Breaking: India’s controversial Broadcasting Bill on hold…Data protection rules to be released in a month

One quick thing: Ghar Wapsi! IPO-bound Pine Labs gets NCLT approval to flip back to India, joining a growing list of firms such as PhonePe, Groww and Meesho who are moving their domicile here.

In today’s newsletter:

- Chaos ensues as RBI crashes the P2P lending party

- Q-comm cash in on Raksha Bandhan festivities

- An AI-powered necklace as your second brain?

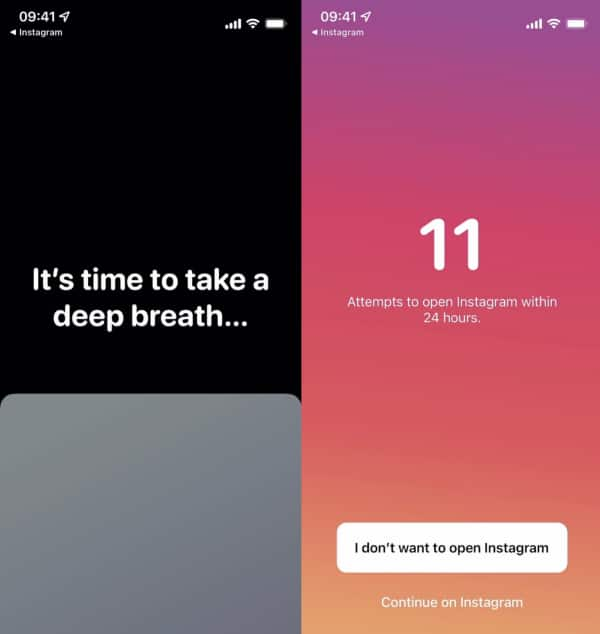

P.S. Struggling to focus on work after the long holiday weekend? This app could be your solution. Scroll below for more deets!

Was this newsletter forwarded to you? You can sign up for Tech3 here

Top 3 Stories

Top 3 Stories

Chaos ensues as RBI crashes the P2P lending party

The RBI has crashed the peer-to-peer (P2P) lending party, and the cleanup isn’t going to be pretty. The industry is now scrambling to salvage what's left.

Tell me more

On August 16, the RBI issued new guidelines for P2P non-bank lending platforms, bringing operations of many firms to a screeching halt.

- No more guaranteeing of minimum returns, instant liquidity options, or promoting P2P as an “investment product”, RBI tells firms.

The 11-member association of P2P platforms, including major players like Liquiloans, Lendbox, LenDenClub, and Faircent, will meet RBI officials this week to seek clarifications, sources tell us.

- The new T+1 settlement rule, requiring repayment within one day, is among the major concerns the association plans to raise.

The aftermath

Meanwhile, several platforms have paused new investments and withdrawals to adjust.

- IndiaP2P and Cache-operated app 13Karat have halted bulk withdrawals and new investments.

- Some firms like LenDenClub claim to have started to make changes earlier this year following RBI supervisory checks.

The fate of other consumer-facing apps like Cred, BharatPe, and Mobikwik also hangs in the balance, as their P2P partnerships are now under review.

Hit the brakes

Q-comm cash in on Raksha Bandhan festivities

Quick commerce firms are increasingly becoming a major rival to traditional e-commerce marketplaces, as indicated by sales trends during the Raksha Bandhan festivities.

What are people buying?

Zomato's Blinkit, Swiggy Instamart, and Zepto witnessed a significant sales jump in the days leading up to the Raksha Bandhan festival.

Blinkit was on course to cross all-time high orders in a day, chief executive Albinder Dhindsa said on X (previously Twitter) on August 18. At its peak, the firm was selling 693 Rakhis per minute, he said.

- Blinkit, which has briefly activated international orders, saw a lot of orders come from the United States, Dhindsa said.

Zepto, which is set to close a $340 million financing soon, sold nearly 4 lakh Rakhis this year. This represents a four-fold increase from last year, co-founder Kaivalya V said in a LinkedIn post.

- Zepto also saw a 2.4x year-on-year (YoY) sales surge in Indian sweets, a 2.7x increase in chocolates, and a 4x rise in gifts sold, he said. The company was offering scratch cards (Shagun ka lifafa) with orders, giving consumers a chance to win prizes. This likely contributed to the boost in sales.

Swiggy Instamart also sold 5x more rakhis this year than what the company sold the entire 2023, co-founder Phani Kishan said on X.

Are q-comm eating into e-commerce?

As quick commerce surges to a $5 billion market in India within just three years, top executives at Blinkit, Swiggy, and Zepto assert that their growth is driven by shifting consumer preferences from e-commerce.

- The sector has gone from good to have in 2021 to an indispensable one now, according to analysts at UBS.

What next?

An AI-powered necklace as your second brain?

What if you have a personal Genie who could do whatever you wish and say? And that too without rubbing a lamp.

Driving the news

Bengaluru-based startup NeoSapien is all set to launch a Gen AI-powered necklace in November, calling it the "second brain".

- The startup’s product - Neo S1 - listens to daily-life conversations and acts as a reminder and decision-making support.

The product has already caught the attention of Peak XV’s managing director Rajan Anandan.

Tell me more

Neo S1 was developed in under six months, which identifies details like names, dates, and tasks, storing them locally on the device as well as on servers.

- A user can access the transcripts through a mobile-based app

Cofounders Dhananjay and Aryan Yadav said they believe that personal assistants are on their way to becoming the next big thing.

Advantage India?

However, NeoSapien is not the first to enter this field. A few US-based startups have tried to break in but have largely failed to gain traction due to executional issues. For example:

- Humane, backed by OpenAI CEO Sam Altman, launched a wearable AI computer Pin earlier this year. However, the product was widely criticized, and returns are now reportedly outpacing sales.

- Another US-based startup Rabbit AI, too, failed to impress most users, even drawing comparisons to the infamous Juicero.

NeoSapien claims that its product is way better in terms of response time and battery life.

Nonetheless, only time will tell if the Yadav’s can defy all odds and cause a behavioural change in customers with their latest gadget.

Dig deeper

MC Special: Foxconn’s China+1 boost for South India

India's southern states are poised to benefit as Foxconn, the world’s largest contract manufacturer, shifts some of its manufacturing from China as part of its China+1 strategy.

Foxconn CEO Young Liu met with India’s top leaders including Prime Minister Narendra Modi, opposition leader Rahul Gandhi, and the Chief Ministers of Karnataka, Tamil Nadu, and Telangana. Separately, Foxconn India representative V Lee met with Andhra Pradesh's IT minister Naresh Lokesh.

The country is capitalising on efforts by global companies to reduce their dependence on Chinese supply chains, with southern Indian states emerging as frontrunners in attracting these investments.

Read our special story