Note to readers: Soch to Success is a weekly column to enhance critical thinking skills for you to achieve success. Each article is packed with insights, tools and a roadmap to action.

I had picked up a line from a movie, Chance Pe Dance. It meant if you get an opportunity, make the most of it. In my marketing role then, about 10 or more years ago, the line worked both as an anchor and a nudge. An anchor to spot opportunities (read chance) and a nudge to take action (read dance). I have no recollection of the scene, actors or the contexts, not even the movie name but I remember using it many times. My husband said Jhankaar Beats. All I remember is the line Chance Pe Dance.

When I searched before writing this piece, I learnt that some other production company wanted to make a movie by this name Chance Pe Dance and Jhankaar Beats team had legally objected to them for using it. It was popular, like the Kitne aadmi the dialogue from the Sholay1. Unmissable.

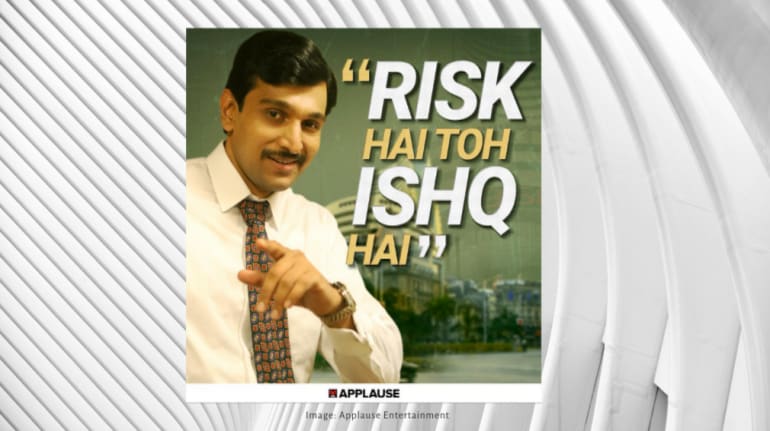

Risk hai toh ishq hai (Take risks to live life/work to the fullest) from Scam 1992—The Harshad Mehta evoked those memories. Powerful. Gabbar like. Unmissable.

Scam 1992—The Harshad Mehta Story is a web series based on the 1992 Indian stock market scam committed by stockbroker Harshad Mehta. The series is adapted from journalists Sucheta Dalal and Debashish Basu's book The Scam: Who Won, Who Lost, Who Got Away.

The web series packed with stellar performances and many nuances is so enthralling that it makes me like the character of Harshad Mehta. Forget abhor, I had to remind myself that he is the scamster and I should not empathise with him. What is there not to like about him— the character looks happy, confident, is a family man, has no vices, is sharp, intelligent and all this adds a swag to his looks. So when he delivers, “Mera Interview lene se pehle mujhe jaan lena, woh kya hai ki mujhe jaan jaoge toh maan joage” (before you take my interview, you should know about me because once you know me, you will get convinced)”, you actually believe in his statement “Risk hai toh ishq hai”.

Truly convincing. That is the impact of a great storytelling that makes one liners stay with you. You not only like such lines, you start using them and they become a part of your life.

Risk hai toh Ishq Hai has its own swag, the swag of confident decision-making. And that is what we are going to talk about in today’s article on Habits for Thinking - the spotlight is on decision-making.

On an average day, we make several decisions, some miniscule, some insignificant, some mindless, some significant, some reversible and sometimes a few critical and irreversible decisions. It is the insignificant and small ones that dominate our time and energy and to some extent influence our significant decision-making style.

The famous story of Steve Jobs and now Mark Zuckerberg's habit of wearing same coloured T-shirts is to avoid everyday decisions of selecting clothes. An insignificant decision for them, very significant for others.

When the character uses the line Risk ishq… he portrays his style of decision-making. He is confident. He knows there is risk. He is partially aware of the known risk and also acknowledges the possibilities of unknown risks. Another layer of his style, which is the most significant part of any decision-making, is that he doesn’t take too much time in making big, significant decisions.

Decision-making is a process that works on its own. While we do get trained to take account of others' opinions and facts, we need to understand and tell our minds to mind a few things before it takes decisions in #RiskHaiTohIshqHai style.

When the world was investing in gold, Warren Buffet stuck to his portfolio. He follows and advises a principle of Circle of Competence. In a letter to shareholders, he wrote:

“Intelligent investing is not complex, though that is far from saying that it is easy. What an investor needs is the ability to correctly evaluate selected businesses. Note that word "selected": You don't have to be an expert on every company, or even many. You only have to be able to evaluate companies within your circle of competence. The size of that circle is not very important; knowing its boundaries, however, is vital.”As we gain experience and knowledge, we make our own mental maps of understanding. Expertise in the fashion business doesn’t mean an understanding of the oil business too. While making decisions, it is important to know the boundaries of that understanding. That is calculated risk. Beyond that boundary, even if you feel you know it all, you would be taking a bigger, unknown risk.

Time is of essenceTime is central to any decision-making. Entrepreneurs understand this much better than others. Being perfect is not the priority, being in action with yet-to-be-improved services and products is the priority for entrepreneurs. You get slow in decision-making and you may miss the bus. In the web series, the line demonstrates quick decision-making.

I have written about Jeff Bezos’s style of decision-making —‘disagree and commit’. His point is simple where he gives more importance to time than his own agreement. The project must move forward and not get stalled because of the leader's nod.

David Eisenhower, a former US president, used a matrix to help him prioritise his work and decision-making. Called the Eisenhower Matrix, it can help you choose which ones you want to decide and which one you would like to delegate or address later. This gives importance and time to significant decision-making.

Some decisions are significant and irreversible. What you order for dinner is irreversible after you finish eating, but is not significant. What you say in a press conference is both significant and irreversible. It is important to spend time on these.

The effect of availability biasWhat is availability bias? All of us have the tendency to use information that comes to mind quickly and easily when making decisions about the future. Our memory is stronger of things that have vivid narration. This availability of our thoughts impacts our decision making.

Studies have shown that victims and near-victims spend on insurance purchases and protective action after disasters. Another example is you tend to handover a new project to a team member who has a clean recent record and not to an equally competent member who committed a small error recently. This is something similar to recency bias in investing where one tends to make investment decisions based on recent memorable events.

Cass Sunstein, founder and director of the Program on Behavioral Economics and Public Policy at Harvard Law School, has given a name to how the availability biases flow into policy—the availability cascade. Here is an excerpt from the book Thinking, Fast and Slow by Daniel Kahneman explaining the concept- availability cascade:

An availability cascade is a self sustaining chain of events, which may start from media reports of a relatively minor event and lead up to public manic and large scale government action. On some occasions a media story about a risk catches the attention of a segment of the public, which becomes aroused and worried. The emotional reaction becomes a story in itself. Prompting additional coverage in the media, which in turn produces greater concern and involvement. The issue becomes politically important because it is on everyone’s mind and the response of the political system is guided by the intensity of the public sentiment. The availability cascade has now reset priorities. Other risks, and other ways that resources could be applied for the public good, all have faded into the background.You will relate to these words and how the story unfolds through Sucheta Dalal, the journalist who went after the scam. That cascade led to a positive outcome. The recent availability cascade of an actor’s death led to a negative impact for the public. The attention could have been on pandemic, economy and safety instead.

As the lovely line stays with you, Risk Hai Toh Ishq Hai, do remember your own circle of competence, power of timely decisions and your alertness towards your own availability bias. Ultimately, Risk Hai Toh Ishq Hai.

The credit for the line goes to dialogue writers for the series Vaibhav Vishal and Karan Vyas. Applause.

(Vishakha Singh, author of a forward-thinking course SHIFT, is a business strategist & a design thinking practitioner. She writes at www.habitsforthinking.in, offering insights into the ever-changing business environment.)

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.