When we think of the attractiveness or otherwise of an investment and gauge it, we usually refer to past performance. We look at, say, the past year’s performance or five-year returns and mentally extrapolate that. Nothing wrong with that.

However, in debt funds, looking at past performance and then trying to figure out the best or even the right investment is futile. Current market conditions may offer better clues. While timing the market is futile, this is not about timing the market. This is about a gauge that is better than just past returns, to shape future expectations. Moreover, in debt funds there is a higher degree of predictability than in equity, hence current parameters need to be looked at.

Relevance of YTM

While investing in debt funds, one parameter that is crucial is Yield to Maturity (YTM).

The yield-to-maturity (YTM) of a debt fund is the weighted average YTM of all the instruments in the portfolio. The YTM of a debt instrument is the annualised return that will be earned, provided the instrument is held till maturity. We will look at the relevance of this parameter and how it has moved over the past couple of years. To understand the relevance of YTM to the performance of debt funds, let us see how returns from debt funds are achieved.

Returns from debt funds come from two components. One is called accrual, the other is mark-to-market.

Accrual is the interest that is accrued or added to the NAV of the fund, every day. The interest payout on the instrument may be once a year or once in six months. However, every day, proportionate interest is added to the NAV of the fund, for each instrument in the portfolio. The exact data on the interest accrual in funds is not available; the YTM is the nearest proxy. The higher the YTM the better, as the level of interest accrual is higher.

Mark-to-market means movement of your fund’s performance along with movement of the underlying market. If bond prices are moving up, good for you. If bond prices are coming down, your returns calculated from NAV movement will be adverse to that extent and you need to hold for a longer time horizon.

Remember, the YTM data is not a guarantee or commitment of returns. It gives us a perspective on what kind of returns can be expected from the debt fund, in reasonably stable market conditions. When market conditions are favourable and bond prices are moving up, it adds to the accruals. In adverse market conditions, it takes away from your accrual and your returns are muted. This is what has been happening over the last two years.

What changed in the last two years

Over the last couple of years, bond yields (interest rates) have been moving up.

This is because inflation has been high and the market anticipated rate hikes by the Reserve Bank of India, which are happening now. Bond yields and prices move inversely. Over the last two years, while the accruals have been happening as usual, the adverse movement of bond prices have been taking away as much. As a result, your returns have been muted.

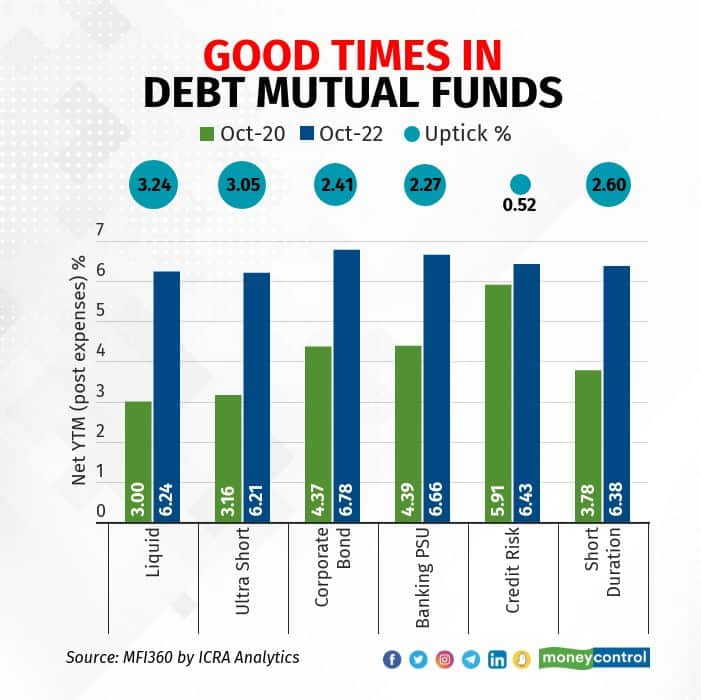

The table below shows us the extent to which portfolio YTMs of debt funds have moved up over the last two years. Your accrual levels are that much better, which is why this is a good time to buy into debt funds.

What should investors do?

As mentioned earlier, portfolio YTM is not a commitment on returns.

However, the RBI’s interest rate-hike cycle is on its last leg and potential future rate hikes have mostly been priced in by the market. Though nobody can predict market movements exactly, it is expected that the volatility of the past two years is behind and the market will be reasonably stable now.

In this situation, YTMs would work for you, as adverse market movements would not take away from accruals. Perhaps a year down the line, as and when inflation eases, the RBI may look to cut interest rates. It is too early to call that now, so your current view may be best based on your portfolio’s net YTM.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.