Rasode mein kaun tha, a 57-second video that gave a musical twist to a dialogue from a TV show, has made Yashraj Mukhate, 25, an overnight internet sensation. Like him, Saloni Gaur, 21, who plays the fictional character Nazma Aapi and lampoons celebrities or takes a satirical look at current affairs, has become a household name. Meanwhile, Eshna Kutty, a 21-year-old dancer, has become all the rage with her hula-hooping-in-sari videos.

Mukhate, who hails from Aurangabad; Gaur, originally from Bulandshahr; and Kutty, who is based in Delhi, are the young faces epitomising the phenomenal success that short videos can script. Like them, there are millions of content creators across India churning out short videos every day in the hope of making them go viral and becoming the next big thing.

These creators are the driving force behind the content revolution in the country. With over 5 billion views every month, India, says a report by Digital Uncovered, has become one of the biggest consumers of videos in the world today.

Snackable contentMuch of this consumption is being driven by a shift towards snackable, personalised content that grabs the short attention span of users. The Indian market for short-form video content has grown sharply from 20 million users in FY16 to 180 million users in FY20, according to data from RedSeer Consulting. Chinese app TikTok was one of the driving contributors of this trend. Before it was banned in June 2020, the app had amassed 200 million+ Indian users, and spawned more than 200,000 influencers.

Soon after TikTok’s departure, several Indian players moved in to fill the void. With an accelerated focus on product, tech and marketing, Josh, Moj and MXTakatak have successfully brought back 97 percent of the TikTok's user base, says RedSeer. International players with in-app short video offerings, such as Insta Reels and YouTube Shorts, have also made a splash.

Overall, the content creator community has grown to 45 million—i.e., 2x its strength in the TikTok era—and 50 million posts are being created per day across platforms, according to the RedSeer data. And yet, this is just a speck in the country’s content creation ecosystem, which is waiting to explode in a market that is projected to grow to 580 million by 2025.

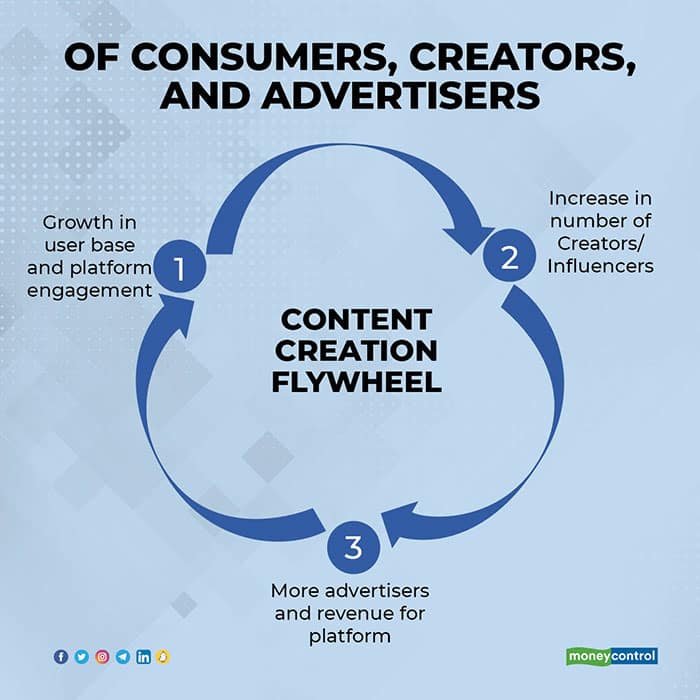

Of consumers, creators, and advertisersShort-form content platforms have three key stakeholders: consumers, creators and advertisers. Creators depend on consumers to become their followers and increase their popularity, while consumers look forward to original and entertaining content from the creators. Many of the hugely followed creators become influencers. Influencers can influence purchase decisions of brands through their content—an opportunity advertisers leverage, generating an immense opportunity for Influencer marketing on these platforms.

According to data from Avendus Capital, investments in the digital content space have doubled to $900 million in 2020 from around $400 million in the previous year and are likely to cross $1.5 billion in 2021.

With a great number of next-gen internet users adopting the platforms, the consumer base is growing fast, motivating creators to increase the quantum and originality of content. To further the cause, platforms are diverting their focus and funds towards grooming, spotlight, and content creation programmes—Josh’s World Famous, Moj’s Creators Program and MXTakaTak’s Launchpad are proof of the pudding.

Platforms are working closely with creators to empower them with the right tools to accelerate their journey towards becoming influencers. The growth of the influencer community is attracting more advertisers to the platform. Truly, the flywheel has been set in motion, spurring the growth of the ecosystem, and opening several prospects for its players.

Identifying opportunities amid the gapsWhile the video apps are thriving, when it comes to active users and downloads, their success is also measured based on engagement indicators such as the number of sessions and session time. It will be imperative for the platforms to sustain their engagement by improving the quality, quantity, and variety of content. Next-gen users, who are spoilt for choice, will want differentiated and unique content that breaks away from traditional categories such as comedy, dance and lip-syncing, and that steers towards specialised genres such as lifestyle, fitness, and tech.

Platforms could benefit from being early birds in onboarding, identifying, and grooming influencers at the start of their journey. This will help them regulate the quality of content being created and build a brand identity in the process. It will also enable the platforms to create trusting relations between users and influencers, and in turn enhance the monetary prospects of influencers.

Another opportunity lies in building creator-education platforms. Talent hunts initiated by platforms are sporadic and benefit a few. The need of the hour is a sustained approach towards content creation that will maintain the supply-demand balance. A formal learning platform could fill the void in the current ecosystem, where a vast majority of content creators either self-learn or emulate their favourite influencers. Such platforms can enable users to become creators, and creators to chart their journeys to influencer fame.

Learning opportunities can include basic aspects such as storyboarding, scripting, and editing to advance concepts such as understanding user-engagement analytics and revenue models. Mentorship by successful influencers and experts, as well as peer-to-peer groups, can greatly benefit the burgeoning creator community, which is likely to cross 100 million over the next five years.

The domestic short-form User-Generated Content market is here to stay and poised to take giant strides towards global success. Identifying unique opportunities to nurture its stakeholders will accelerate success and enhance the monetisation potential of the entire ecosystem.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.