State Bank of India's relatively high rate of UPI transaction failures is weighing in on the Unified Payments Interface’s success ratio, data from National Payments Corporation of India, which operates the instant payments system, shows.

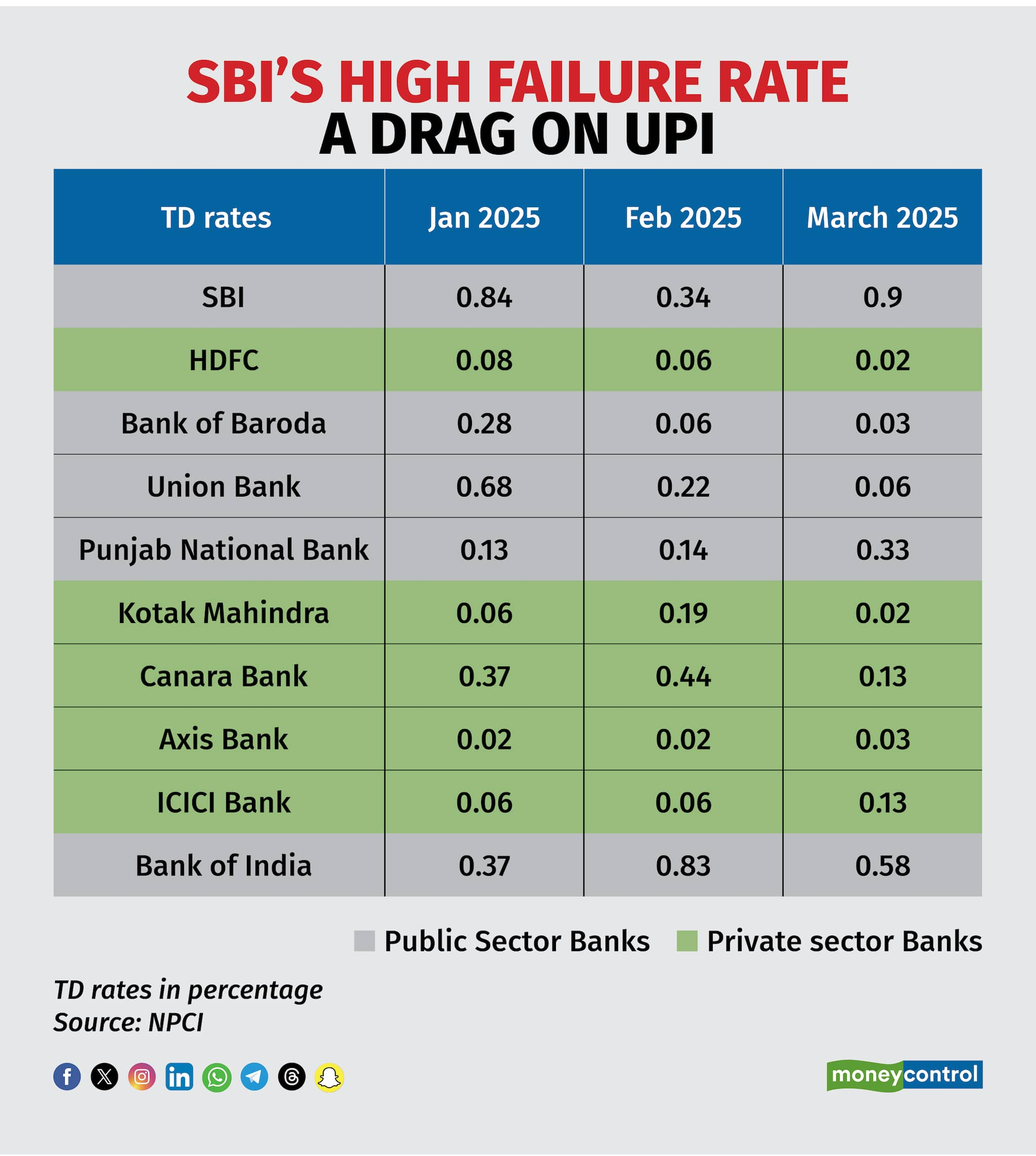

While most large private sector banks continue to have a low technical decline (TD) of below 0.1 percent, SBI's touched 0.9 percent in March, NPCI data shows. SBI’s TD rate was 0.84 percent in January and 0.34 percent in February.

The government-owned SBI is the country's largest bank and also leads the UPI transaction pack by a wide margin.

A technical decline (TD), the industryspeak for a transaction not getting through, happens when the server of a bank or that of NPCI is unresponsive or for some technological reason the payment doesn’t get through.

NPCI usually has a 100 percent “uptime”, indicating that mostly the issue is with the bank through which payment is being made.

SBI did not respond to Moneycontrol queries on the state-owned bank’s high technical decline and the steps taken by it to address the issue.

HDFC Bank, ICICI Bank, Axis Bank and Kotak Mahindra Bank reported TD rates of 0.02 percent, 0.13 percent, 0.03 percent and 0.02 percent respectively, in March.

Some of the public sector banks such as Union Bank of India and Bank of Baroda, which have much fewer resources, continue to have a lower TD than SBI.

But their other PSU counterparts Canara Bank, Punjab National Bank and Bank of India usually have a higher TD, occasionally even higher than SBI.

While SBI is over thrice as big as the second largest bank, HDFC Bank, in the UPI ecosystem, its high TD is a drag on the overall performance of the country’s most popular real-time digital payments platform.

In March, SBI registered 5 billion transactions and HDFC around 1.5 billion.

UPI facilitates 83 percent of all digital transactions in the country, the Reserve Bank of India data shows.

UPI platform saw three outages during the last couple of weeks. While the one on March 26 happened because of a technical issue at NPCI, the other two outages were attributed to infrastructure issues with banks, mostly due to the financial year-end transaction load and processing issues.

“SBI has a key role in ensuring a high success ratio for UPI transactions. Among the major banks, it more often has had among the highest TD rate and that will result in a less than seamless experience for UPI customers holding SBI savings accounts,” said the digital head of a public sector bank.

The person added that SBI’s TD rate also has a bearing on the performance of third-party UPI apps (such as Google Pay or Paytm) which have SBI as one of their bank partners or technically called a payment service provider (PSP) bank.

NPCI did not comment on whether SBI is acting as a drag on the overall UPI experience.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.