Like most industrialised countries these days, China is contending with a shortage of skilled workers. A declining labour force and an urgent need to boost productivity has prompted Beijing to put forward a solution: install more industrial robots on factory floors. That, though, won’t cut it.

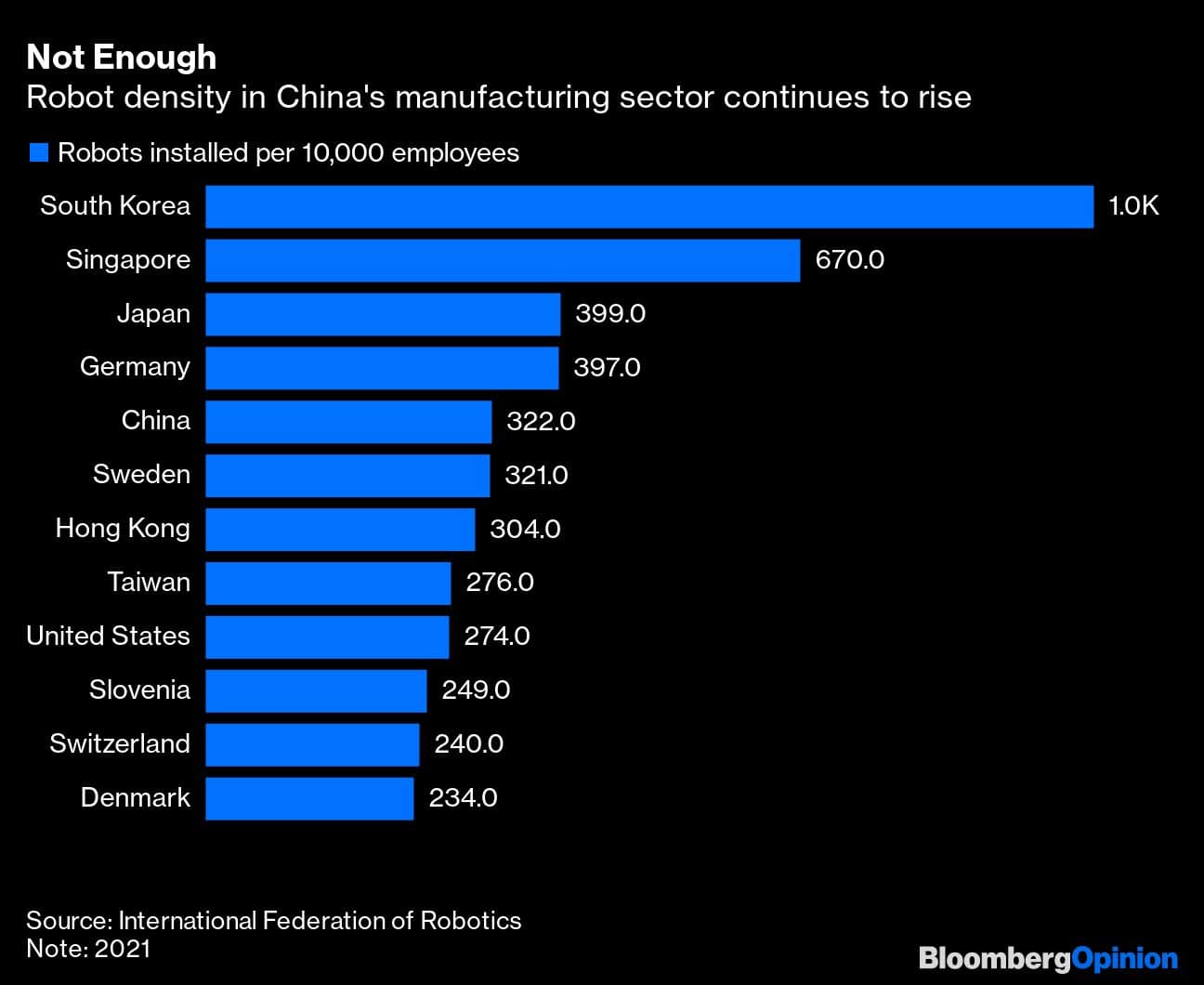

In a bid to spruce up production lines that can churn out higher-value goods, China’s Ministry of Industry and Information released the Robotics-plus Application plan last month. It had a clear target: double the industrial sector’s robot density by 2025, from 246 per 10,000 workers in 2020. The blueprint recommends widening the use of machines into areas like hydropower stations, wind farms and critical electricity systems.

Such technology target-setting is Beijing’s modus operandi (think: Made in China 2025). To reach the latest goals, robot density will only need to grow 13 percent a year, Daiwa Capital Markets Hong Kong Ltd points out. At the same time, the country’s manufacturing labour will likely fall over the next three years, as it did in 2020. Productivity growth continues to slow, raising the need for industrial machinery. All told, the trends point to a perfect demand-supply case for automation.

Homegrown companies like Estun Automation Co and Shenzhen Inovance Technology Co are making fast and accurate machines that can assemble cars, move in three dimensional planes and twist in complex ways — almost like a human arm. Others can solder, fasten screws and make laser markings. Metal processing and auto-parts firms are lapping them up, with sales growing as much as 72 percent in the last quarter of 2022. Japan’s Fanuc Corp and Yaskawa Electric Corp command leading market shares, supplying a bulk of the demand.

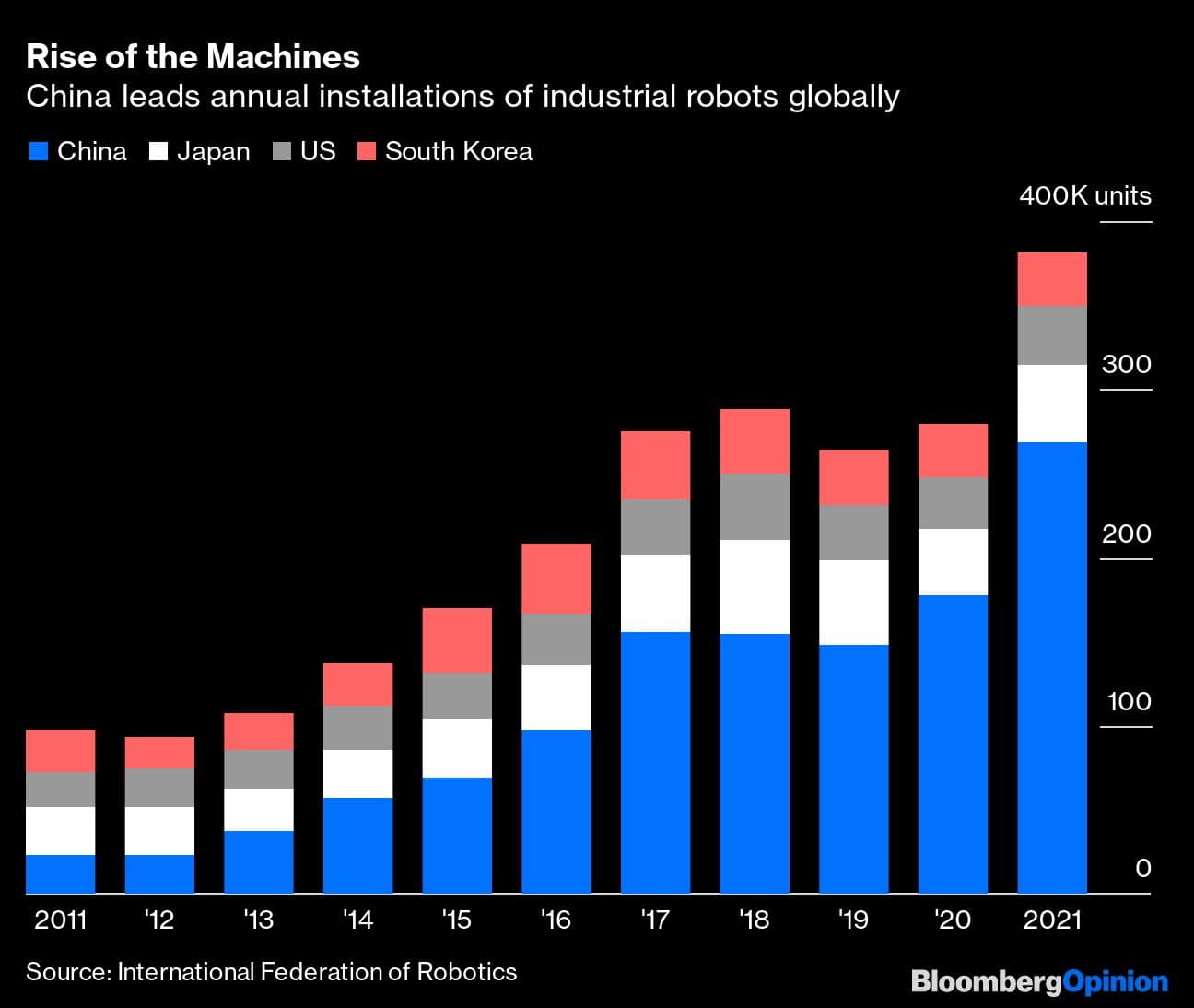

Meanwhile, previous government drives to automate factories have resulted in China sitting on the largest operational stock of robots in the world and the highest annual installations. That’s helped speed up production processes and improved manufacturing precision.

Yet, having more robots on factory floors doesn’t mean China will make swift technological gains and giant productivity leaps. While these machines are meant to plug the labour gap, they also need highly skilled personnel to reap the returns of smart manufacturing. Without the right levels of proficiency, employees can’t program and operate automated equipment.

At the rate China is rolling out this technology, the nation’s estimated 300 million migrant workers won’t be able to contribute much to the manufacturing sector’s gross domestic product. As of 2021, only 12.6 percent were college-educated or above.

This is worrying for the largest workforce in the world. As much as 40 percent of activities undertaken by hundreds of millions of migrant labourers stand to be automated by the end of the decade. More than half are 41 years and older, and reskilling is an uphill task. Meanwhile, bringing in younger, more highly skilled and educated Chinese will take a while — it won’t happen at the pace robot density is increasing, or within the ministry’s stated timeframe. Meanwhile, fewer are choosing to go into manufacturing, instead preferring the services sector. These citizens are now less mobile, finding employment closer to home.

To stem further attrition, state planners have put in a gargantuan effort to lure back workers in their post-COVID Zero recovery efforts. A host of subsidies have been unveiled. Thousands of buses, flights and trains were deployed to haul people to manufacturing centers and construction projects after the Lunar New Year. In the southern city of Dongguan, officials have spent almost $3 million to recruit people. While that may do for infrastructure-building and services, the effort may be undermined if few can operate the complex robots across China’s factories.

Policymakers are turning their attention to training and upskilling the labour pool. They are also encouraging companies to invest in vocational education. That may help, but Beijing will need to do more for its workers to catch up with the robots. The last thing it needs is a heap of idle machines.

Anjani Trivedi is a Bloomberg Opinion columnist covering industrial companies in Asia. Views are personal, and do not represent the stand of this publication.

Credit: Bloomberg

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.