The market ended the rangebound session on a flat note on July 5, with the benchmark Nifty continuing its uptrend for the seventh consecutive session but the BSE Sensex snapped six-day gains. Auto, FMCG and select IT stocks supported the market, whereas there was some profit booking in banking and financial services.

The BSE Sensex fell 33 points to 65,446, while the Nifty50 rose 10 points to 19,399 and formed an Inside Bar kind of candlestick pattern on the daily charts.

"The Nifty remained in sideways movement over the past two days, suggesting a lack of demand at higher levels. However, the overall trend remains strong, as the index continues to sit comfortably above critical moving averages, indicating the absence of aggressive short positions at this time," Rupak De, Senior Technical analyst at LKP Securities said.

On the higher end, he feels the resistance is placed between 19,450 and 19,500 which the Nifty might face some difficulty in surpassing.

Looking ahead, it is expected that the Nifty will likely continue to trade sideways, as long as it sustains within the range of 19,200 to 19,500, implying rangebound trades unless there is a directional breakout, he said.

The broader markets performed better than benchmarks as the Nifty Midcap 100 and Smallcap 100 indices gained more than 0.7 percent each on positive breadth.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks in this article are the aggregates of three-month data and not just the current month.

Key support, resistance levels on Nifty

The pivot point calculator suggests that the Nifty may get support at 19,355, followed by 19,336 and 19,305, whereas in the case of an upside, 19,418 can be a key resistance area for the index, followed by 19,437 and 19,469.

Bank Nifty index remained consolidative in a narrow range of 200 points between 45,100 to 45,300 area for the most part of the trading session and formed an Inside Bar and a Doji candlestick patterns on the daily scale but higher lows formation is intact from the last six sessions.

Some profit booking was seen in selective private banks but it managed to hold its support of 45,000 levels. The index fell 150 points to close at 45,152.

"Now it has to continue to hold above the 45,000 mark to make an up move towards 45,500, followed by its recent life high of 45,650 levels, whereas on the downside support shifted higher at 45,000, and then 44,750 levels," Chandan Taparia, Senior Vice President, Analyst-Derivatives at Motilal Oswal Financial Services said.

The pivot point calculator indicated that the Bank Nifty is likely to take support at 45,083, followed by 45,001 and 44,869, whereas 45,347 can be the initial resistance zone for the index, followed by 45,428 and 45,560.

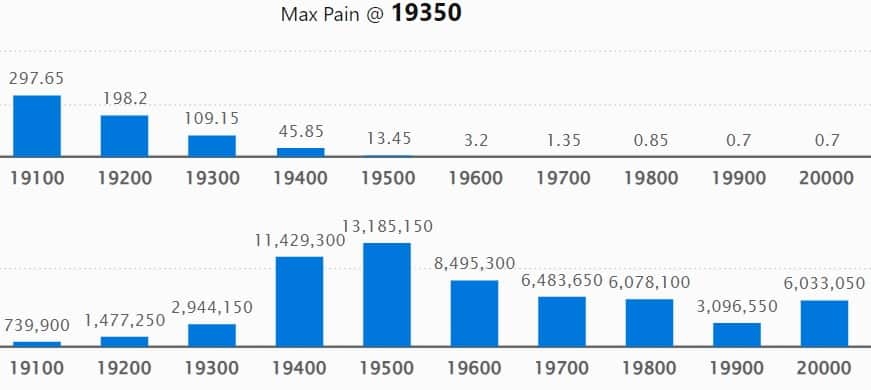

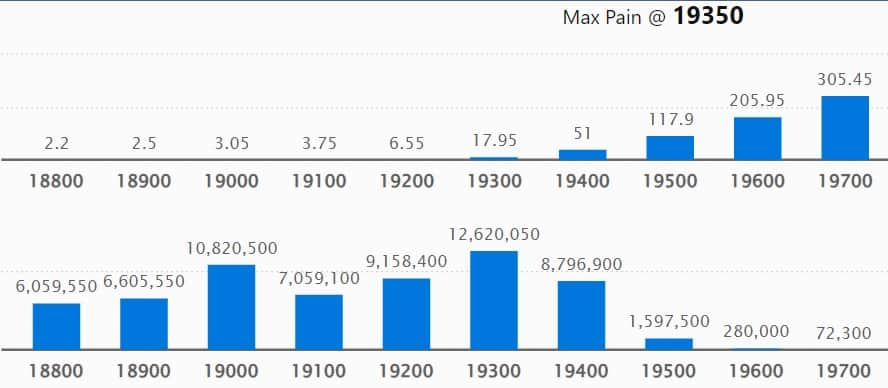

The maximum weekly Call open interest (OI) was seen at 19,500 strike, with 1.31 crore contracts, which can act as a crucial resistance area for the Nifty50 in coming sessions.

This was followed by 1.14 crore contracts at 19,400 strike, while 19,600 strike has 84.95 lakh contracts.

We have seen the meaningful Call writing at 19,500 strike, which added 32.1 lakh contracts, followed by 19,800 strike and 19,600 strike, which added 22.85 lakh and 16.54 lakh contracts, respectively.

Maximum Call unwinding was at 19,300 strike, which shed 4.46 lakh contracts, followed by 19,100 and 19,200 strikes, which shed 3.41 lakh and 2 lakh contracts, respectively.

On the Put side, the maximum open interest was at 19,300 strike, with 1.26 crore contracts, which can be a crucial support level for the Nifty50 in the coming sessions.

This was followed by the 19,000 strike, comprising 1.08 crore contracts, and the 19,200 strike, which has 91.58 lakh contracts.

Put writing was seen at 19,400 strike, which added 33.63 lakh contracts, followed by 19,300 strike and 19,200 strike, which added 24.35 lakh contracts and 19.61 lakh contracts, respectively.

We have seen Put unwinding at 18,600 strike, which shed 15.45 lakh contracts, followed by 18,900 and 18,300 strikes, which shed 13.92 lakh contracts and 9.01 lakh contracts, respectively.

Stocks with high delivery percentage

A high delivery percentage suggests that investors are showing interest in the stock. We have seen the highest delivery in Bosch, Bharti Airtel, Torrent Pharma, HDFC, and UltraTech Cement among others.

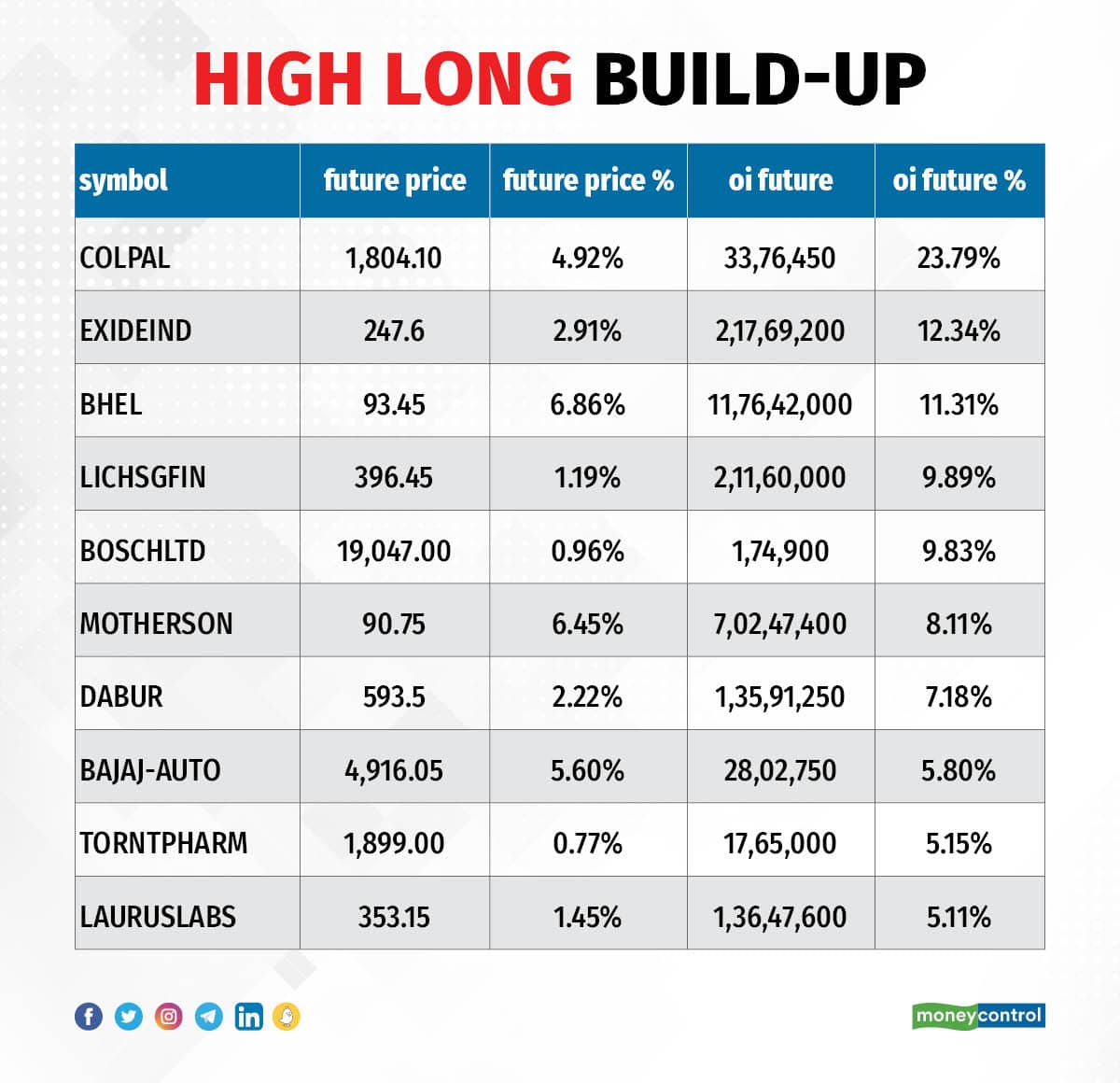

We have seen a long build-up in 79 stocks including Colgate Palmolive, Exide Industries, BHEL, LIC Housing Finance, and Bosch, based on the open interest (OI) percentage. An increase in open interest and price indicates a build-up of long positions.

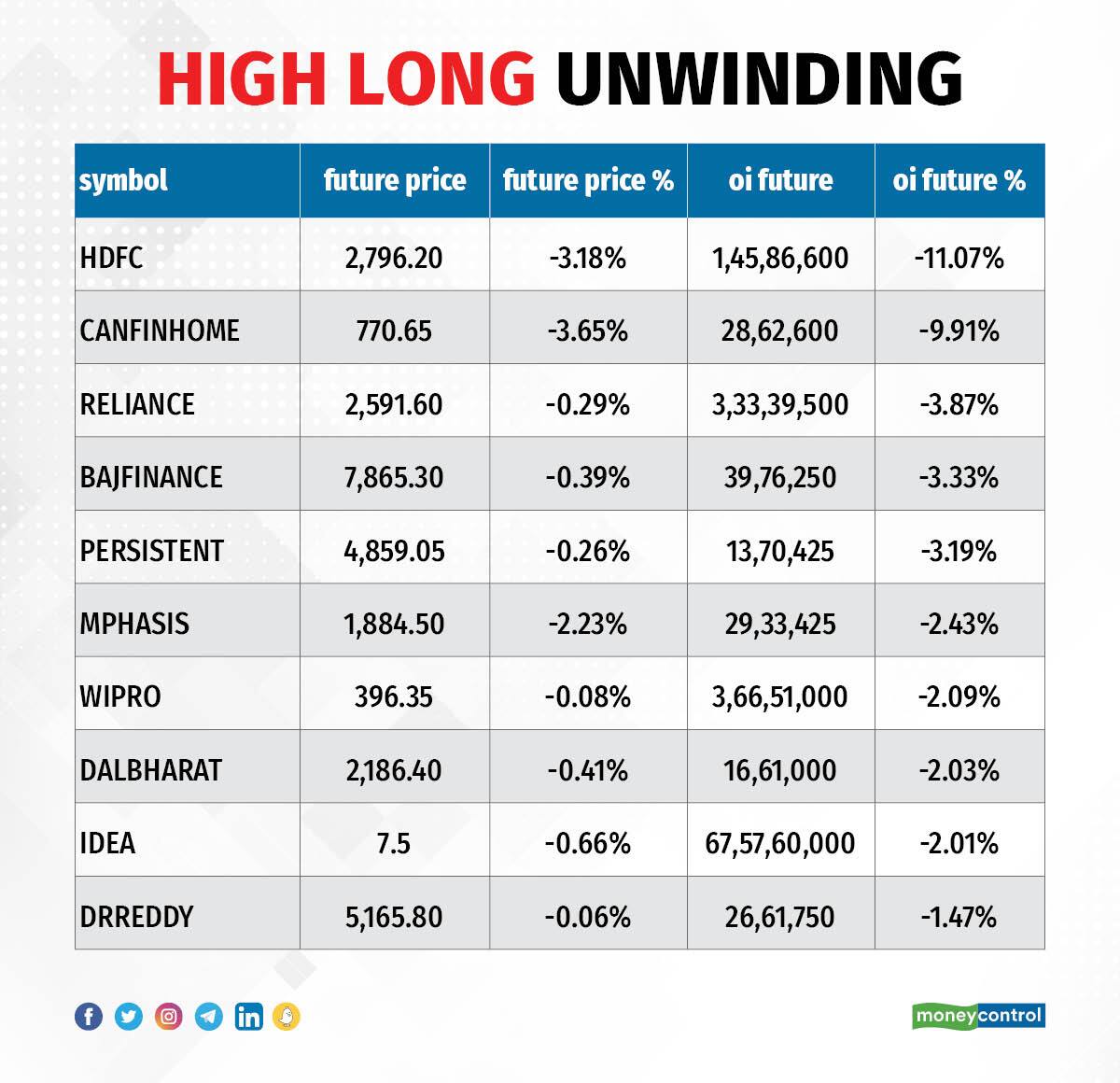

Based on the OI percentage, 22 stocks including HDFC, Can Fin Homes, Reliance Industries, Bajaj Finance, and Persistent Systems saw a long unwinding. A decline in OI and price generally indicates a long unwinding.

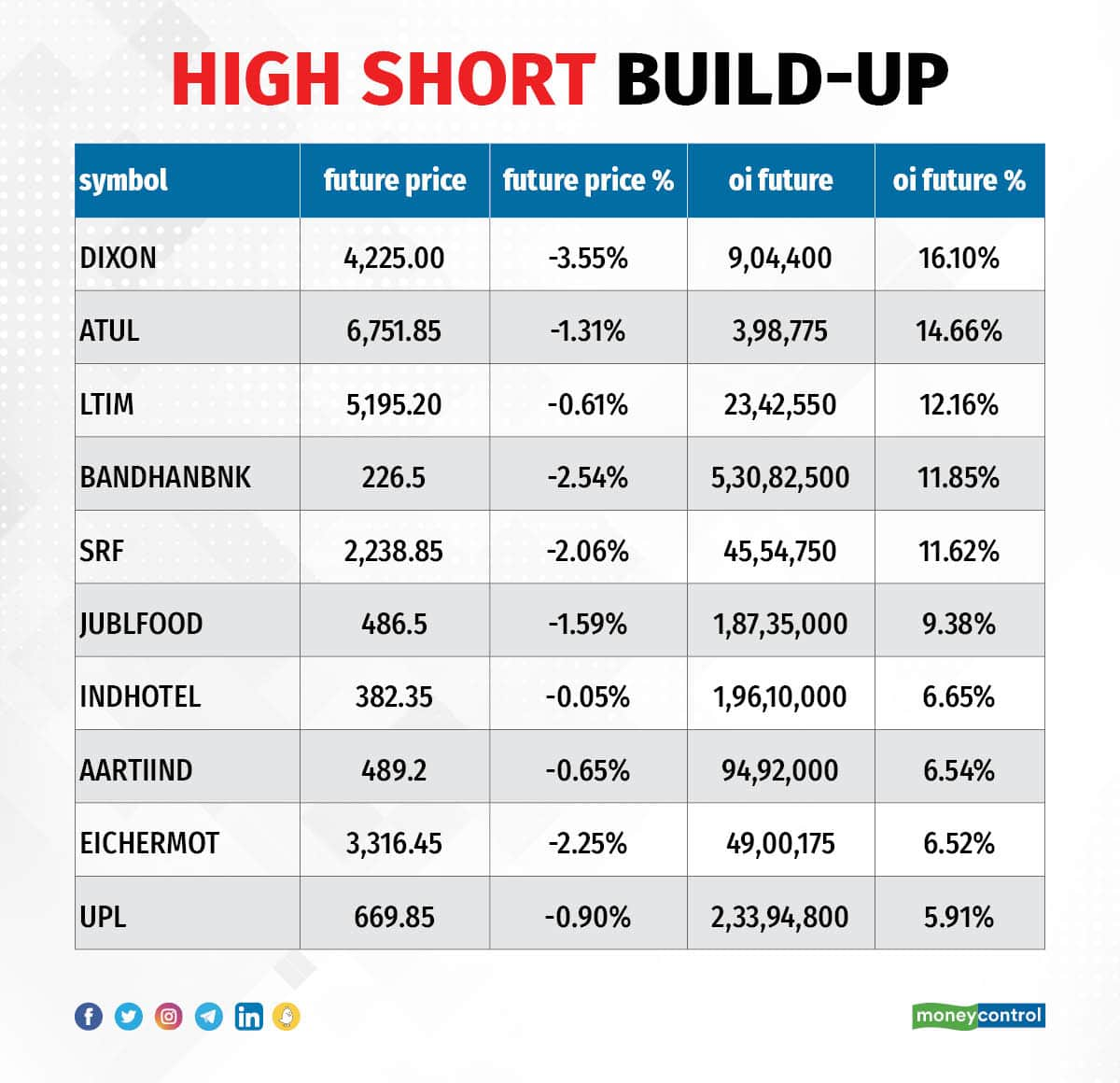

31 stocks see a short build-up

We have seen a short build-up in 31 stocks including Dixon Technologies, Atul, LTIMindtree, Bandhan Bank, and SRF, based on the OI percentage. An increase in OI along with a price decrease indicates a build-up of short positions.

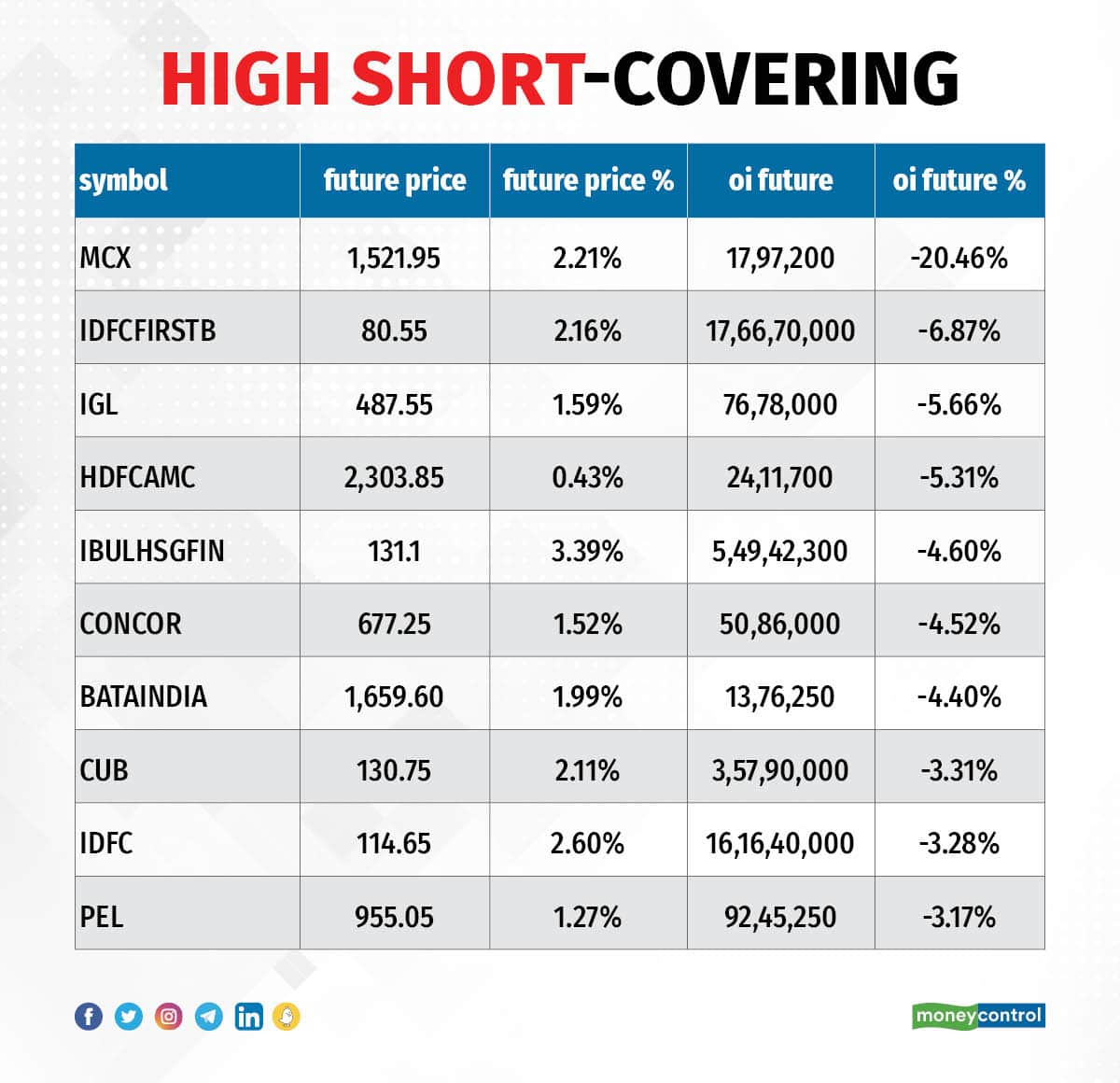

Based on the OI percentage, 55 stocks were on the short-covering list. These included MCX India, IDFC First Bank, Indraprastha Gas, HDFC AMC, and Indiabulls Housing Finance. A decrease in OI along with a price increase is an indication of short-covering.

(For more bulk deals, click here)

Investors Meetings on July 6

Stocks in the news

Prestige Estates Projects: The south-based real estate developer and its subsidiary Prestige Exora Business Parks has entered into a joint venture agreement with W S Industries (India) for the development of IT/IT-enabled services/parks in 6.53 acres of immovable property in Chennai. WS Industries (India) proposes to implement the project through its subsidiary company WS Insulators.

DCB Bank: The Reserve Bank of India has granted its approval to Tata Asset Management to acquire shareholding of up to 7.5 percent in DCB Bank through the schemes of Tata Mutual Fund. The approval is valid for one year from the date of the RBI letter. Tata Asset Management is also advised by the RBI to ensure that its aggregate shareholding in DCB Bank shall not exceed 7.5 percent at all times.

Biocon: Subsidiary Biocon Biologics has completed the integration of the acquired biosimilars business in over 70 countries in emerging markets effective July 1, increasing the scale and scope of its business. The existing commercialized portfolio of biosimilars managed by Viatris in these markets is now a part of Biocon Biologics’ commercial organisation. The subsidiary will work with existing and new partners to expand its footprint and strengthen its business presence in these countries.

JSW Steel: JSW Steel will be replacing HDFC in the BSE Sensex with effect from July 13. JBM Auto Components, Zomato, and APL Apollo Tubes will replace HDFC in S&P BSE500, S&P BSE 100 and S&P BSE 200 indices respectively.

KEC International: The infrastructure EPC major has secured new orders of Rs 1,042 crore across its various businesses including the maiden international order for a signalling and telecommunication project in SAARC, and also orders for T&D projects in India, the Middle East, Europe and the Americas.

Solara Active Pharma Sciences: The pharma company has received board approval for the issuance of equity shares up to Rs 450 crore via a rights issue. Further, the board has appointed Kartheek Chintalapati Raju as non-executive (non-independent) director of the company, and Poorvank Purohit as Managing Director & Chief Executive Officer of the company after the resignation of Jitesh Devendra as Managing Director.

Ujjivan Small Finance Bank: The small finance bank has reported a 44 percent year-on-year growth in total deposits at Rs 26,655 crore for quarter ended June FY24 and the sequential growth was 4 percent. CASA dropped 3 percent QoQ but increased 27 percent YoY to Rs 6,550 crore. Disbursements fell 12 percent QoQ, but grew 22 percent YoY to Rs 5,280 crore driven by robust growth in microbanking, housing and FIG, while advances grew by 31 percent YoY and 5 percent QoQ to Rs 25,346 crore.

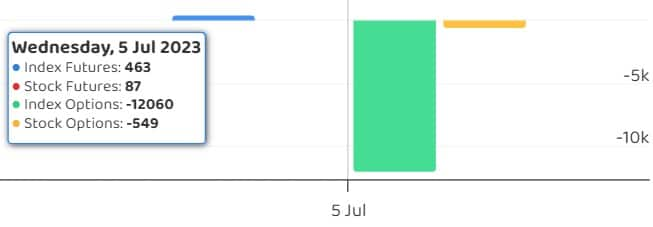

Fund Flow

Foreign institutional investors (FII) bought shares worth Rs 1,603.15 crore, whereas domestic institutional investors (DII) sold shares worth Rs 439.01 crore on July 5, provisional data from the National Stock Exchange shows.

Stock under F&O ban on NSE

The National Stock Exchange has removed Indiabulls Housing Finance from its F&O ban list for July 6 and has not added any fresh stock to the list. Securities thus banned under the F&O segment include companies where derivative contracts have crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Disclaimer: MoneyControl is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!