government now?

BUSINESS

RBI Policy: As inflation fears continue, MPC keeps repo rate unchanged yet again

The RBI announcement came in the wake of recent spike in inflation triggered by high prices of food items