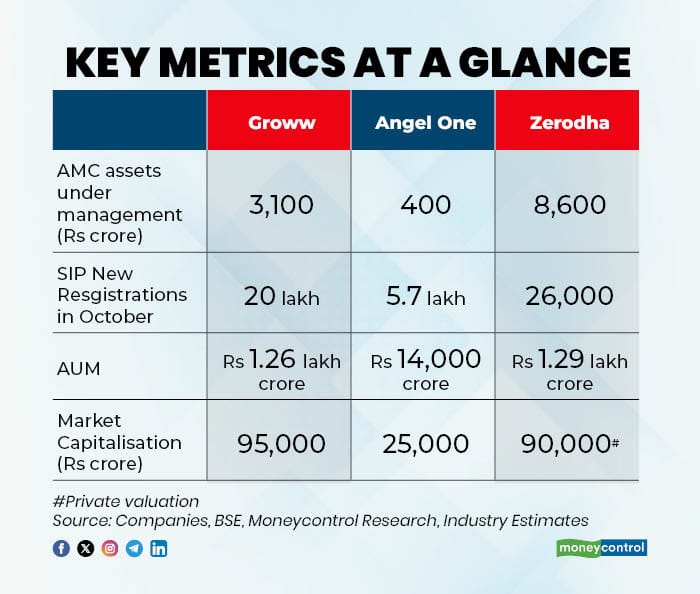

Groww is undoubtedly the country’s most popular investment platform with more than 2 million new Systematic Invest Plan (SIPs) registrations on the platform in October, Moneycontrol reported on December 2.

The Bengaluru-based wealth-tech company, which started its journey in 2016 as a mutual fund distribution platform, was also among the few brokerages that saw active investors rise in the month of October.

However, when it comes to several operational metrics in value, it still has a lot to catch up with Zerodha, which had a head start with deep-pocketed investors.

For instance, Groww’s total Assets Under Management (AUM) of all their businesses and customers as of December stood at Rs 3.2 lakh crore, Zerodha’s stood at around Rs 7.5 lakh crore.

Role of equity investment

For Zerodha, almost 80 percent of the AUM is in the form of equity; meanwhile, for Groww, 53 percent of this is in the form of a Mutual Fund.

.

.

To be sure, Zerodha has been a platform for equity investment and derivatives trading from its early days. Groww started equity deliveries almost a decade later.

Interestingly, Angel One, the country’s third-largest broker by active investors, has a stronger presence in equity investment and trading compared to Zerodha and Groww.

The Mumbai-based broker has a much longer vintage with the company’s mutual fund AUM comprising only around 10 percent of its overall AUM.

Credit Books

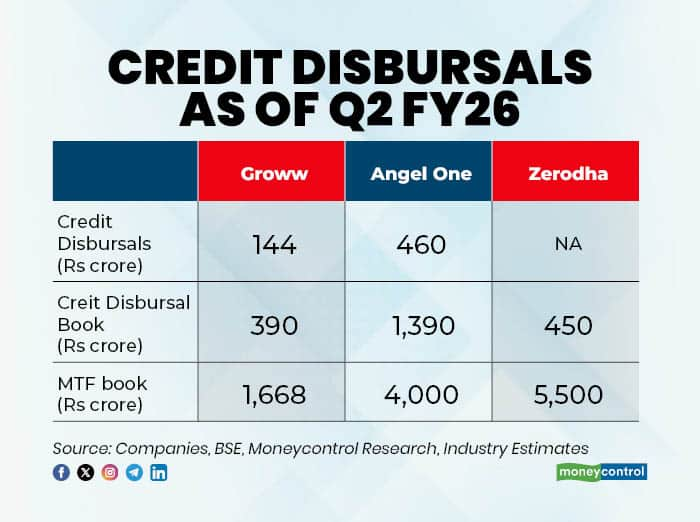

The credit push among retail brokerages is beginning to show clear strategic divergence.

New-age entrant Groww remains conservative, disbursing only Rs 144 crore in Q2 FY26 with a credit book of Rs 390 crore, even as its MTF book has quietly scaled to Rs 1,668 crore.

MTF (Margin Trading Facility) is a brokerage product that allows investors to buy stocks by paying only a part of the total investment upfront, while the broker finances the remaining amount. It is SEBI-regulated leverage, meaning the broker lends money against the shares that investors buy.

Angel One, by contrast, is aggressively leaning into leverage-led growth, disbursing over three times Groww’s volume and building a sizeable Rs 1,390-crore credit book alongside a Rs 4,000-crore MTF portfolio.

Zerodha, long vocal about avoiding consumer credit, still maintains a small Rs 450-crore credit book but dominates MTF with Rs 5,500 crore, underscoring its preference for lower-risk, collateralised offerings.

Groww's retail focus

“Groww has a lot of retail investors. However, the profit pool and value lies with the day traders, a cohort of 30-40 lakh customers and hence Groww’s value will be lower than Zerodha and Angel One for a few more years,” said Rishabh Katiyar, Principal at Info Edge Ventures.

According to industry experts, it is difficult to attract traders who are committed to one platform for a long time.

Hence, Groww’s strategy has always been to focus on new to investing cohort and tapped ETFs, index funds and mutual funds.

Groww’s SIP domination

When it comes to the popular Systematic Investment Plan (SIP), Groww’s dominance in the ecosystem is unparalleled. It contributed to almost 47 percent of all new SIP registrations in the country in an ecosystem where more than 30 platforms have registered more than 10,000 new users.

In fact, the next four players together account for only 60 percent of Groww’s size and scale. SIPs was popularised at scale by Groww and other popular payment apps such as PhonePe and Paytm, which figure in the top five apps for attracting new SIP users.

Surprisingly, Angel One has made some inroads to become the second-largest SIP player in volumes, attracting 5.6 lakh new registrations.

However, even here, early movers such as SBI Bank, HDFC Bank and Zerodha tend to have higher AUM than Groww. SBI had accumulated Rs 2.7 lakh crore in assets through its SIP portfolio. NJ IndiaInvest followed the state-owned lender with an AUM of Rs 2.6 lakh crore. Groww’s AUM stood at 1.26 lakh crore, while that of Zerodha’s stood at 1.29 lakh crore.

Investor churn and volatile returns

Even as market returns remained below last September’s peak, the market regulator Securities and Exchange Board of India (SEBI), imposed restrictions on derivatives trading saw several customers leave the trading market.

Moreover, market volatility and flat returns led to a decline in active investors for most of the top 10 players over the last 12 months. However, Groww returned to growth during October and even increased its market share during the month.

All the top three brokers have seen a drop of around a million active customers from their respective peak client numbers.

“Groww is going after a larger market. The day trading pool is not growing fast enough and it will be difficult to expand your $10 billion valuation to $20 billion valuation if you attract a pool that is not growing,” Katiyar added.

Groww has assiduously followed the principle of making money from 5 crore customers by selling them more financial services products rather than aggressively courting a smaller set of users who are loyal to a certain legacy platforms.

Market capitalisation rises for Groww and Zerodha despite headwinds

Last month, Groww, in its first quarterly results post the public market listing, reported better-than-expected financials, helping the Bengaluru-based wealth-tech company to maintain its market capitalisation well above the IPO valuation of Rs 63,000 crore and now hovers around Rs 95,000 crore.

The market capitalisation of Angel One stood at Rs 25,000 crore, and that of privately held Zerodha was estimated at around Rs 90,000 crore by Hurun, a wealth research firm.

Financials

Another area where Groww sets itself apart from its key competitors is the revenue and net profit growth. Zerodha and Angel One have seen their revenue and net profit drop for three quarters in a row.

While Zerodha’s quarterly financials are not public, its founder, Nithin Kamath, has said that the company has seen its revenue and net profit plunge by 40 percent during the June quarter because of regulatory changes in derivatives trading.

Angel One has seen its net profit decline by 38 percent during the September quarter.

Meanwhile, Groww’s net profit rose 12 percent year-on-year during the September quarter of FY 26, even as the company’s revenue fell 9.5 percent.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.