Kunal Shah-led fintech unicorn CRED announced on February 6 the acquisition of online financial planning and investment platform Kuvera, in a mix of cash and stock deal.

The acquisition is touted as Cred’s entry into the wealth management space as the fintech firm looks to leverage Kuvera’s 3 lakh-active “affluent” investor community for cross sell opportunity, while offering its own users with newer financial products alongside payments, loans and insurance.

Among all, mutual funds and fixed deposits (FD) stand out to be the most popular, besides other offerings like SIPs, international equities (commercial arrangement with Vested Inc), pension fund, and digital gold.

Having said that, it remains unknown as to how Cred would monetise on Kuvera’s products as most of them, expect FDs, attract limited to zero fee.

Kuvera, which houses an Investment Advisor (IA) license, also offers personal goal planning tool and taxation advice which may get added on the Cred platform.

“Kuvera is extremely popular among financially savvy Indians; their products and vision are aligned with CRED’s principle of investing for long-term value creation rather than short-term entertainment. Look forward to working and sharing learnings with the Kuvera team in our mutual intent to enable financial progress,” said Kunal Shah, founder, CRED, in the statement.

Interestingly, the fintech arm of Cred--Dreamplug Advisory Solutions Private Limited (DASPL)--had applied for a separate IA license, SEBI documents reveal, despite acquiring one from Kuvera deal.

The application, submitted back on December 15, remains under process.

Backed by Fidelity and Eight Roads Ventures - Arevuk Advisory Services Private Limited (Kuvera) - was started in 2017 by former Morgan Stanley executive Gaurav Rastogi and former vice-president of Axis Capital Neelabh Sanyal.

Post the deal, both Rastogi and Sanyal, along with the team will continue to operate independently while working closely with CRED to scale its network, ecosystem, brand, and distribution, the company said.

While the latest deal terms remain undisclosed, Kuvera was last valued at $100 million, having raised about $10 million in funding.

However, the free financial planning and investments platform has not been able to generate profits while revenue continues to dwindle.

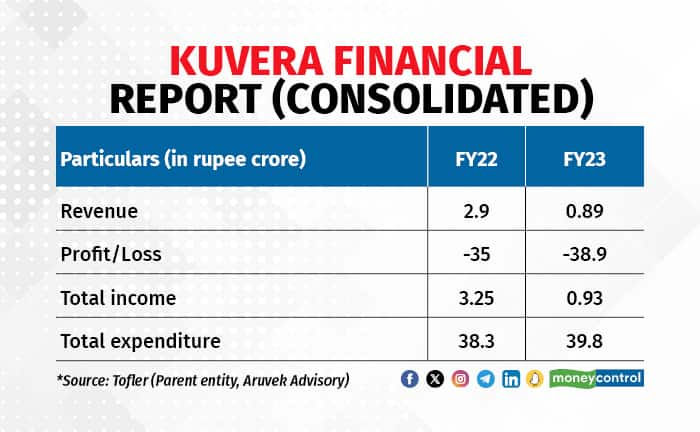

For FY23, the fintech’s consolidated operating revenue dropped 69 percent from Rs 2.9 crore in FY22 to 89 lakhs. The losses jumped to Rs 38.9 crore, with expenses moving in the same tune at Rs 39.8 crore.

On standalone basis, the auditors point that Kuvera held a negative operating cash flow of Rs 21 crore during FY23, resulting in the erosion of its net worth with liabilities exceeding the assets.

“As of that date (31 march 2023), the company’s accumulated losses amount to Rs 93 crore. These events and conditions indicate that a material uncertainty exists that may cast significant doubt on the company’s ability to continue as going concern,” it notes.

Kuvera FY23 results

Kuvera FY23 resultsKuvera has also been eying to enter stock broking services, via its subsidiary Arevuk Securities set up in 2022. However, its application remains stuck with the SEBI.

In a recent update, the company has withdrawn its application for the broking license, the filings reveal.

Kuvera declined to comment to Moneycontrol’s query on the same.

"Through our engagement with CRED we realized that our core values of transparency, user value and simplicity align beautifully with each other. Together with CRED we see an exciting opportunity to fast-track building new products and features for our community while also bringing a trusted wealth management solution to millions more," said founder Gaurav Rastogi.

Cred financial ambitions: New entry into insuranceAmong the financial services, Cred currently offers personal loans (Cred Cash) via its in-house NBFC Newtap Technologies, Buy-Now-Pay-Later (Cred Flash), P2P lending via LiquiLoans (Cred Mint), UPI payments (Cred Pay).

In the past, it had acquired business-expense management startup Happay, and data intelligence and co-lending platform CreditVidya.

The latest on the block is insurance.

The latest acquisition would allow Cred to offer direct mutual funds, financial planning tools, SIPs, digital gold among others.

The latest acquisition would allow Cred to offer direct mutual funds, financial planning tools, SIPs, digital gold among others.Moneycontrol learnt that the fintech has started offering standalone insurance service housed under its fintech arm DASPL, which managed to secure a composite license to offer the service.

At present, it has tie ups with Acko, Digit and ICICI Lombard.

CRED reported Rs 1,400 crore in revenue from operations for FY23, a 256 percent growth over the Rs 393 crore that the company reported in FY22. Meanwhile, the losses grew marginally to Rs 1,347 crore in FY23.

One of CRED's biggest revenue drivers and profit engines is its lending division, Cred Cash, which has disbursed about Rs 12,000 crore worth of loans, according to sources.

Almost 90 percent of its revenues come from Cred Cash, utility bill payments space Cred Max and insurance services.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.