Finance Minister Nirmala Sitharaman recently presented the Monthly Economic Review (MER, May 2022) to the Cabinet. The MER noted that ‘while the world is looking at a distinct possibility of widespread stagflation’, India ‘is at low risk of stagflation’. RBI’s State of Economy Report (May 2022) also stated that ‘India is better placed than many other countries in terms of avoiding the risks of a potential stagflation’.

Before discussing the possibility of stagflation in India, we need to understand the history of stagflation.

‘Stagflation’ was first coined by UK politician Iain Macleod in 1965. In a parliamentary debate he reflected on how the UK economy has the “worst of both the worlds” of stagnation in growth/employment, and high inflation. This was followed by the statement that introduced the term stagflation: “We have a sort of "stagflation" situation and history in modern terms is indeed being made”.

However, ‘stagflation’ caught the attention of policymakers only in the 1970s when the global economy, particularly the United States, suffered from both stagnation of growth and high inflation. Since then stagflation has become an important part of macroeconomics discussion and policy.

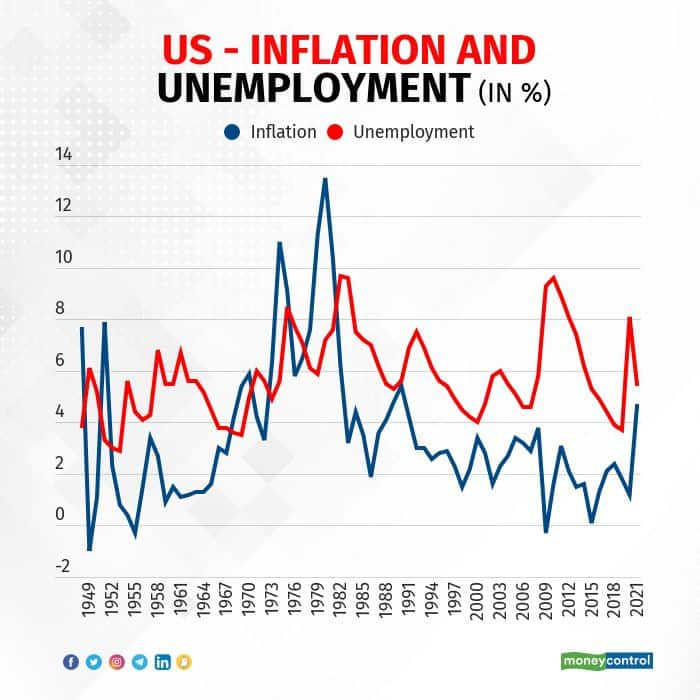

The Phillips CurveBefore the 1970s, macroeconomics centred on a concept called Phillips Curve, which suggested an inverse relationship between unemployment and inflation data — if an economy had high unemployment it would have low inflation, and vice-versa.

In a high unemployment economy, the policymakers will ease interest rates, leading to expansion in employment/output, and subsequently generate higher inflation too. Gradually as the unemployment situation eases, the policymakers can increase policy again, and bring inflation under control. Thus, the Phillips Curve became an important tool for both macroeconomists and policymakers.

The Phillips Curve relationship broke down in the 1970s with a rise in both inflation and decline in growth and high unemployment, particularly in the US economy.

The failure of Phillips Curve led to a new macroeconomic thinking. Economists, led by Milton Friedman, said that at most there is a short-run trade-off between the two variables. Over a long run, if one trades off higher inflation for lower unemployment, it feeds into higher inflation expectations which leads to higher inflation in future. Thus, the Phillips Curve was not inversely sloped, but vertical over the long run. The implication was that the central banks should stop managing unemployment, and just focus on controlling inflation. As a result, the central banks started to focus on controlling inflation as its policy goal.

The 2008 crisis led to yet another change in thinking on monetary policy. The crisis led to a decline in growth, and for the next decade the central banks in advanced economies faced a different problem of low inflation. They lowered policy rates and increased monetary stimulus, but struggled to increase inflation. The economists said the Phillips Curve had not flattened which implied that inflation will not increase even if there was lower unemployment. The central banks were under pressure as growth was lower and few central banks also started including growth/employment/financial stability as part of their objectives.

The 2020 pandemic and the Russia-Ukraine war have brought back the 1970s stagflation to the fore. The pandemic led to lockdowns and disruptions in supply chains, leading to both collapsing growth and rise in inflation. As the economies were recovering from the double blow of the pandemic, the occurrence of war not just continued disrupting supply chains, but also pushed higher the prices of oil and commodities.

Most developed countries are seeing inflation levels last seen in the 1980s. With the war led inflation, the central banks are increasing interest rates like never before. The US Federal Reserve raised policy rates by 75 bps in its last meeting. The last time interest rates were raised by such a magnitude was in 1994. The rate hikes will lead to further decline in growth. The World Bank and BIS have released reports on the rising risks of global stagflation amidst sharp slowdown in growth.

Stagflation In India?Given the above, how real is the risk of stagflation in India?

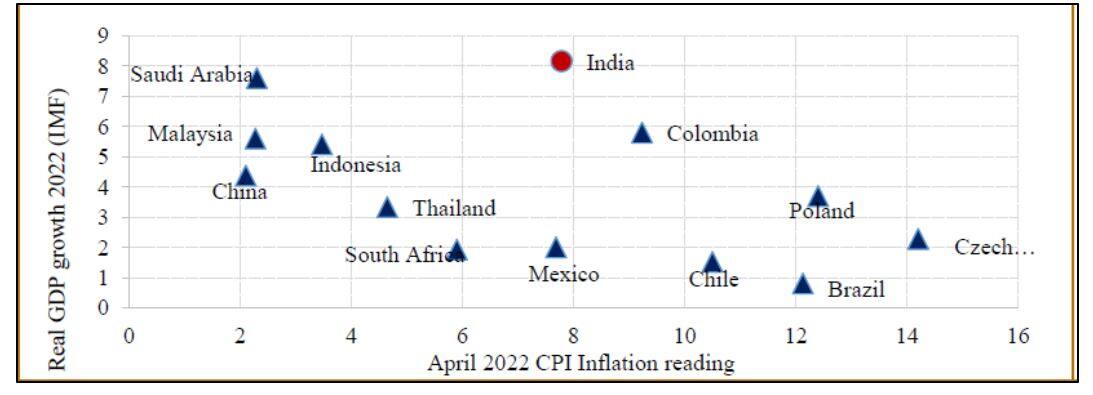

The finance ministry’s MER draws attention to the chart below, which compares the inflation and growth (as unemployment data is not readily available, growth has replaced unemployment) of various countries. While India is expected to be the fastest-growing country at 8 percent in 2022, its inflation is placed in the middle at 8 percent.

The MER adds that India’s stabilisation policies will help keep stagflation risks lower. On inflation, the Reserve Bank of India has increased policy rates and the government has followed by cutting duty on oil imports. The government has also increased subsidy on LPG cylinders to households and fertiliser subsidy to farmers. The government has also banned exports of wheat, and allowed duty-free imports of soybean and sunflower oil.

On the growth front, the production-linked incentive (PLI) scheme has been extended to 14 sectors. The government’s focus on renewable energy will bring investments, and help reduce dependence on oil imports. The capital-expenditure-oriented budget will continue to provide stimulus. However, the rise in subsidies and continued expenditure adds upside risk to fiscal deficits. The RBI’s report adds that most constituents of GDP have surpassed pre-pandemic levels, and domestic economic activity is gaining strength.

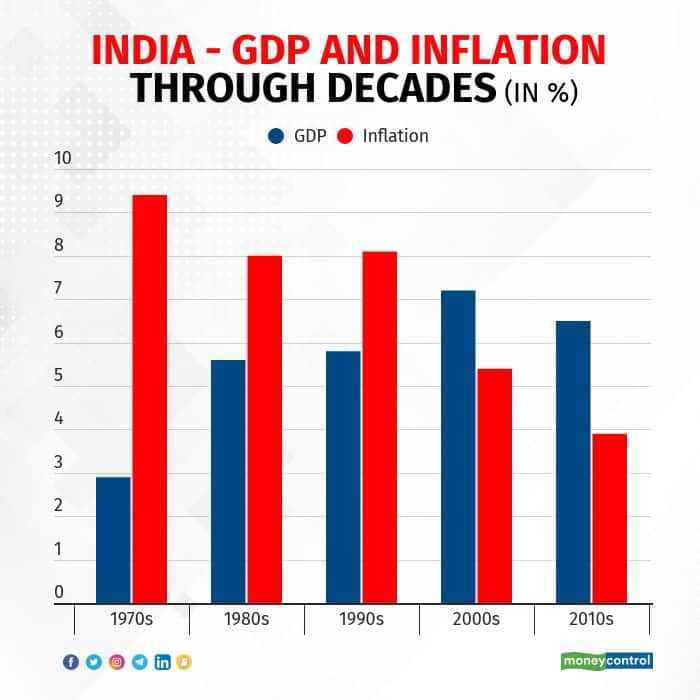

Stagflation risks in India are lower when compared to other countries. However, India cannot be complacent as its growth and inflation figures show we also faced stagflation in the 1970s. Even if we escape stagflation this time around, there is still a risk of facing high inflation and subdued growth as has been the case for most part of India’s macroeconomic history. We can see that average growth is higher than average growth only in the last two decades. We should do our best to not reverse these macroeconomic outcomes.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.