The offer made by British Prime Minister Boris Johnson, on July 1, to accept holders of British National Overseas (BNO) passports among the Hong Kong residents and put them on the road to citizenship, came as a pleasant surprise to at least the 300,000 BNO passports holders.

Keeping aside the rights and wrongs of the politics behind the move, let us focus on the implication of such decision, if materialised, on the world economy.

Starting with the host country, viz., Britain, this would help to shift from low-skilled to high-skilled immigration, because these immigrants would assist Britain to be turned into a commercial hub linking Europe and Asia. Thereby it would also justify the decision of leaving the European Union, by shaping into ‘Global Britain’ rather than ‘Little England’. Surely, embracing around 300,000 diligent, entrepreneurial Hong-Kongers would be an excellent catalyst for UK business.

However, the primary agenda of the post-Brexit UK economy is to negotiate its ‘own’ trade and investment deals with major economies, like the United States, India, Brazil and China. Then, should the UK be concerned ‘too much’ regarding its bilateral economic relationship with Beijing? Possibly not, if Brits are not worried about ‘Made in China’ or ‘Made in Hong Kong’ labels.

It can be a possibility that like the US, the UK too can find a third region (block of countries), which, in turn, is also engaged with integrated bilateral ties with China and Hong Kong. For example, Vietnamese exports to the US surged in 2019 and some of the products, such as plywood, are made in China; but shipped to the US via Vietnam with ‘Made in Vietnam’ labels.

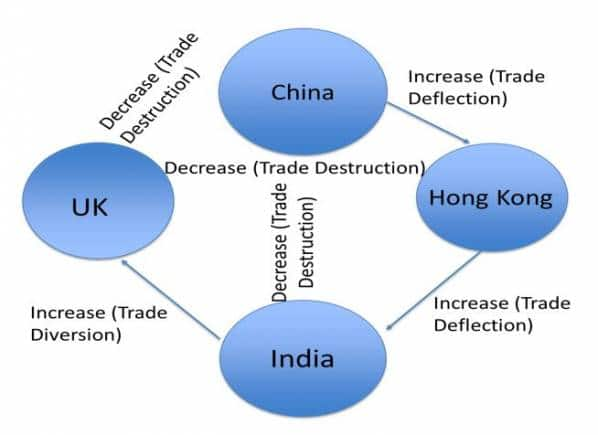

In the figure alongside we illustrate the possible effects of deterioration in the UK’s bilateral ties with Hong Kong and China on the trade flows, keeping India as the alternative partner for trade diversion. If the UK resists imports from China and Hong Kong, it would have to impose anti-dumping duties on the products from these two countries. The immediate effect is ‘trade destruction’ — that is, a decrease in the UK’s imports of the targeted products from China and Hong Kong.

Now given the fact that India has been Hong Kong’s third-largest export market, with almost $34 billion bilateral trade as of 2017 (Census and Statistics Department, Hong Kong), even considering for the recent India-China tension, and accounting for the possible ‘trade destruction’ between China and India, if India can maintain good bilateral economic flows to and from Hong Kong, it can emerge as the favourable candidate to be the third country market for the ‘trade diversion’ of the UK.

Therefore, the naturally arising question here is: what do we mean by a ‘trade diversion’ effect? In our context, ‘trade diversion’ implies an increase in the UK’s imports from India rather than from China or Hong Kong.

Hereby comes the third effect, which is an increase in China’s exports to Hong Kong and the consequent increase in Hong Kong’s exports to India, known as the ‘trade deflection’ effect. This kind of rerouting, trans-shipment or re-exporting of services has been advocated by upstream firms too. In the logistical terminology, the process of rerouting circumvention can be described as the following:

(1) the products made in China or Hong Kong can be exported to another country/region (in our example, India) at little cost to exporters;

(2) the customs clearances for cargo can be cleared in India, then the cargo can be sent to the relevant warehouse in India, and then can be picked up and subsequently reloaded in a new container (booked in India); and,

(3) a local factory can be found in India to provide all the original certificate of origin (C/O) documents from India and then export the products to the UK.

Although multinational companies now run out of mainland China and Hong Kong, international businesses and investors trust Hong Kong’s legal system. Therefore, Hong Kong’s status as one of Asia’s most prominent financial hubs will be hard to shake. The city’s seamless interface with the West, not to mention its massive port, make it a very easy place to do business with global investors.

Given this, India must grab this opportunity to become a successful third country market for rerouting trade from Hong Kong to the UK. One possible alternative success formula for India is to collude with the countries with larger ethnic Chinese population, such as Taiwan or Vietnam, for rerouting Chinese and Hong Kong exportable. This is because such countries can help to understand the requirements of the exporters from China and Hong Kong better.

Only time will tell whether the present turmoil of Hong Kong would prove to be a cornerstone in stimulating India’s global stature or not.

Shreya Banerjee is a research scholar and Soumyatanu Mukherjee is a Faculty of Finance at the Southampton Business School, University of Southampton (UK). Views are personal.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!