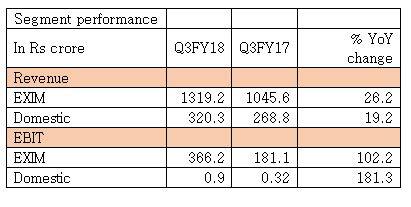

Container Corporation of India (CONCOR), which enjoys close to 86% market share at one of the largest ports in India, JNPT, has been the key beneficiary of revival in the EXIM trade. During the quarter ended December 2017, the company reported strong 26% year-on-year increase in EXIM revenues to Rs 1319.2 crore along with an equally strong 19% growth in domestic business to Rs 320.3 crore.

Apart from higher volumes, company’s strategy to increase the count of double staking has helped in generating higher revenue. Double staking, which is about 10% of its total volumes increased by almost 90% during the quarter to 532 rakes. This partially helped company to save costs and as a result the company reported 1025 basis point reduction in operating cost ratio to 67% in Q3FY18 as against 77% in the year-ago quarter.

Lower costs and higher volumes further helped in improving margins. For instance, despite 139.5% increase in staff cost as a result of implementation of wage hike related to pay commission, operating profit margin increased to 27.2% an improvement of almost 735 basis points.

This year has been good for Concor on the back of higher volumes. In FY18, till November, industry’s container volumes grew at 14% including 16% growth in EXIM volumes and 20% growth in domestic volumes. This also got reflected in Concor’s performance.

During the nine months ended December 2017, Concor reported 13% growth in operating income and 44% growth in net profit to Rs 755.4 crore. Moreover, the company is hopeful of maintaining the momentum with volumes growing and its strategy to leverage existing assets working in its favour.

It is working on increasing contribution of double staking in the overall revenue. That apart, income from other value added services like cargo handling, customisation for sectors like cement would be value accretive and help it to sustain margins. Post the commissioning of the dedicated rail freight corridor, Concor would be the biggest beneficiary because of the increasing share of rail in overall logistics space.

Consensus estimate suggest an EPS (earnings per share) of about Rs 40-41 per share this year (FY18) and around Rs 50 a share in FY19. At the current market price of Rs 1,459, this translates to a price to earnings ratio of 35 times FY18 and 30 times FY19 estimated earnings.

Valuations are still reasonable considering high return ratios and leadership position in a growing industry. That apart, the company has good earnings visibility and sitting on cash equivalent of close to Rs 2,900 crore, which is about 10% of its market capitalisation.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.