The market continued to trend lower for the second consecutive day, with the benchmark indices falling a third of a percent dented by banking & financial services on June 1.

The BSE Sensex fell 194 points to 62,429, while the Nifty50 slipped 47 points to 18,488 and formed a Bearish Belt Hold kind of pattern on the daily charts, which is a bearish reversal pattern but needs confirmation in the following session.

"Nifty remains in an uptrend with trend support placed at 18,150. As long as the index maintained this level we expect the uptrend to continue towards 18,800-19,000," Sahaj Agrawal, Head of Research- Derivatives at Kotak Securities said.

For the short term, he is looking at 18,400-18,450 as a support zone. Breach of the trend levels could infuse volatility, he feels.

The broader markets continued to perform better than benchmarks for yet another session. The Nifty Midcap 100 and Smallcap 100 indices gained 0.15 percent, and 1.02 percent, respectively as breadth tilted in favour of advances.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks in this article are the aggregates of three-month data and not just the current month.

Key support, resistance levels on Nifty

As per pivot charts, the Nifty may get support at 18,467, followed by 18,439 and 18,395. If the index advances, 18,555 would be the key resistance level to watch out for followed by 18,582 and 18,627.

The Bank Nifty lost more than 300 points for yet another session, closing at 43,790 and formed a long bearish candlestick pattern on the daily scale, making lower highs and lower lows for the second consecutive day.

"Till it holds below 44,044 levels, some weakness could be seen towards 43,500, then 43,333 levels, while on the upside hurdle is expected at 44,144, then 44,250 levels," Chandan Taparia, Senior Vice President | Analyst-Derivatives at Motilal Oswal Financial Services said.

As per the pivot point calculator, the Bank Nifty is expected to take support at 43,711, followed by 43,599 and 43,418. The key resistance level to watch out for would be 44,073, followed by 44,185, and 44,366.

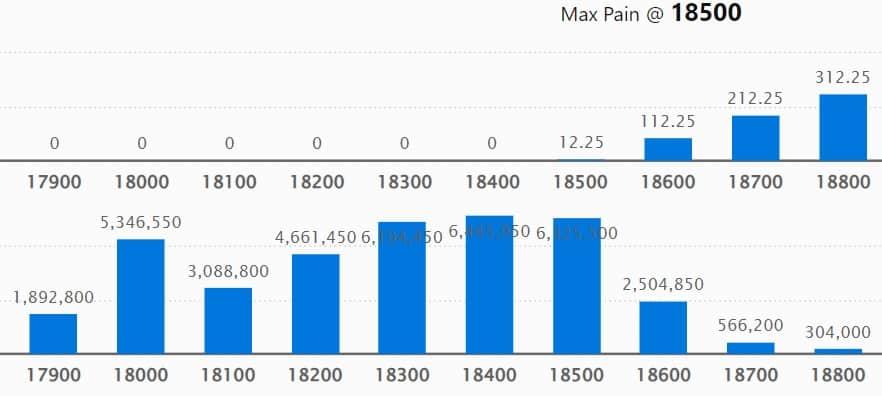

On the weekly options front, the maximum Call open interest (OI) was at 18,500 strike, with 1.02 crore contracts, which is expected to be a crucial resistance level for the Nifty.

This was followed by 18,600 strike comprising 99.01 lakh contracts and 18,700 strike with more than 93.46 lakh contracts.

The meaningful Call writing was seen at 18,500 strike, which added 23 lakh contracts.

The meaningful Call unwinding was at 18,600 strike, which shed 33.86 lakh contracts, followed by 18,700 strike, which shed 31.02 lakh contracts, and 18,800 strike, which shed 29.81 lakh contracts.

On the Put side, the maximum open interest was at 18,400 strike, with 64.45 lakh contracts, which is expected to be an important support level in the coming sessions.

This was followed by the 18,500 strike, comprising 63.25 lakh contracts, and the 18,300 strike with 61.94 lakh contracts.

We have seen Put writing at 17,700 strike, which added 82,200 contracts, followed by 19,400 strike, which added 400 contracts.

Put unwinding was seen at 18,500 strike, which shed 45.82 lakh contracts, followed by 18,300 strike, which shed 39.39 lakh contracts, and 18,000 strike which shed 33.38 lakh contracts.

Stocks with high delivery percentage

A high delivery percentage suggests that investors are showing interest in the stock. The highest delivery was seen in Ramco Cements, NMDC, UPL, HDFC and NTPC, among others.

An increase in open interest (OI) and price typically indicates a build-up of long positions. Based on the OI percentage, 51 stocks, including Anappuram Finance, India Cements, Voltas, Bajaj Auto and Apollo Hospitals Enterprise, saw long build-ups.

A decline in OI and price generally indicates a long unwinding. Based on the OI percentage, 43 stocks, including ABB India, Torrent Pharmaceuticals, TVS Motor Company, Cummins India and Samvardhana Motherson International, saw a long unwinding.

44 stocks see a short build-up

An increase in OI along with a price decrease indicates a build-up of short positions. Based on the OI percentage, 44 stocks, including Coal India, City Union Bank, Dr Lal PathLabs, Kotak Mahindra Bank and Navin Fluorine International saw a short build-up.

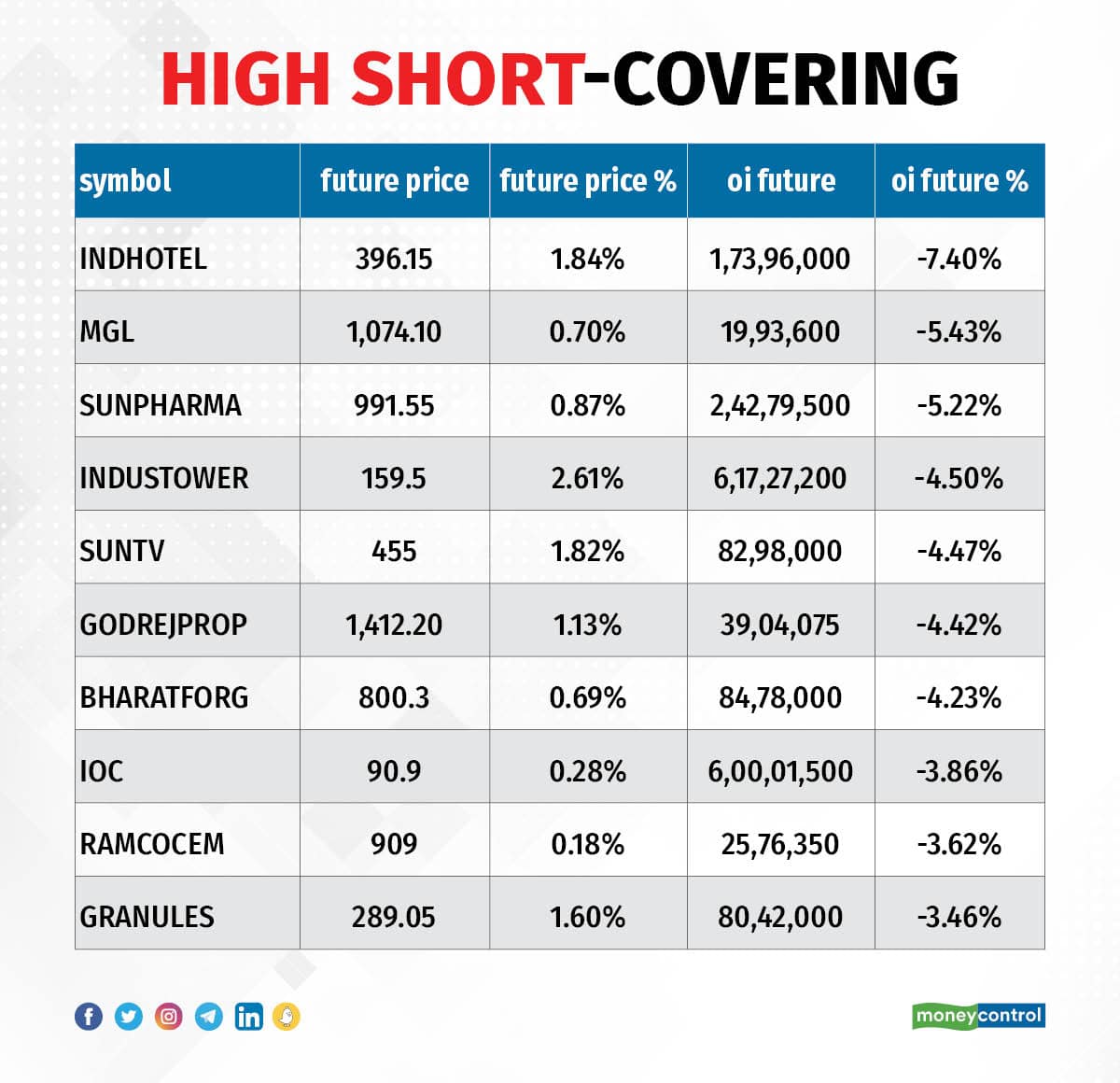

A decrease in OI along with a price increase is an indication of short-covering. Based on the OI percentage, 51 stocks were on the short-covering list. These included Indian Hotels, Mahanagar Gas, Sun Pharmaceutical Industries, Indus Towers and Sun TV Network.

(For more bulk deals, click here)

Investors Meetings on June 2

Stocks in the news

Coal India: The offer for sale issue by the country's largest coal mining company has been subscribed 3.457 times the base size. The offer size for non-retail investors is 8.31 crore shares and for retail investors 92.44 lakh shares are in the base issue. Now, the government has decided to exercise the green shoe option to the extent of up to 9.24 crore shares or 1.5 percent stake, in addition to the base issue size of 9.24 crore shares. Accordingly, the total offer size will be 18.48 crore shares, of which 1.84 crore shares would be reserved for allocation to retail investors, as part of the offer on June 2.

Aditya Birla Capital: The financial services company said the board has approved preferential issuance of Rs 1,250 crore to its promoter and promoter group entity, out of the total approved equity fundraising of up to Rs 3,000 crore. The preferential issuance will be undertaken at a price of Rs 165.1 per share. The company will issue shares worth Rs 1,000 crore to Grasim Industries (promoter), and Rs 250 crore to Surya Kiran Investments Pte Ltd (promoter group entity).

Paras Defence and Space Technologies: The company has entered into a joint venture agreement with Israel-based CONTROP Precision Technologies. Both will undertake the business of manufacturing, implementation/installation, integrated logistics support, after sales support, training etc., in the electro-optic (EO)/infra-red (IR) field in accordance with the Government of India’s Make in India initiative. Paras will hold a 30 percent stake in the joint venture and the rest 70 percent is held by CONTROP.

TVS Motor Company: The two-and-three-wheeler maker registered a sales growth of 9 percent YoY, increasing from 3.03 lakh units in May 2022 to 3.3 lakh units in May 2023, beating analysts' estimates. Domestic sales grew by 32 percent YoY to 2.52 lakh units, but exports fell 30.5 percent to 76,607 units. TVS iQube Electric recorded sales of 17,953 units in May 2023, increasing significantly from 2,637 units in May 2022.

Maruti Suzuki India: The country's largest car maker announced production of 1.8 lakh vehicles in May 2023, increasing 9.3 percent over 1.64 lakh units produced in May 2022. Passenger vehicle production stood at 1.76 lakh units, up 9.8 percent over the same month last year.

NHPC: The state-owned hydropower development organization has entered into a Memorandum of Understanding (MoU) with Vidhyut Utpadan Company (VUCL), Nepal for joint development of the Phukot Karnali HE Project (480 MW). This is a run-of-the-river hydropower project in the Kalikot district of Karnali Province, Nepal.

Eicher Motors: The company announced the sale of 77,461 units of Royal Enfield in May 2023, increasing 22 percent over 63,643 units sold in the same month last year, beating analysts' estimates, driven by domestic business. Exports fell 34 percent YoY to 6,666 units in May 2023.

Tata Motors: The Tata Group company sold 74,973 units of commercial and passenger vehicles in May 2023, falling 1.6 percent from 76,210 units in May 2022, but were above analysts' estimates. Domestic sales dropped 2 percent YoY to 73,448 units, but exports grew by 4.8 percent to 1,525 units in the same period.

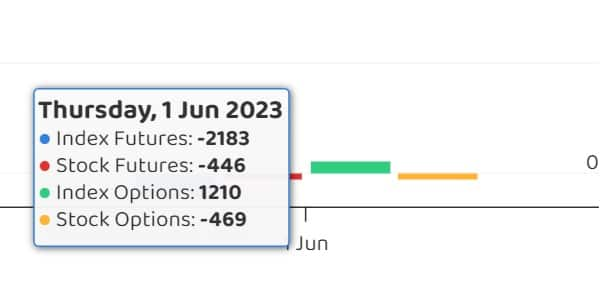

Fund Flow

Foreign institutional investors (FIIs) sold shares worth Rs 71.07 crore, whereas domestic institutional investors (DIIs) bought shares worth Rs 488.93 crore on June 1, provisional data from the National Stock Exchange shows.

Stocks under F&O ban on NSE

The National Stock Exchange has not added any stock to its F&O ban list for June 2.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!