At a time when the market is trading at ‘cloud 9’, a geopolitical concern is something which you least expect, especially if you are an Indian investor. Nobody would have dreamt it that something like this will be sitting on the front door of India market Friday

morning.

Markets across the globe came under pressure after the US military launched cruise missile strikes against a Syrian airbase controlled by President Bashar al-Assad's forces in response to a chemical attack in a rebel-held area.

Military strike kicked off risk off sentiment, which fuelled demand for safe havens like bonds and Yen. Sovereign bonds, gold and oil prices rallied hard while equities took a hit.

The Nifty hit a record high of 9,273.90 earlier in the month of April and nearly 200 stock rose to fresh lifetime highs in the same period which includes names like HDFC, Maruti Suzuki, Kotak Mahindra Bank, Yes Bank, P&G, MRF, RBL Bank, Dalmia Bharat, Godrej Industries, Natco Pharma, IIFL Holdings, Future Retail, Jubilant Life Sciences, Exide etc.

But, in the world of equity markets, some of the best correction or entry points come when you least expect it. Back in September 2016, when India carried out "surgical strikes" on terror launch pads across LoC led to sharp decline in Sensex and Nifty.

The Nifty managed to hold around its 5-days exponential moving average (EMA) placed around 9,225. The risk-reward equation becomes favorable for long-term investors if the index slips below 9,000 levels.

“I think the jury is out, it depends on what comes next. Clearly, Russia is a key backer, and how it Russia responds, and locally Iran is a key backer, and how Iran responds are part of the unknowns that we will have to see,” Arvind Sanger, Managing Partner, Geosphere Capital Management said in an interview with CNBC-TV18.

The world is becoming a more uncertain place. Sanger further added that I would wait for more meaningful, attractive entry point before we jump in. A good buying zone would emerge if the Nifty slips below 9,000.

Nobody knows if the correction could escalate further, but if you have direct exposure to equities, it would be better if you hedge your portfolio and reduce your leverage holdings.

Invest via Mutual FundsIf you are not someone who doesn’t have the time to track markets on a regular basis mutual funds are your best bet. On one hand, they assure professional management of your money and on the other, it results in diversification which spreads your risk.

Retail investors have realised that fact which is evident from the Folio counts which has only increased over the years.

Overall, MF AUM has seen a very healthy growth rate of 45 percent so far in FY17. The overall industry AUM is Rs 18 lakh crore, as of data collated as on 28 February 2017.

Industry Folio count saw a 10.5 percent increase to crossed the 5 crore count. Total folio count is at 5.28 crores as on Feb 2017.

If the markets start to trend southwards increase your allocation towards mutual funds (MFs) because the bullish argument for Indian market still remains intact.

Do not discontinue your systematic investment plans (SIPs) because at low net asset value (NAV) you would be able to get more units at the same monthly amount.

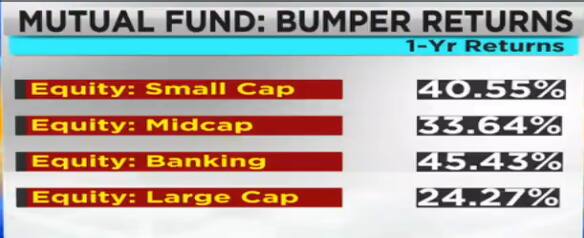

The top performing theme of FY17 was smallcap theme, which gave 40 percent return to investors followed by midcap theme which gave 33 percent, banking which delivered 45 percent and largecap MFs gave 24 percent return.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.