Krishna KarwaMoneycontrol Research

Of late, the Indian retail sector has been at an inflexion point on the back of favourable macroeconomic factors such as increasing consumer disposable incomes, a spurt in demand from smaller cities/rural regions, growing penetration of organised retail and co-existence of offline and online channels.

Aditya Birla Fashion & Retail and Shoppers Stop, two well-known names in Indian retail, recently announced their quarterly numbers.

Here's a look at how things panned out for them:-

Aditya Birla Fashion and Retail (ABFR)

ABFR (market cap: Rs 11,926.4 crore) is one of India’s largest fashion retailers with a 6.8 million square footprint. ABFR’s network as on December 31, 2017 spans 2412 stores, 4850 multi-brand outlets, e-commerce portals, and 3750 shop-in-shop outlets.

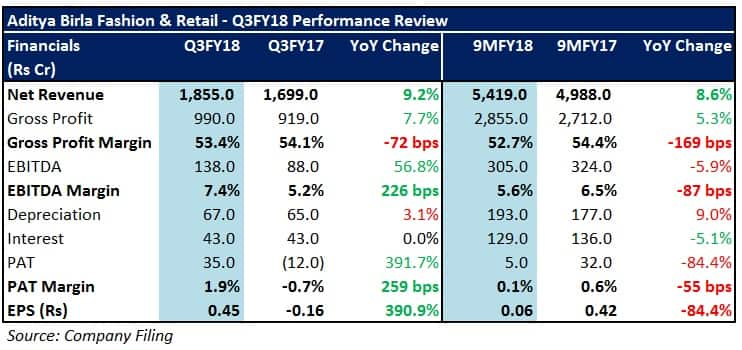

In the quarter gone by, ABFR’s sales were marginally affected at the start due to the preponement of the festive season to Q2FY18. However, tailwinds such as wedding season, strong winter and an early onset of the end-of-season promotion schemes during the festive period compensated for it.

In contrast, the fast fashion sub-segment was a dampener on account of a 14 percent decline in revenue (owing to business rationalisation) and an inability to break-even (due to one-time inventory corrections accounted in Forever 21).

What lies ahead?

Lifestyle segment

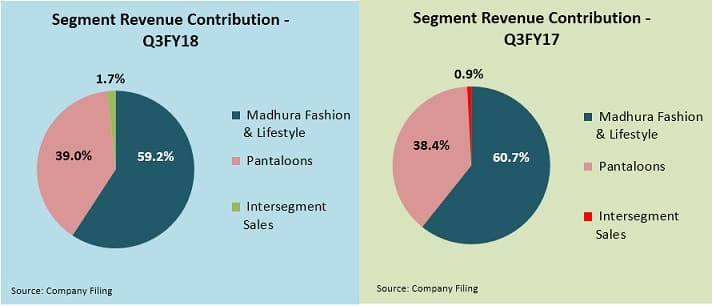

Prospects of ‘Pantaloons’ and ‘Lifestyle Brands’ segments look good. Moreover, cost control measures in these areas will facilitate margin accretion. Pantaloons will play a key role in driving ABFR’s future earnings and it is evident from the scale of investments made by the company over a period of time.

GST woes behind

Barring ABFR’s Tamil Nadu and Andhra Pradesh markets, GST-induced disruptions seem to be normalising, thus hinting at recovery of the wholesale channels. The company will add 60-80 new stores in the coming years, mainly in the tier 2/3 cities of India, roughly 20 percent of which would be franchise-run.

Fast fashion segment

ABFR aims to restructure its ‘Forever 21’ brand by FY19 end through closure/resizing of stores, selective expansion and optimal inventory management. Additionally, to initiate a turnaround in the ‘People’ brand, the company will adopt the large format store model extensively to enhance visibility.

Other businesses segment

To boost the sale of innerwear products, ABFR is focused on product differentiation, geographic expansion, and promoting the international innerwear brands portfolio. The company entered into a licensing/distribution agreement with ‘Ralph Lauren’ and will open its first ‘Ted Baker’ outlet in Q4FY18.

Shoppers Stop Limited (SSL)

Shoppers Stop (market cap: Rs 4,555.5 crore), one of the largest department stores in India (237 outlets, 4.5 million sq feet area), sells products across categories such as apparel, lifestyle, and home furniture. Crossword, Home Stop, MAC, Estee, Clinique, and Bobbi Brown are the company’s major brands.

SSL’s year on year revenue growth was subdued owing to store renovations and lower MRPs due to downward revisions of GST rates on non-apparel products (comprising nearly 37 percent of SSL’s sales). The improved bottom-line performance was attributable to cost efficiencies and debt reduction.

The plan ahead?

Operating leverage

SSL expects 4/7.5 percent same-store sales growth by FY18/FY19 end, respectively. The company targets achieving higher asset turns from its Rs 130 crore capex schedule in FY19, mainly through margin-accretive private label brands.

Online presence

SSL’s exclusive deal with Amazon India (SSL’s products will be available on Amazon from May 2018) will give its brands/products ample visibility. Simultaneously, the company is working on streamlining its own omnichannel network . The blend of online and offline channels should augur well for top-line growth.

Debt repayment

SSL intends to pare Rs 40-50 crore of debt by Q4FY18 and become debt-free by FY19 end. Consequently, a higher percentage of the company’s operating profits from its core departmental store business should flow to the bottom-line.

Should you invest?

Though ABFR’s business transformation looks promising, a lot depends on how quickly the ‘Forever 21’ stores regain momentum. Losses in the innerwear products business will extend for a few more quarters. Steep rent costs at marquee locations and high competitive intensity may impact margins too.

ABFR hasn’t rallied much in recent times, which leaves decent room for a re-rating. At 36.7x FY20 projected earnings, investors with a medium to long-term investment horizon may consider the stock.

Conclusion of the Hypercity deal between Shoppers Stop (SSL) and Future Retail will strengthen SSL’s financial performance pretty noticeably since the company gets rid of a loss-making and grocery-oriented (primarily, if not entirely) margin-dilutive division.

SSL, in a bid to increase the contribution of its own brands to overall revenue (to 12/15/18 percent by FY18/19/20 end, respectively), has changed its strategy from ‘fashion at premium’ to ‘fashion at value’. This hints at the possibility of balancing volume-driven sales growth at reasonable realisation levels.

Completion of refurbishment of SSL’s 8 stores in Q4FY18, addition of 6 new outlets (1 in Q4, 5 in FY19), and accounting for one-time adjustments in FY18 itself (pertaining to exit from the Timezone brand and Hypercity impairment) will work in favour of SSL’s earnings visibility prospects from H2FY19.

SSL, therefore, appears to be moving on from most of its major headwinds in the past, which, we believe, could lead to a re-rating.

The stock has corrected quite a bit over the past month and thus offers some valuation comfort. At 29.7x FY20 projected earnings, SSL deserves an investor’s attention.

For more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!