HDFC Standard Life Insurance Company, the part of housing finance major HDFC, will open its Rs 8,695-crore initial public offering for subscription on November 7, with a price band of Rs 275-290 per share.

It would be the third life insurance company getting listed on bourses; and is the first initial public offering by a company promoted by HDFC, since the initial public offering of HDFC Bank in 1995.

The global co-ordinators and book running lead managers are Morgan Stanley India Company, HDFC Bank, Credit Suisse Securities (India), CLSA India and Nomura Financial Advisory and Securities (India). The book running lead managers are Edelweiss Financial Services, Haitong Securities India, IDFC Bank, IIFL Holdings and UBS Securities India.

Equity shares are proposed to be listed on the BSE and the NSE.

Here are 10 things one should know before investing in IPO:-

Company Profile

HDFC Standard Life Insurance Company was established in 2000 as a joint venture between HDFC and Standard Life Aberdeen plc, initially through its wholly owned subsidiary The Standard Life Assurance Company and now through its wholly owned subsidiary, Standard Life Mauritius.

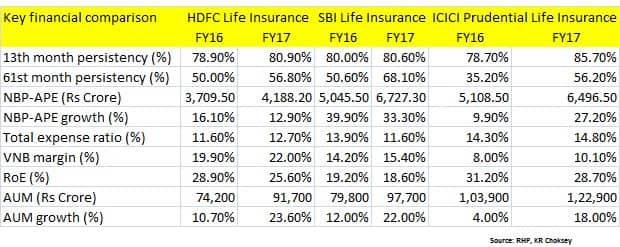

It is one of the most profitable life insurers, based on value of new business (VNB) margin, among the top five private life insurers in India (measured on total new business premium) in FY16 and FY17, according to CRISIL.

It has also consistently been among the top three private life insurers in terms of market share based on total new business premium between FY15 and FY17, according to CRISIL.

The company’s bancassurance partners include banks, non-banking financial companies, micro-finance institutions and small finance banks in India. The number of major bancassurance partners grew from 31 as of March 2015 to 125 as of September 2017.

Bancassurance remained its most significant distribution channel, generating 54.1 percent of total new business premiums for six months ended September 2017.

The company has a broad, diversified product portfolio covering five principal segments across the individual and group categories, namely participating, non-participating protection term, non-participating protection health, other non-participating and unit-linked insurance products.

In FY12, it established a wholly-owned subsidiary, HDFC Pension, to operate its pension fund business under the National Pension System (NPS). And in FY16, the company established its first international wholly-owned subsidiary in the UAE, HDFC International, to operate its reinsurance business.

About the Issue

The initial public offering up to 29,98,27,818 equity shares of HDFC Standard Life Insurance, which will close on November 9, comprises of an offer for sale of 19,12,46,050 shares by Housing Development Finance Corporation and up to 10,85,81,768 shares by Standard Life (Mauritius Holdings) 2006 Limited.

The offer comprises of a reservation of up to 21,44,520 shares for purchase by HDFC Life Employees, reservation of up to 8,05,000 shares for eligible HDFC Employees and reservation of up to 2,99,82,781 shares for HDFC shareholders.

The IPO will constitute 14.92 percent of the fully diluted post-offer paid-up equity share capital of the company

Bids can be made for a minimum of 50 equity shares and in multiples of 50 shares thereafter.

Objects of Issue

The objects of the offer are to achieve benefits of listing equity shares on stock exchanges and to carry out the sale of offered shares by the promoter selling shareholders.

The listing of equity shares will enhance the 'HDFC Life' brand name and provide liquidity to existing shareholders.

The company will not receive any proceeds from the offer.

Strengths

> HDFC Life has strong parentage and has strong brand recall among Indian consumers.

> It has strong financial performance defined by consistent and profitable growth.

> Growing and profitable multi-channel distribution network provides it with the flexibility to adapt to changes in the regulatory landscape and mitigate the risk of over-reliance on any single channel. Its distribution network comprises four distribution channels - bancassurance, individual agents, direct, and brokers and others.

> Its focus on customer centricity enabling it to show growth across business cycles.

> It has leading digital platform that provides a superior experience for customers and distributors.

> It has an independent and experienced leadership team with capabilities and know-how across the banking, financial services and insurance sectors.

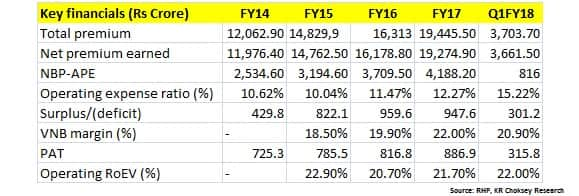

Financials

Its profit after tax increased by a CAGR of 6.3 percent from Rs 785.51 crore in FY15 to Rs 886.92 crore in FY17. Insurance profit increased by a CAGR of 9.7 percent between FY15 and FY17.

It has total net worth of Rs 4,460 crore and a solvency ratio of 200.5 percent as at September 30, 2017, above the minimum 150 percent solvency ratio required under IRDAI regulations.

It has delivered a return on equity of 25.6 percent, return on invested capital of 40.7 percent and operating return on embedded value of 21.7 percent during FY17.

NBP is new business premium; APE is annualised premium equivalent; VNB is value of new business; RoEV is return on embedded value

Peers Comparison

Top 10 shareholders including promoters

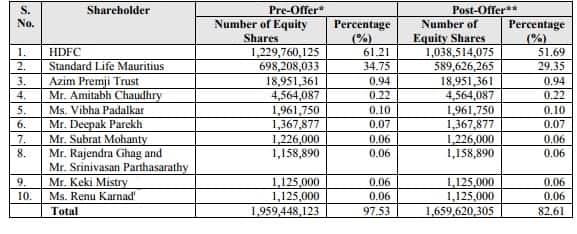

HDFC and Standard Life Mauritius are two promoters of the company, which respectively hold 61.21 percent and 34.75 percent of equity shares as of October 25, 2017.

Top 10 shareholders as of October 25, 2017:-

Management

Board of Directors:-

Management Organisation Structure:-

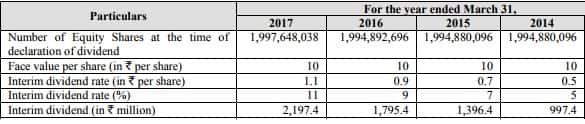

Dividend Policy

Risks and Concerns

Here are some risks and concerns highlighted by brokerage houses:-

> Changes in regulation and compliance requirements could limit the company’s ability to introduce new products, increase operating expenses and reduce operating flexibility

> Adverse market fluctuations and economic conditions would have a material adverse effect on the business, financial condition, results of operations and prospects

> Any termination/ change in bancassurance arrangements or decline in performance of bancassurance partners may adversely affect the business and financial condition

> Interest rate fluctuations may materially and adversely affect profitability

> Catastrophic events, such as natural disasters, which are often unpredictable, may materially and adversely affect HDFC Life’s claims experience, investment portfolio and financial condition.

> Concentration of investment portfolio in any particular asset class, market or industry may increase risk of suffering investment losses

> A significant proportion of total new business premiums are generated by unit-linked products and participating products. Any adverse regulatory changes or market developments that adversely impacts sales of such products could have a material adverse effect on the business, financial condition, results of operations and prospects

> As a significant portion of business is generated from relatively few regions, the company is susceptible to economic and other trends and developments, in these areas.

> The company faces significant competition and the business and prospects will be materially harmed if the company is not able to compete effectively

> Liquidity risk to the company’s investment portfolio

> HDFC Life’s Embedded Value and VNB information is based on several assumptions and may not be comparable to similar information reported by its peers.

> The company relies on third parties in several areas of its operations on a regular basis. If any of these third parties were to terminate their contractual relationships with the company and the company fails to secure an adequate alternative, its business and results of operations could be materially disrupted.

Image source: RHP

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!