It was a historic day for the market, as the S&P BSE Sensex surged to a fresh record high of 30,167.09, while the Nifty rose to a fresh lifetime high of 9,367 on Wednesday. But, if you are looking at just the benchmark indices, you will miss out the action in individual stocks.

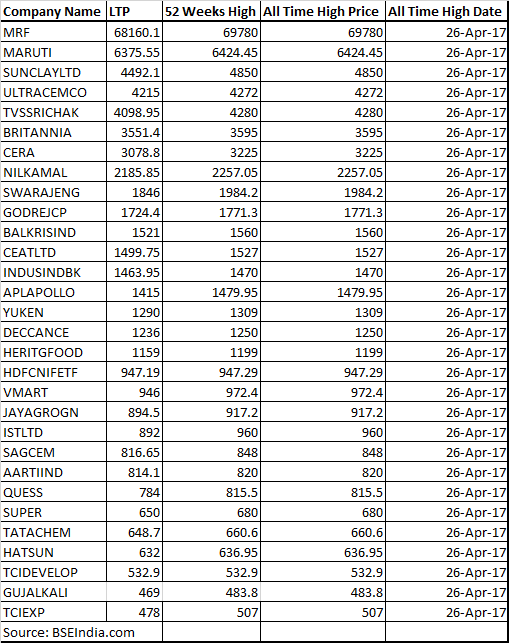

As much as 77 stocks hit fresh lifetime highs on the BSE, which include names like MRF, Maruti Suzuki, UltraTech Cement, TVS Srichakra, Britannia, IndusInd Bank, CEAT, Nilkamal, Aarti Industries etc. among others.

If we include stocks, which are at 12-month highs, the list extends to nearly 300 stocks which signify strong bullish momentum in the markets. But, investors should remain cautious at current levels as markets are trading near crucial resistance levels.

The liquidity wave might have taken every second stock higher, but for investors, a clear study of fundamentals is required before they deploy their hard-earned money in specific stocks, based on their risk profile.

“Investors should look at every stock on an individual basis and see if it meets your investment philosophy for whatever investment style you are following. If it does not then take a call accordingly,” Sanjeev Prasad, Kotak Institutional Equities said in an interview with CNBC-TV18.

“Ultimately, stocks keep on going and there has to be some fundamental rationale for that. Honestly, over the last one to one and a half month, the kind of stocks that are rallying without any real change in fundamentals, and investors should take a cautious call” he said.

More than 130 stocks rose to fresh 52-week highs on the NSE which include names like Bayer Crop, Navin Fluorine, Swaraj Engines, SKF India, HDFC, Aditya Birla Nuvo, HDFC Bank, APL Apollo Tube, Bajaj Finance, and Siemens etc. among others.

On the BSE, the list extends to 279 stocks which include names like Cera Sanitaryware, Sundaram Clayton, Yuken India, Deccan Cements, Grasim Industries, Heritage Foods, IGL, Cummins India, V-Mart Retail, KSE, UPL, Aarti Industries etc. among others.

The Nifty is trading at trailing P/B (price/book value) of 3.5x, which is in line with the long-term average. The foreign institutional investors (FIIs) have invested the USD 25 billion and the domestic financial institution has invested USD 13.2 billion in last three years.

The overall environment in financial markets across the globe has been quite cheerful in the last couple of days, which has supported rally in the Indian market. Although, the current up move could be the result of short coverings along with the creation of fresh long positions.

“It seems that our market was awaiting some positive triggers to resume the uptrend and has done exactly the same. The chart structure looks sturdy and most of the technical indicators are pointing northwards; indicating a continuation of the ongoing optimism,” Ruchit Jain, Equity Technical Analyst at Angel Broking told moneycontrol.

“Until any signs of reversal seen, we expect the Nifty index to continue its uptrend in the month of May and head higher towards 9410 and 9632, which are the target projections considering the 141 percent and 161.8 percent reciprocal retracement of the previous corrective move,” he said.

The support base for the index has now shifted higher to 9,150, and thus traders can now trail the stop loss on existing long positions below 9,150 on a closing basis.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!