How have India’s oldest MF schemes rewarded investors?

A Moneycontrol analysis of India’s oldest equity-oriented mutual fund schemes have shown that they have returned 9-19% of compounded annualised returns since inception. They are either equity scheme or hybrid schemes having rich track record of paying dividend. These schemes rewarded the long term investors well and helped them to reach their financial goals

1/16

From the time India’s first ever mutual fund (MF) Unit Trust of India (UTI) was launched over the last 60 years to the time India’s first private sector MF was launched in 1993 to present times, mutual funds have grown to the chosen vehicle for the retail investor. Mutual funds are also arguably one of the best-regulated financial investments.

MFs haven’t disappointed in returns, either. Here we list out the top 15 oldest mutual funds in India that were launched since 1986. They are either equity schemes or hybrid schemes that have a rich track record of paying dividends. Schemes embedded with insurance and children funds are excluded from the list (UTI ULIP, LIC MF ULIS and UTI CCF - Savings Plan). Note that past performance is not indicative of future results. (Source: ACEMF).

MFs haven’t disappointed in returns, either. Here we list out the top 15 oldest mutual funds in India that were launched since 1986. They are either equity schemes or hybrid schemes that have a rich track record of paying dividends. Schemes embedded with insurance and children funds are excluded from the list (UTI ULIP, LIC MF ULIS and UTI CCF - Savings Plan). Note that past performance is not indicative of future results. (Source: ACEMF).

2/16

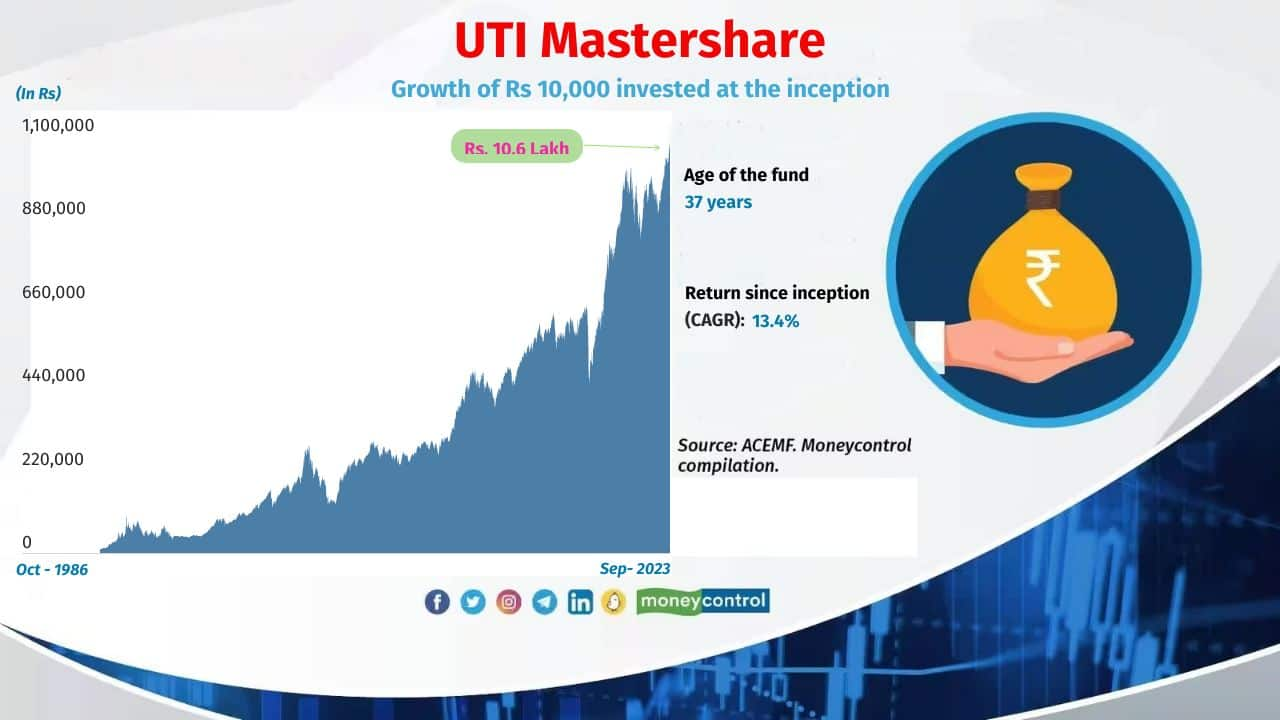

UTI Mastershare

Inception date: 15-Oct-1986

The first equity-diversified fund of the Indian mutual fund industry, UTI Mastershare, was initially a closed-ended fund. It was later converted into an open-ended fund in 2003. The fund had a rich track record of paying dividends, bonus issues and rights issues. Currently, it is categorised under large-cap funds.

Inception date: 15-Oct-1986

The first equity-diversified fund of the Indian mutual fund industry, UTI Mastershare, was initially a closed-ended fund. It was later converted into an open-ended fund in 2003. The fund had a rich track record of paying dividends, bonus issues and rights issues. Currently, it is categorised under large-cap funds.

3/16

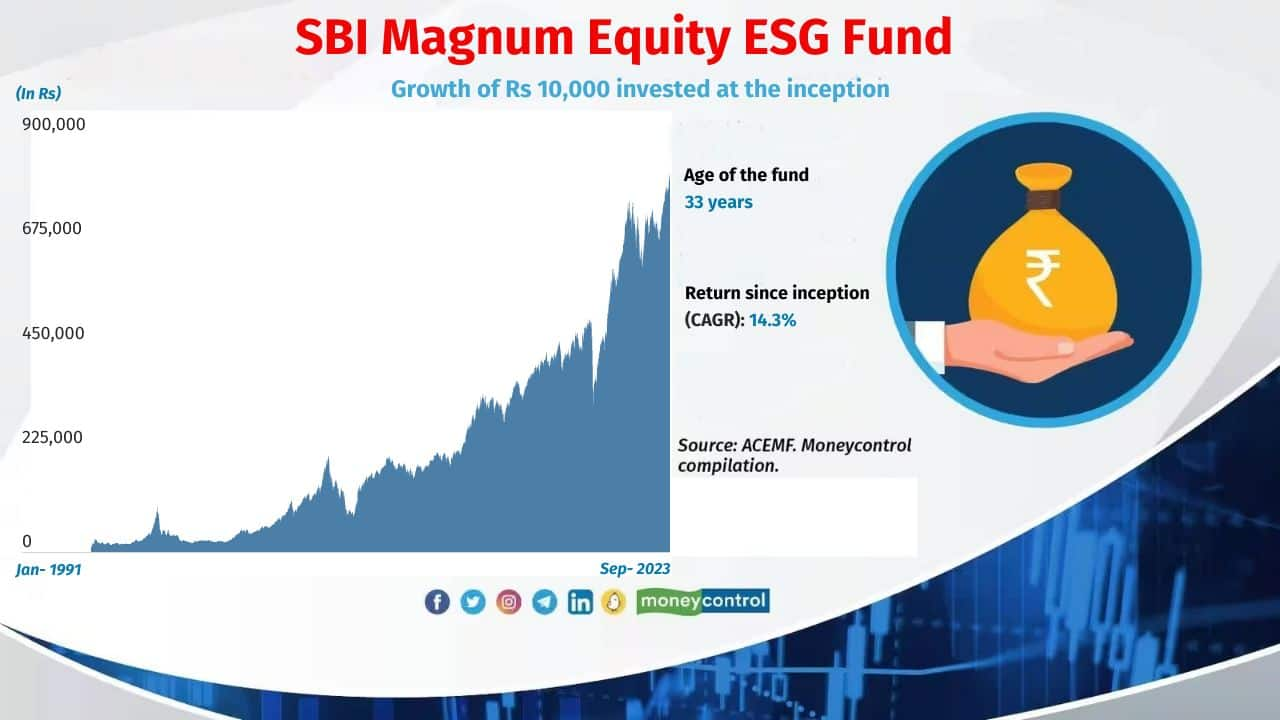

SBI Magnum Equity ESG Fund

Inception date: 01-Jan-1991

Launched as Magnum Multiplier Scheme ‘90, the equity-oriented fund got its name changed to Magnum Equity Fund when it was converted as an open-ended fund in 1997. During the re-categorization exercise in 2018, the fund house changed the fund’s attribute and the name to SBI Magnum Equity ESG Fund.

Also see: Microcaps that are fund house favourites but yet to unlock their potential

Inception date: 01-Jan-1991

Launched as Magnum Multiplier Scheme ‘90, the equity-oriented fund got its name changed to Magnum Equity Fund when it was converted as an open-ended fund in 1997. During the re-categorization exercise in 2018, the fund house changed the fund’s attribute and the name to SBI Magnum Equity ESG Fund.

Also see: Microcaps that are fund house favourites but yet to unlock their potential

4/16

LIC MF Aggressive Hybrid Fund

Inception date: 01-Jan-1991

Formerly known as LIC Balanced fund, LIC MF Aggressive Hybrid Fund has been managed with a balanced portfolio of equity and debt since inception. Currently, it is categorised under the Aggressive Hybrid Fund category.

Inception date: 01-Jan-1991

Formerly known as LIC Balanced fund, LIC MF Aggressive Hybrid Fund has been managed with a balanced portfolio of equity and debt since inception. Currently, it is categorised under the Aggressive Hybrid Fund category.

5/16

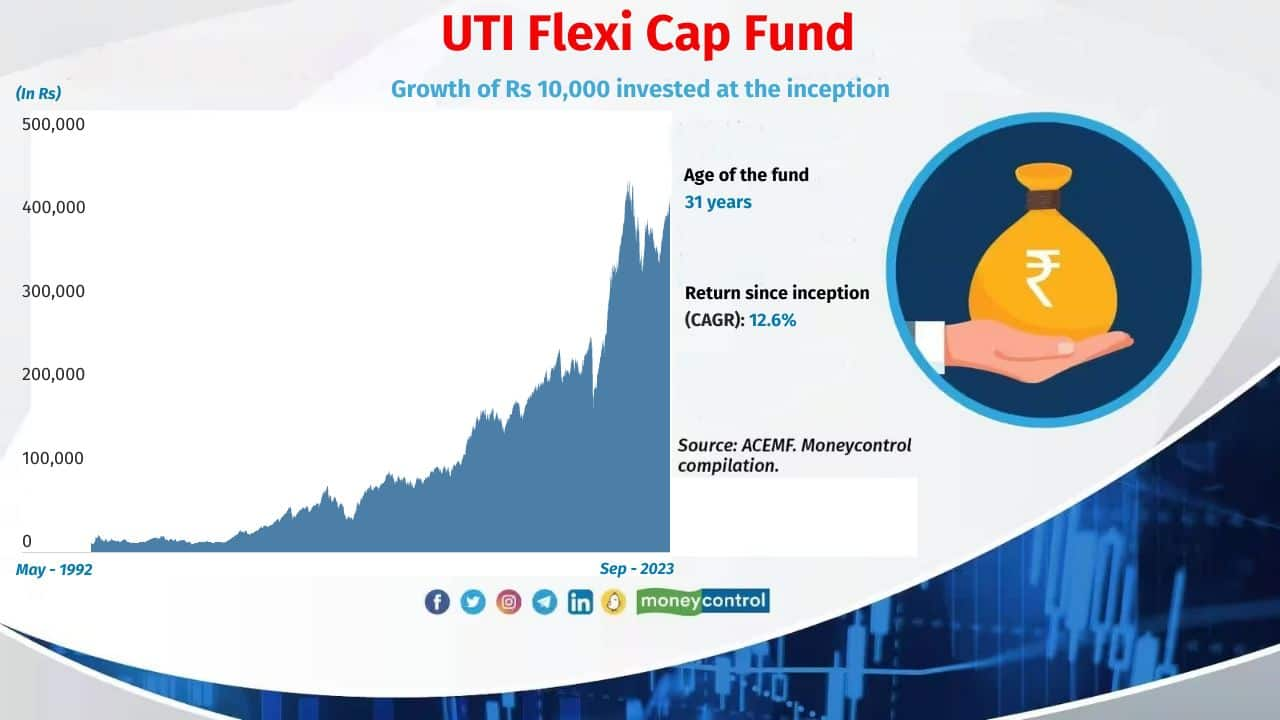

UTI Flexi Cap Fund

Inception date: 18-May-1992

Launched as UTI Mastergain '91, the fund was later renamed UTI Equity in 2005, following which it was renamed again as UTI Flexi Cap Fund in 2021 when the market regulator introduced flexicap and multi-cap categories.

Also see: Risk mitigation strategy: low volatile largecap stocks held by smallcap funds

Inception date: 18-May-1992

Launched as UTI Mastergain '91, the fund was later renamed UTI Equity in 2005, following which it was renamed again as UTI Flexi Cap Fund in 2021 when the market regulator introduced flexicap and multi-cap categories.

Also see: Risk mitigation strategy: low volatile largecap stocks held by smallcap funds

6/16

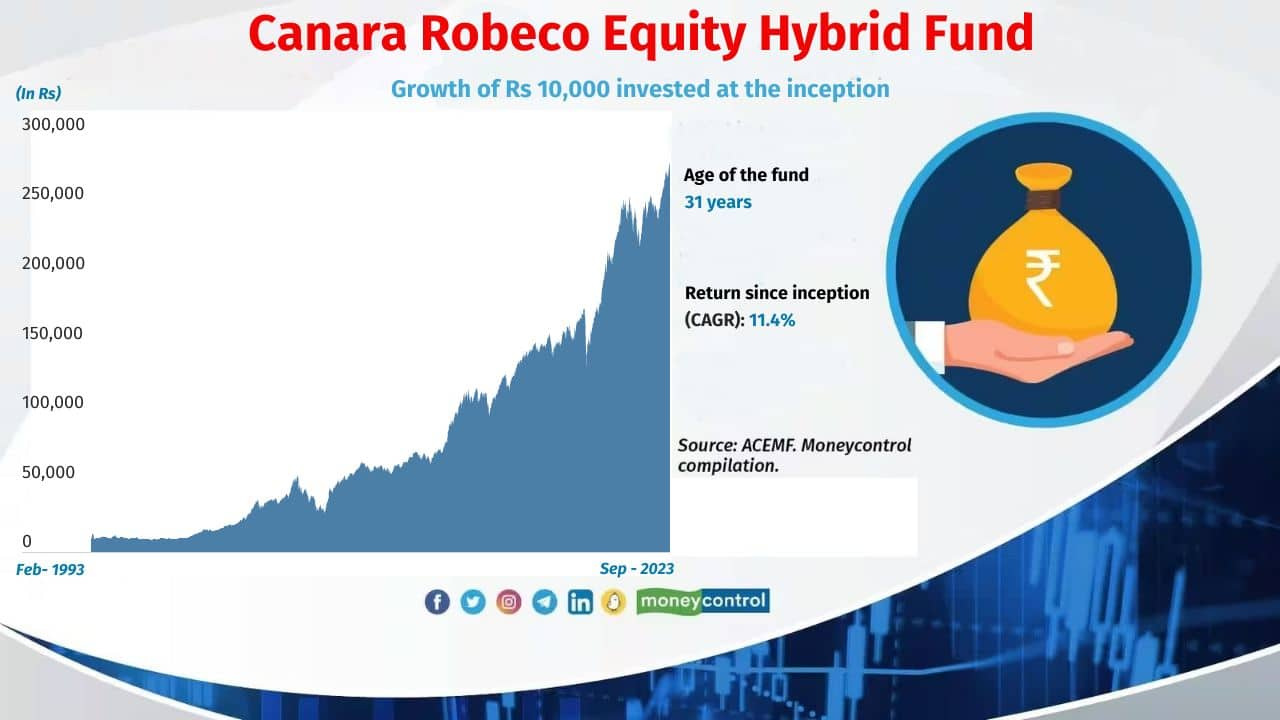

Canara Robeco Equity Hybrid Fund

Inception date: 01-Feb-1993

Formerly called GIC Balanced, Canara Robeco Equity Hybrid Fund has been one of the better-performing funds since its launch. Currently, it is part of the Aggressive Hybrid Fund category.

Inception date: 01-Feb-1993

Formerly called GIC Balanced, Canara Robeco Equity Hybrid Fund has been one of the better-performing funds since its launch. Currently, it is part of the Aggressive Hybrid Fund category.

7/16

Tata Large & Mid Cap Fund

Inception date: 25-Feb-1993

It was launched as Ind Sagar and later renamed as Tata Large & Mid Cap Fund. As per the current strategy, it invests about 35 percent each in large and midcap stocks.

Also see: Nifty at 20K: These stocks had low weight on index - Active funds got the bet right

Inception date: 25-Feb-1993

It was launched as Ind Sagar and later renamed as Tata Large & Mid Cap Fund. As per the current strategy, it invests about 35 percent each in large and midcap stocks.

Also see: Nifty at 20K: These stocks had low weight on index - Active funds got the bet right

8/16

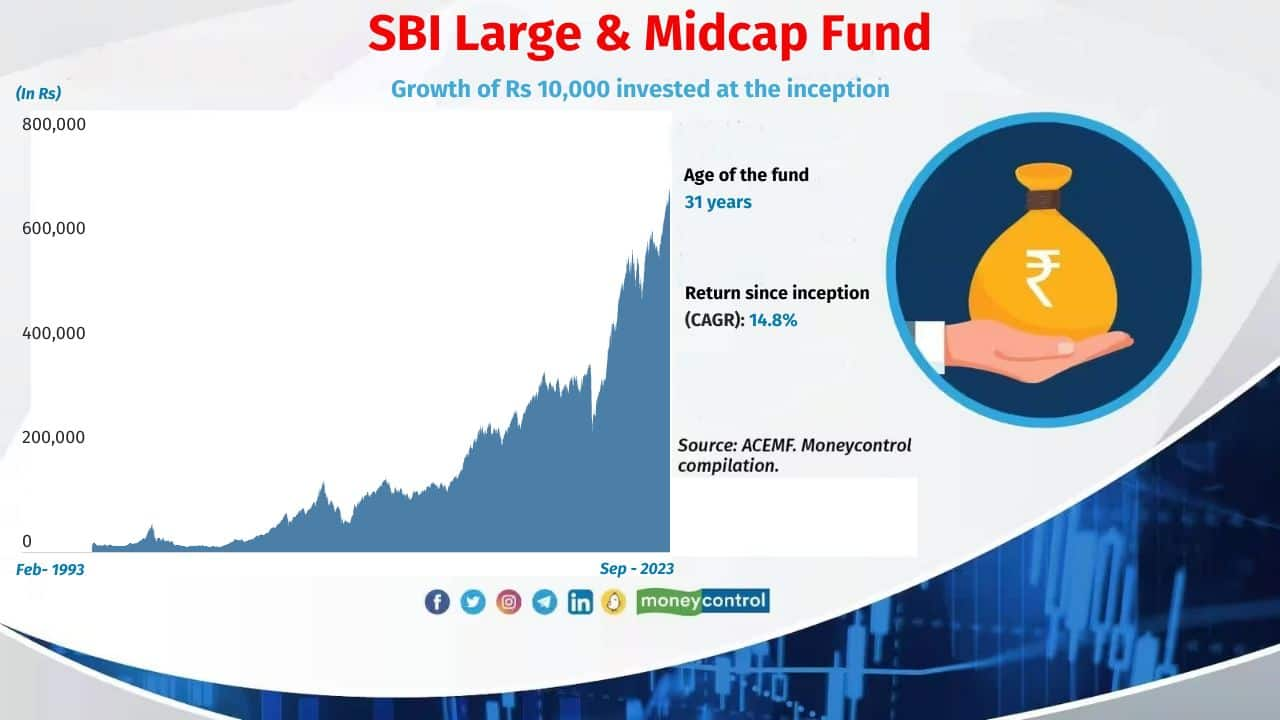

SBI Large & Midcap Fund

Inception date: 28-Feb-1993

Earlier known as SBI Magnum Multiplier Plus, SBI Large & Midcap Fund invests about 35 percent each in large and midcap stocks.

Inception date: 28-Feb-1993

Earlier known as SBI Magnum Multiplier Plus, SBI Large & Midcap Fund invests about 35 percent each in large and midcap stocks.

9/16

Canara Robeco Equity Tax Saver Fund

Inception date: 31-Mar-1993

Previously called Can Equity Taxsaver, Canara Robeco Equity Tax Saver Fund has been an above-average performer in most of the period since launched.

Also see: 13 Smallcap Gems That Infrastructure Mutual Funds Love to Hold

Inception date: 31-Mar-1993

Previously called Can Equity Taxsaver, Canara Robeco Equity Tax Saver Fund has been an above-average performer in most of the period since launched.

Also see: 13 Smallcap Gems That Infrastructure Mutual Funds Love to Hold

10/16

SBI Long-Term Equity Fund

Inception date: 31-Mar-1993

Earlier known as Magnum Taxgain Scheme 93, SBI Long Term Equity Fund was once managed with a midcap heavy portfolio. It has been a long-term wealth creator while proving the tax benefit.

Inception date: 31-Mar-1993

Earlier known as Magnum Taxgain Scheme 93, SBI Long Term Equity Fund was once managed with a midcap heavy portfolio. It has been a long-term wealth creator while proving the tax benefit.

11/16

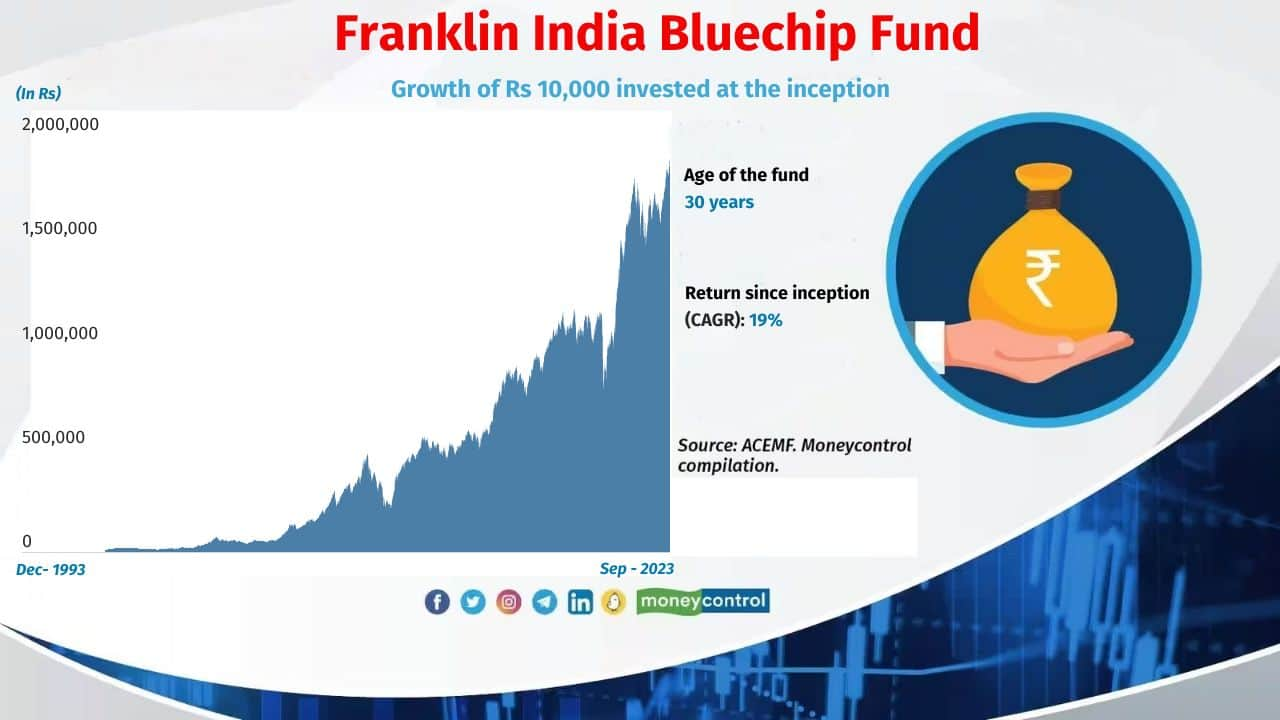

Franklin India Bluechip Fund

Inception date: 01-Dec-1993

The fund was launched as Kothari Pioneer Bluechip fund and renamed later as Franklin India Bluechip fund.

Also see: Stocks With Multiple Faces! Common Names Across Smart-Beta MFs

Inception date: 01-Dec-1993

The fund was launched as Kothari Pioneer Bluechip fund and renamed later as Franklin India Bluechip fund.

Also see: Stocks With Multiple Faces! Common Names Across Smart-Beta MFs

12/16

Franklin India Prima Fund

Inception date: 01-Dec-1993

Formerly called Kothari Pioneer Prima Fund, Franklin India Prima Fund has been investing mainly in mid and smallcap companies. Currently, it is categorised as a midcap fund.

Inception date: 01-Dec-1993

Formerly called Kothari Pioneer Prima Fund, Franklin India Prima Fund has been investing mainly in mid and smallcap companies. Currently, it is categorised as a midcap fund.

13/16

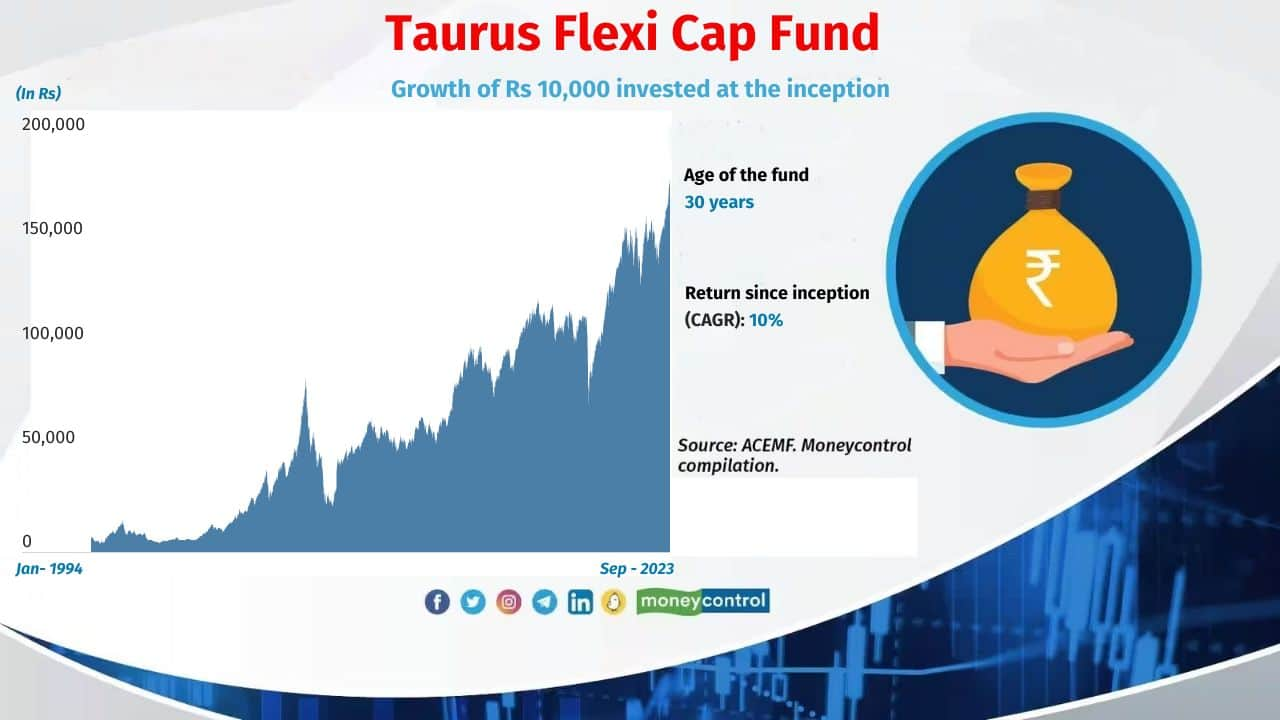

Taurus Flexi Cap Fund

Inception date: 29-Jan-1994

Formerly known as Taurus Starshare, Taurus Flexi Cap Fund is currently allocating to the stocks across market capitalisation and sectors.

Also see: The quality test: Should you invest in smart beta funds focusing on quality?

Inception date: 29-Jan-1994

Formerly known as Taurus Starshare, Taurus Flexi Cap Fund is currently allocating to the stocks across market capitalisation and sectors.

Also see: The quality test: Should you invest in smart beta funds focusing on quality?

14/16

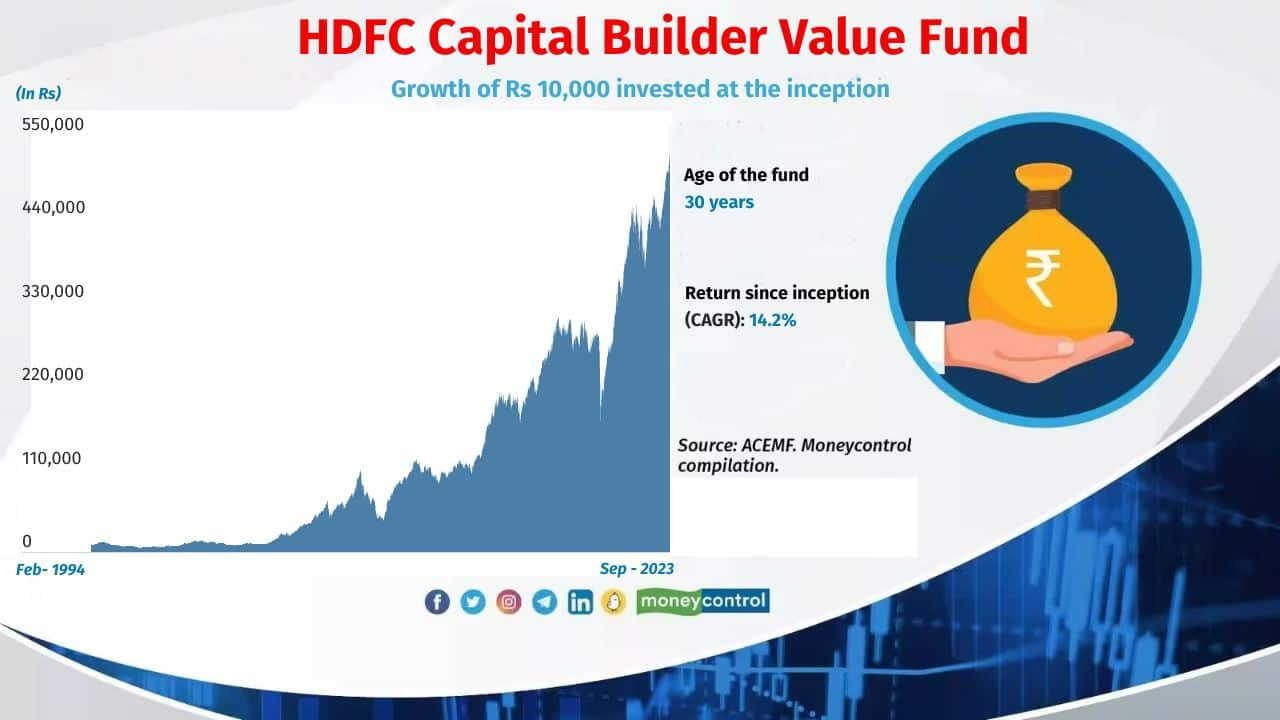

HDFC Capital Builder Value Fund

Inception date: 01-Feb-1994

The fund was launched as Zurich India Capital Builder. Now it is categorised under value funds.

Inception date: 01-Feb-1994

The fund was launched as Zurich India Capital Builder. Now it is categorised under value funds.

15/16

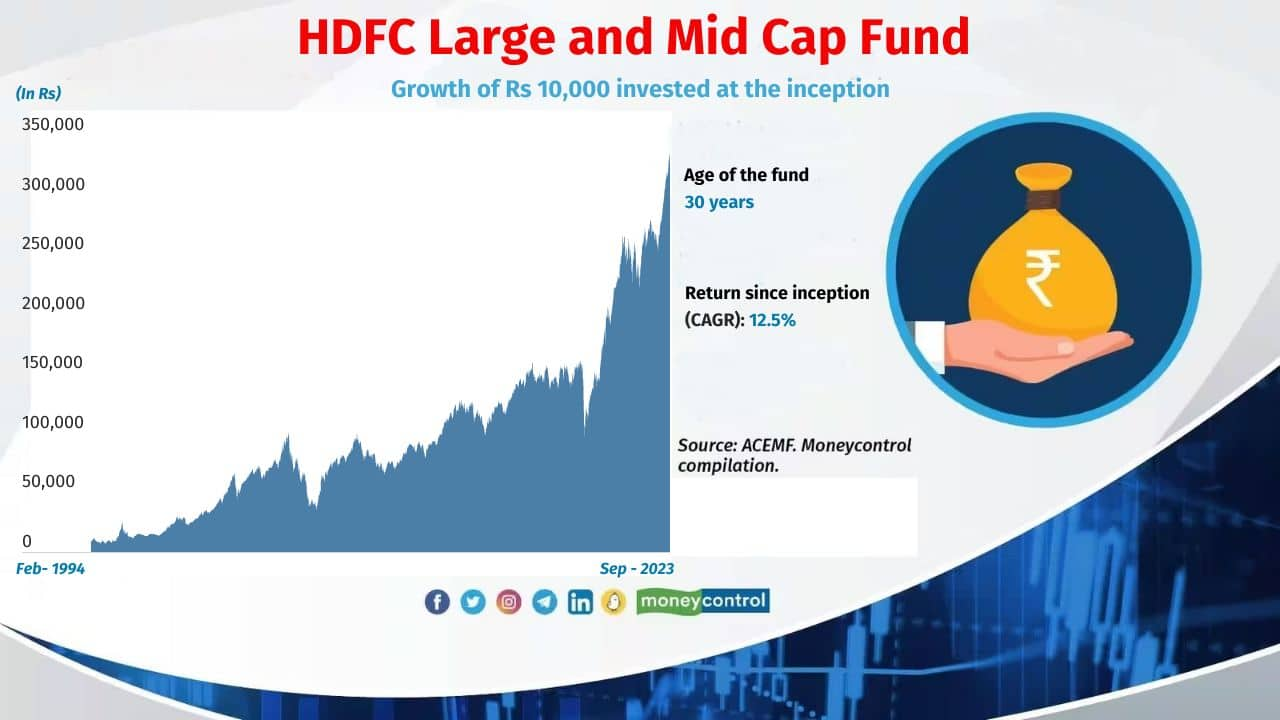

HDFC Large and Mid Cap Fund

Inception date: 18-Feb-1994

Earlier known as Morgan Stanley Growth Fund, it was a flagship fund of the Morgan Stanley mutual fund. Being close-ended, the funds were listed and traded in the various stock exchanges in India. It became an open-ended fund in 2009. It was later renamed as HDFC Large Cap Fund in 2014. Currently, it is categorised under the large and midcap fund categories.

Also see: Buy-and-hold: Mutual Fund schemes that churn the least

Inception date: 18-Feb-1994

Earlier known as Morgan Stanley Growth Fund, it was a flagship fund of the Morgan Stanley mutual fund. Being close-ended, the funds were listed and traded in the various stock exchanges in India. It became an open-ended fund in 2009. It was later renamed as HDFC Large Cap Fund in 2014. Currently, it is categorised under the large and midcap fund categories.

Also see: Buy-and-hold: Mutual Fund schemes that churn the least

16/16

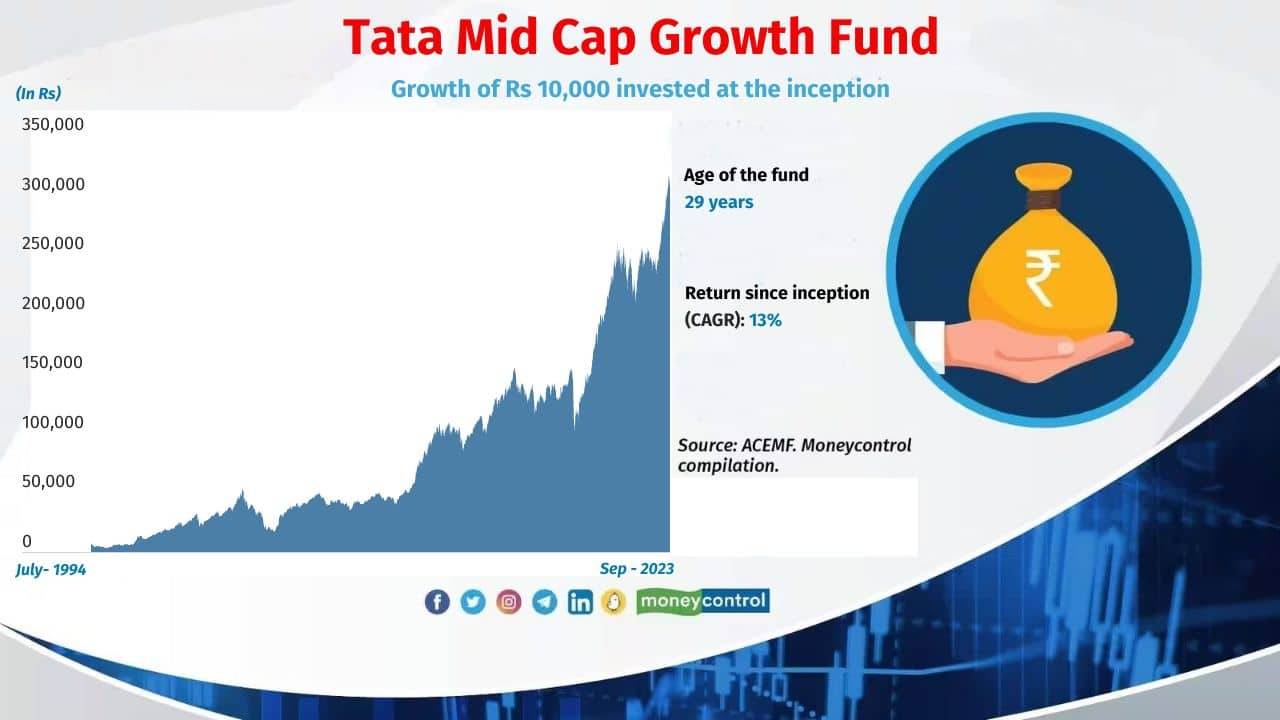

Tata Mid Cap Growth Fund

Inception date: 01-July-1994

Earlier called Tata Ind Navratna Fund, Tata Mid Cap Growth Fund managed to deliver better returns since its launch.

Also see: MC30 scheme review: Why PGIM India Midcap Opportunities Fund is a long-term wealth creator

Inception date: 01-July-1994

Earlier called Tata Ind Navratna Fund, Tata Mid Cap Growth Fund managed to deliver better returns since its launch.

Also see: MC30 scheme review: Why PGIM India Midcap Opportunities Fund is a long-term wealth creator

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!