The IPO (initial public offer) of Godrej Agrovet (GAL) provides an opportunity to invest in a high quality/growth company run by a trusted promoter group. The farm to fork company has stakes in promising segments which we believe are well-positioned to create value in the long term. Investors with a long term horizon should look at this multi-year compounding proposition of the business.

The CompanyIncorporated in 1991, GAL has generated consistent returns and achieved high growth through both organic and inorganic routes and has become a prominent player across all its business verticals. The company has a pan India presence with major concentration in South and has a strong brand recall.

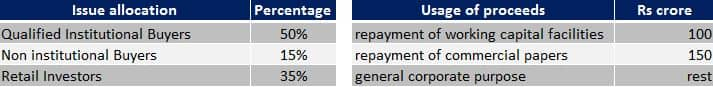

The IPOGAL’s issue comprises a fresh issue of up to Rs 291.5 crore, an offer for sale by Godrej Industries for up to Rs 300 crore and 1.23 crore shares sale by V Sciences. In the price band of Rs 450 - Rs 460 per share, the total issue size approximates between Rs 1,145 crore – Rs 1,157 crore. The issue would reduce the promoter’s stake (Godrej Industries) in the company by approximately 6 percent.

GAL has a diversified farm products business with operations spanning across five major verticals. Majority business of the company belongs to under penetrated and high growth segments.

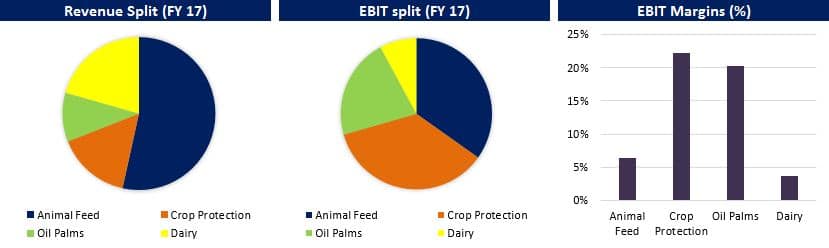

Animal feed - GAL is the market leader in the compound cattle feed business and is growing fast in the poultry and aqua feed segments. Overall animal feed has displayed consistent margins and growth.

Crop Protection - This vertical offers crop protection and yield enhancing products under various brands and has a strong brand recall. The company has a solid research focus to improve the product quality in collaboration with Astec life sciences, which it acquired in 2015.

Oil Palms - GAL is the largest Indian producer of the palm oil. The segment enjoys high margins of around 20 percent and has exhibited a CAGR (compounded annual growth rate) of 16.5 percent over the last 4 years.

Dairy – GAL ventured into the Dairy business in 2005, acquired Creamline Dairy in 2015 and operates in the market through its varied product offering under the brand ‘Jersey’.

Processed food & Poultry - The Company has a distinguished standing in the processed food and poultry market through its JV with Tyson Foods. This business houses popular brands like ‘Yummiez’ and ‘Real Good Chicken’.

What do we like about Godrej Agrovet?Consistent returns - The company has consistently generated strong returns over the past years with return on equity averaging around 33 percent (2017:27 percent) and return on capital employed of 19 percent. The balance sheet seems strong with a 0.6x net debt to equity ratio.

Asset light model - GAL enjoys an asset light model and procures most of the raw material from small fragmented players through pre-determined contracts. This reduces the operational costs, helps the company to attain better returns and enables them to focus on core areas.

Synergistic verticals - The Company has operations in diversified yet synergistic verticals which helps it lower cost and increase returns. By-products of one business form raw materials for another, thereby generating better returns.

Distribution network - GAL has a robust last mile distribution network with more than 4000 distributors in animal feed business and more than 6000 in the crop protection business. Company’s brands like Yummies, Real good chicken and Jersey have a strong customer connect.

Pedigreed promoters - Belonging to the esteemed promoter group of Godrej industries enables GAL to enjoy trust and confidence of customers and across the entire supply chain.

However, the business carries usual risks like high dependence on weather, risks from spread of animal diseases etc. Moreover, the company relies on third party fragmented suppliers, so any drop in supplies can impact performance. GAL has major concentration in southern states especially Andhra Pradesh and this exposes it to the political and economic instability in the state. Last but not the least, there exists risks of research stagnation.

ValuationGAL being a diversified entity has different competitors across businesses. We have attempted to value the business on a “sum of the parts” (SOTP) basis.

At the price band of Rs 450-460, the issue is priced at a P/E multiple of 36.6x-35.8x and EV/EBITDA of 17.1x-16.7x and a Market Cap/Sales of 1.7x. At the upper price band of Rs 460, the company’s valuation stands at Rs 8,524 crore. Our SOTP exercise suggests a valuation of Rs 9,302 crore on trailing earnings. We see secular upside and investors must consider investing in this value-creating business from a long term perspective.

For more research articles, visit Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.