Anubhav Sahu

Moneycontrol Research

Graphite India and HEG continue to witness purely pricing-led growth wherein quarterly revenue has more than doubled on sequential basis. While benefiting from high operating leverage, the company showcased improved profitability as it progressed in the renewal of its supply side and demand side contracts.

Also read: Graphite India Q2 - Gains from improved pricing; Watch out for fresh contracts

HEG’s quarterly update

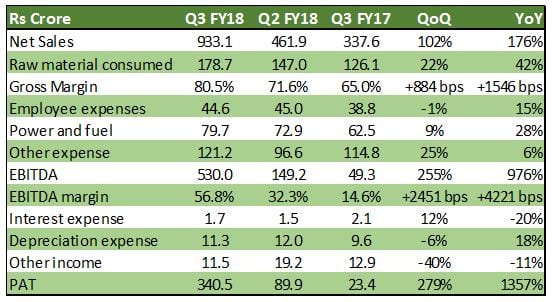

HEG’s quarterly result was well ahead of expectations. Sales more than doubled on sequential basis and exhibited the benefit of change in pricing trend and progress in contract renewals for the graphite electrodes.

Its gross margin saw a spurt on sequential basis on account of lagged growth in contracted raw material prices. YoY basis, increase in raw material prices have been mainly due to increase in prices for needle coke.

Having said that, gross margins for the company which lagged its peer Graphite India last year, has gone ahead in this quarter.

Infact at the EBITDA margin level, company is well ahead of Graphite India (66.8 percent vs. Graphite India’s 56.8 percent in Q3 FY18) on account of lower employee and power expenses.

However, HEG’s plants are now running close to 85 percent utilization which is below compared to Graphite India (~95 percent) and expect a run rate of 80-90 percent in FY19.

Table: Graphite’s Q3 FY18

China factor remains supportive for Graphite electrode price

As per management feedback, in China, closure of inefficient induction furnaces and polluting blast furnaces is expected to be replaced by electric arc furnace. New policy measures announced in China, ensures zero growth in steel capacity by requiring steel capacity replacement to be kept in ratio – 1.25:1 or 1:1 (regional differentiation).

About 56 new EAF furnaces are coming up in by the end of current year with an aggregate capacity of ~60-70 MT. Thus Chinese production through EAF route is expected to rise from 5.2% (CY 2016) to about ~13%.

Further, near about, 300 kMT of graphite electrode manufacturing capacity (earlier capacity: 890kMT) has also been shut down in China.

Rest of the world

Chinese steel exports have declined to annual run rate of 75 MT (CY 2017) from about 115 MT in 2016. Further, Chinese exports of semi-finished steel (eg: billets) have also reduced from 35 MT (CY 2016) to 7-8 MT (CY 2017).

This has led to higher steel production in rest of the world through EAF route. Additionally, recent winter cuts of 36 MT in China are likely to increase steel production in other countries

In result, the US and EU steel industry grew by 4.0% YoY each, driven by higher domestic capacity utilization. The Middle East steel production has also increased by 11.8% YoY in CY 2017. These all are major EAF producing regions (40-65% production through EAF route) and increased capacity utilization in these regions is supportive for electrode demand.

Capacity expansion and needle coke supply

While HEG is exploring the option of increasing capacity from 80,000 MT to 100,000 MT, supply constraint of needle coke may keep it waiting for now.

However, good news is that Conoco Phillips, the largest producer of needle coke in the world, is executing a major capacity expansion plan of 15-20% of existing capacity. While this would help in stabilizing raw material prices, needle coke’s usage for other high margin application – Lithium Ion batteries (~15% of usage) would remain a critical factor to look at.

Chart: Global needle coke capacity (kT)

Overall, near term constraints due to needle coke supply caps the volume growth for the graphite electrode manufacturers, valuations can sustain at current level due to higher end market demand as well as higher usage of

EAF route for Steel manufacturing.

In context of changing steel production dynamics, supply side reforms in China and the imbalance in graphite electrode supply-demand, Graphite India (11.4x 2019e earnings) and HEG (9.6x 2019e earnings are pricing in reasonable growth even if we factor in lower net margins (20% lower than Q3FY18) on account of delayed impact of new needle coke contracts and sales remain at current run rate (assuming same pricing for graphite electrodes).

For more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.