With more than 50 years of experience in the fluorine value chain and amongst the largest chemical company in this space, Navin Fluorine (Market cap: Rs 3959 cr) has scaled up the value ladder. It’s foray into complex chemistry applications of fluorine and resultant steady cash flows make it an interesting pick from the chemical space.

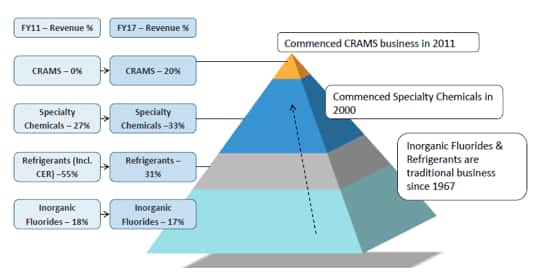

Company descriptionNavin Fluorine International (NFIL, Padmanabh Mafatlal group company), established in 1967, is a diversified major in the fluorochemical value chain having exposure to high margin segments - CRAMS (Contract Research and Manufacturing Services), Specialty Chemicals, along with high volume and relatively low margin Inorganic fluoride business and the legacy Refrigerant gas business.

Major end markets for the company are agro-chemicals and pharmaceuticals with some of the known clienteles as Clariant, Bayer, Syngenta, BASF, Lupin, Sun Pharma, Samsung and LG. Key manufacturing locations are at Surat, Dahej and Dewas with R&D centres at Surat and Runcorn, UK.

As per Montreal protocol, gradual phase out of ozone depleting refrigerant gases is underway which has capped the volume growth in medium term for the refrigerant gases (Mafron-22/ HCFC-22/R-22) produced by the company. It’s noteworthy that first phase of production cut down for developing countries happened in 2015 (-10%) and next is scheduled for 2020 (-25%).

While the company is not into new replacement gases like R-410a and R-32, it gains from the better pricing realisations for the R-22 (lower production worldwide) and increasing non-emissive applications of this gas, particularly in the pharma, agro-chemical industries.

In addition to that it is important to mention that prospects of moving to newer generation refrigerant gases (low global warming replacement) are being explored as the company has an exclusive tie up with Honeywell to produce Honeywell Solstice yf (R-1234yf, Automobile refrigerant gas) which is a replacement of another phased out gas i.e. R-134a (HFC- hydrofluorocarbons)

Inorganic fluorides business caters to products having usage in range of industries like Steel, Oil & Gas, and abrasives. Turnaround in steel industry and increasing share of exports (14% in 9m FY18 vs. 11% in FY16) in the segment are expected to support near term growth.

Over the years, NFIL has diversified to high margin applications of fluorochemicals (Specialty Chemicals & CRAMS).

In case of Specialty chemicals, NFIL has a broad portfolio of intermediates used for domestic pharmaceutical industry (~40% of Specialty chemicals revenue), global agrochemical industry (~40%) and rubber industry. While higher sales of exports (43% in FY17) in this segment is the salient feature, underlying growth in global agrochemicals and the pricing pressure in the pharma industry are two relevant factors which needs to be watched.

The CRAMS opportunityPharmaceutical and agrochemicals are the key end markets where usage of fluorine is expanding, whilst imparting functional properties. Literature (Nature's building blocks: An A–Z guide to the elements by John Emsely) suggest that about ~20% of the FDA approved pharmaceutical drugs (eg: Lipitor and Prozac) contain fluorine. Similarly, 30% of the agrichemical compounds are estimated to contain fluorine (Source: Fluorines treasure trove, ICIS).

Common class of drugs having fluorine application are mineralocorticoids, anesthetic agents, antidepressants. Among the functional properties which gets imparted due to fluorine is delayed metabolism (lengthens time between dosing and activation) and lipophilicity (ability to dissolve in fats).

Now in this R&D intensive field, innovators (both Pharma & Agrichem) are looking at contract research opportunities due to rising cost (regulatory requirements), longer gestation period and falling success rates.

NFIL is well positioned in contract research services (initiated in 2010) in the pharmaceutical space wherein it is the only company in India having fluorine-based cGMP plant (Current Good Manufacturing Practice regulations as enforced by the US FDA). Here it partners with innovators in early stage of R&D which makes it a high margin opportunity.

As a further fillip, company’s capability in this space was enhanced with its acquisition of Manchester Organics Ltd, UK that provide access to developed markets.

Back in India, NFIL’s JV with Piramal enterprise (Convergence Chemicals – NFIL share: 49%) for manufacturing a fluorine specialty chemicals exclusively for health care arm of Piramal, provides a high visibility income stream (revenue potential: ~Rs 145 crore based on asset turnover of 1x).

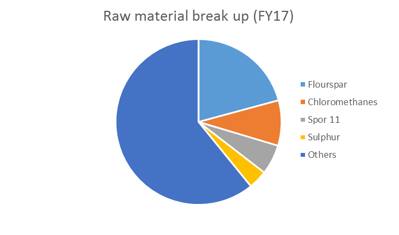

De-risking initiative for raw material (63% imported FY17) sourcingPrices of Fluorspar, one of the key raw material for the company, have risen to the tune of 50% YoY due to improving demand and reduced supply (production cut down in China). Additionally, volatility in raw material prices have been a recent concern due to which the company has been working on various de-risking initiatives.

One of the ways it is ensuring it is by sourcing some of its raw material needs domestically. For instance, NFIL (25% share) along with the Gujarat Fluorochemicals have JV with Gujarat Mineral Development Corporation (GMDC) to benefit from the steady supply of fluorspar ores from the GMDC mines. Here, it’s noteworthy that company majorly depends on Non-China sources for its fluorspar needs.

Balance sheet appears healthy with zero debt and provides scope for expansion.Company has recently approved a capex plan (Rs 115 cr) towards additional cGMP facility in Dewas which is expected to come onstream in June’19.

Valuations:

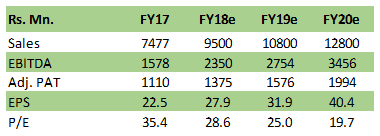

We are encouraged by the transition NFIL has made from commodity fluorides applications and refrigerant gases to that high values CRAMS/ specialty chemicals. The company’s continuous investment and R&D (4%-6% of Sp. chemicals and CRAMS sales) into complex fluorine applications are expected to lead the topline growth. Secondly, accompanying product mix is expected to offset margin pressure from the raw material side.

Other salient aspect is the free cash flow (FCF). In last five years, company has generated steady FCF (30% of net income) while undergoing cumulative capex expenditure to the tune of Rs 300 crore.

As far as valuations are concerned, stock is currently trading 25x 2019e earnings which is broadly in line with the multiple enjoyed by the sp. Chemical sector (GICS: 23x) but at discount to that for the pure pharma CRAMS players.

Factors to watch out are competition from the Chinese players (CRAMS), raw material inflation and revival in global agrochemical industry.

Overall, we look at the company as an accumulation candidate benefitting from the barriers of entry created by the technical knowhow.

For more research articles, visit our Moneycontrol Research Page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!