The market lost more than 1 percent after upward consolidation of last few days, and closed below not only 50 DEMA but also 100 DEMA (days exponential moving average) in a single-day move on the Nifty50 as bears turned strong, pulling down all sectors on January 25, the monthly F&O expiry day.

The BSE Sensex tanked 774 points to 60,205, while the Nifty50 plunged 226 points - the biggest loss in a day since December 23 (2022) - to 17,892 and formed long bearish candle on the daily charts with lower high lower low formation, indicating negative mood among market participants. But it has taken the support at 17,800, the lower end of range, which is expected to be a crucial level to watch going forward.

"On the daily timeframe, the index remained below the 50-day exponential moving average (around 18,091). Besides, the index remained below the 50-day exponential moving average, which confirms the bearish trend. On the lower end, however, the correction was limited to the upper band of the falling wedge pattern on the daily chart," said Rupak De, Senior Technical Analyst at LKP Securities.

He feels the sentiment looks very weak, with the RSI (relative strength index) in a bearish crossover. However, a further correction may occur if the price falls below 17,840, whereas on the higher end, resistance is placed at 18,000, the market expert said.

The broader markets also traded in line with benchmarks as the Nifty Midcap 100 and Smallcap 100 indices fell 1.5 percent and 1.2 percent, respectively.

The market was shut on January 26, for Republic day.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks in this article are the aggregates of three-month data, and not just of the current month.

Key support and resistance levels on the Nifty

As per the pivot charts, we have the key support level for the Nifty at 17,849, followed by 17,789, and 17,789. If the index moves up, the key resistance levels to watch out for are 18,043, followed by 18,103 and 18,201.

The Nifty Bank was the biggest loser among sectors, correcting nearly 1,100 points to 41,648 and formed long bearish candle on the daily charts.

The important pivot level, which will act as crucial support for the index, is placed at 41,518, followed by 41,237, and 40,781. On the upside, key resistance levels are placed at 42,429, followed by 42,711, and 43,166.

On the monthly basis, we have seen the maximum Call open interest (OI) at 17,900 strike, with 1.12 crore contracts, which can be crucial resistance level in coming sessions.

This is followed by 18,000 strike, comprising 99.69 lakh contracts, and 18,500 strike, where we have more than 86.32 lakh contracts.

Call writing was seen at 17,900 strike, which added 1.02 crore contracts, followed by 18,000 strike, which added 72.77 lakh contracts, and 17,800 strike, which added 3.2 lakh contracts.

Call unwinding was seen at 18,200 strike, which shed 69.87 lakh contracts, followed by 18,100 strike, which shed 63.09 lakh contracts, and 18,300 strike, which shed 59.75 lakh contracts.

On the monthly basis, the maximum Put OI was seen at 17,800 strike, with 54.41 lakh contracts, which can be a crucial support level for coming sessions.

This is followed by the 17,900 strike, comprising 53.16 lakh contracts, and 17,500 strike, where we have 43.18 lakh contracts.

Put writing was seen at 17,600 strike, which added 9.45 lakh contracts, followed by 17,700 strike, which added 7.15 lakh contracts, and 17,500 strike which added 6.26 lakh contracts.

Put unwinding was seen at 18,100 strike, which shed 85.43 lakh contracts, followed by 18,000 strike, which shed 74.48 lakh contracts, and 18,200 strike, which shed 22.28 lakh contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks. We have seen the highest delivery in HDFC AMC, Colgate Palmolive, HCL Technologies, Britannia Industries, and Reliance Industries, among others.

Here are the top 10 stocks which saw the highest rollovers on monthly F&O expiry day including Bosch, Nestle, Eicher Motors, Dr Reddy's Laboratories, and Honeywell Automation with more than 98 percent rollovers.

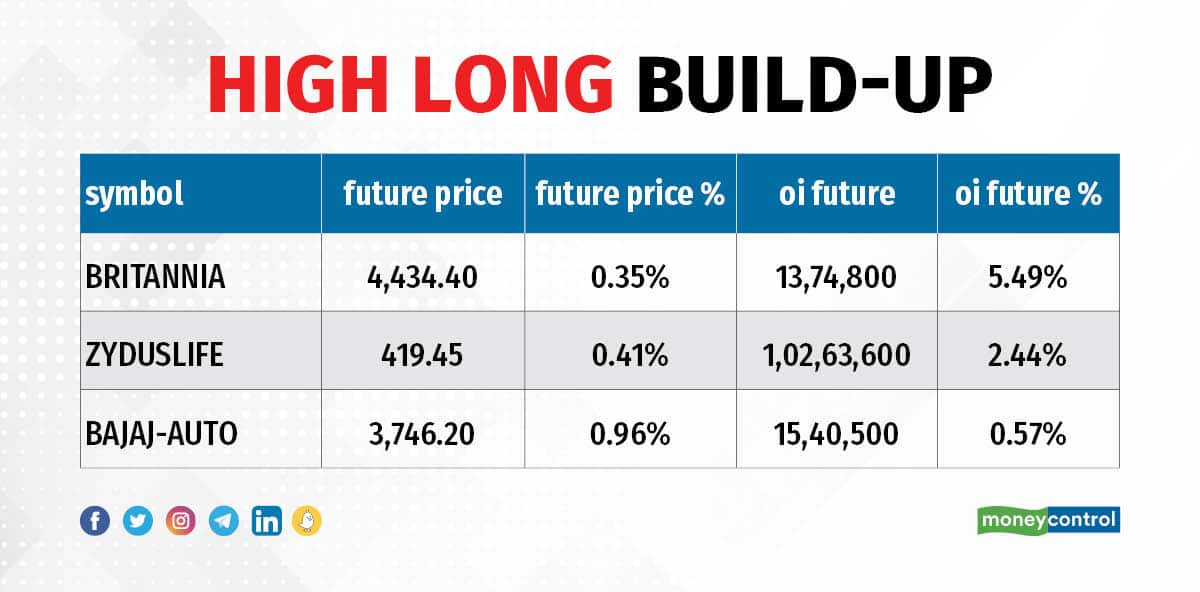

An increase in OI, along with an increase in price, mostly indicates a build-up of long positions. Based on the OI percentage, we have seen a long build-up in only 3 stocks - Britannia, Zydus Life Sciences, and Bajaj Auto - on Wednesday.

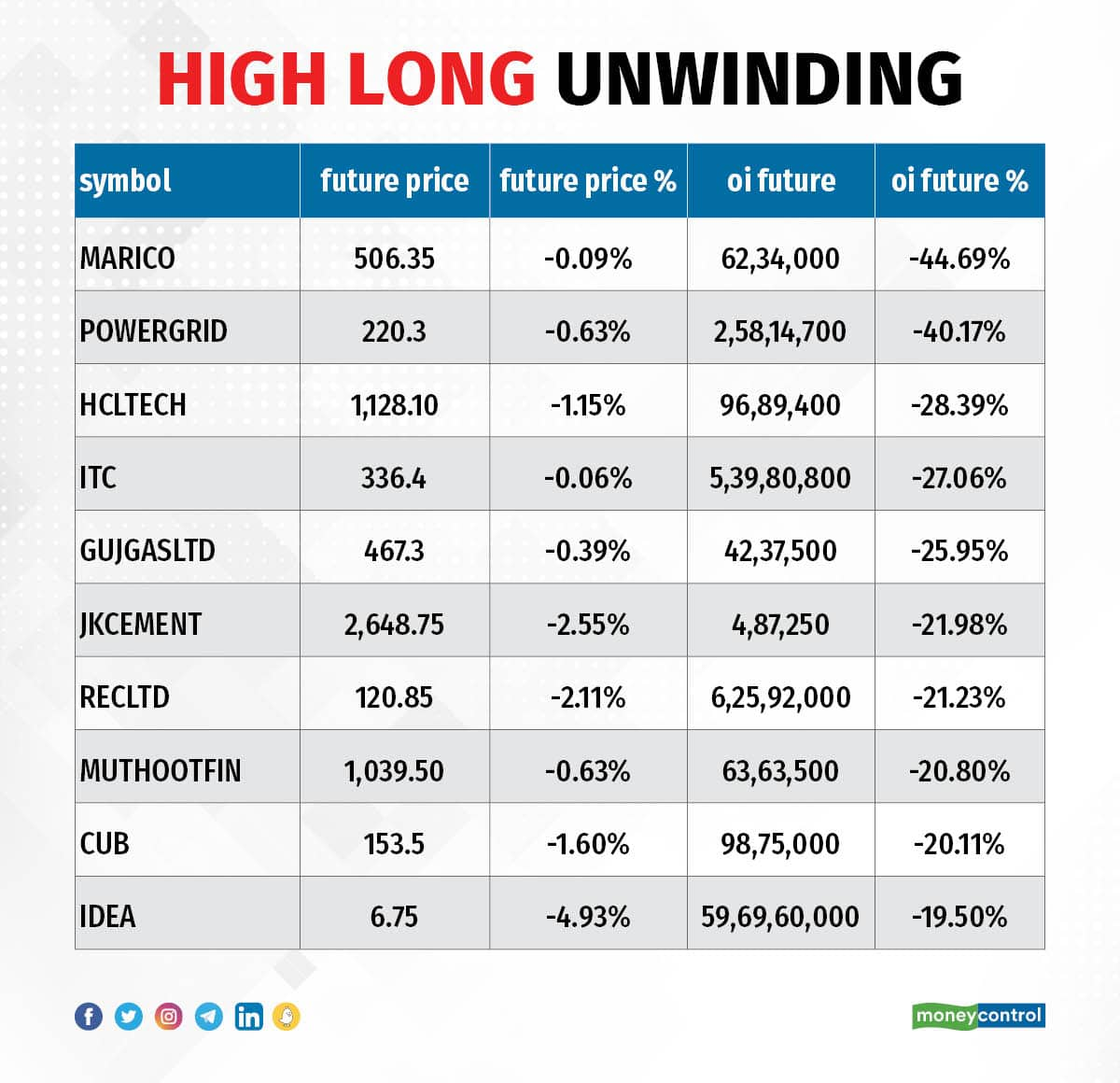

A decline in OI, along with a decrease in price, mostly indicates long unwinding. Based on the OI percentage, 172 stocks saw long unwinding on Wednesday due to sharp selling pressure in the market, including Marico, Power Grid Corporation of India, HCL Technologies, ITC and Gujarat Gas.

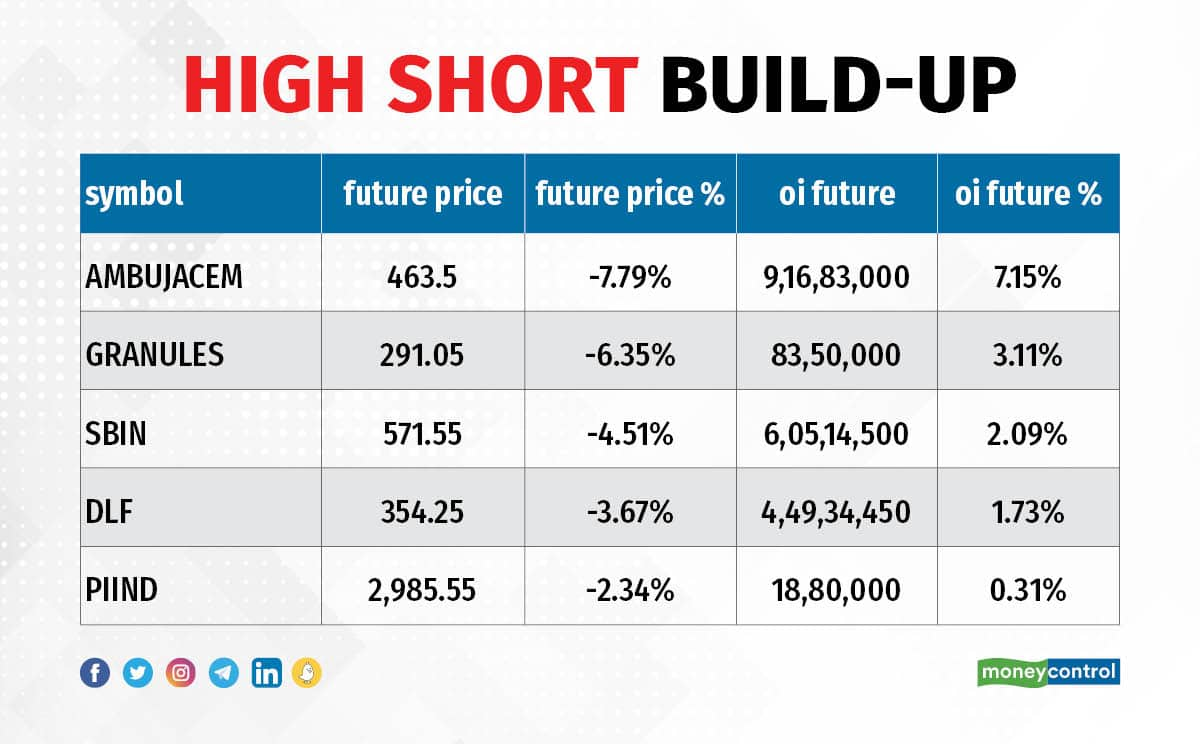

An increase in OI, along with a decrease in price, mostly indicates a build-up of short positions. Based on the OI percentage, we have seen short build-up in 5 stocks - Ambuja Cements, Granules India, State Bank of India, DLF, and PI Industries - on Wednesday.

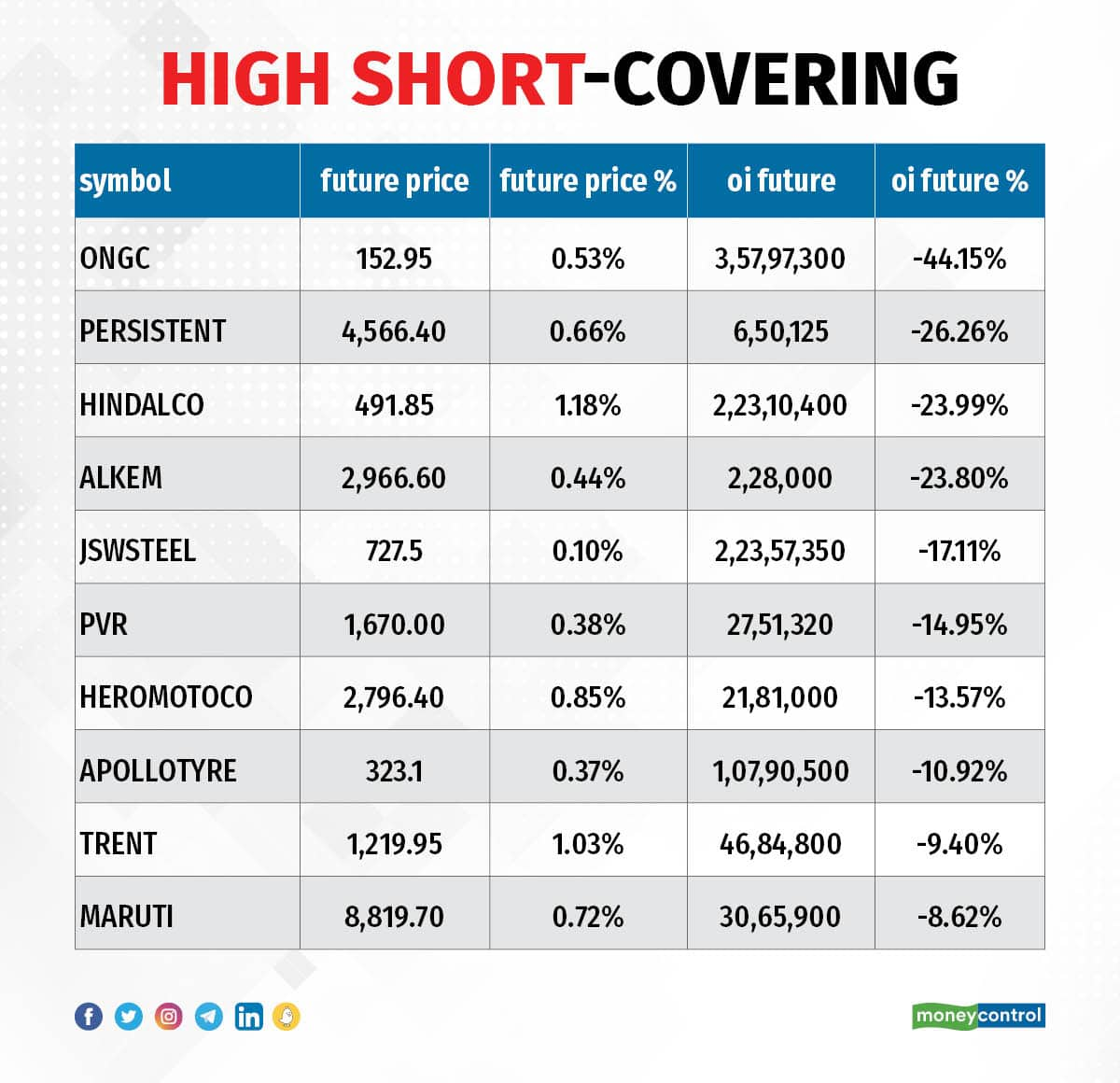

15 stocks witnessed short-covering

A decrease in OI, along with an increase in price, mostly indicates a short-covering. Based on the OI percentage, we have total 15 stocks in the short-covering list on Wednesday, including ONGC, Persistent Systems, Hindalco Industries, Alkem Laboratories, and JSW Steel.

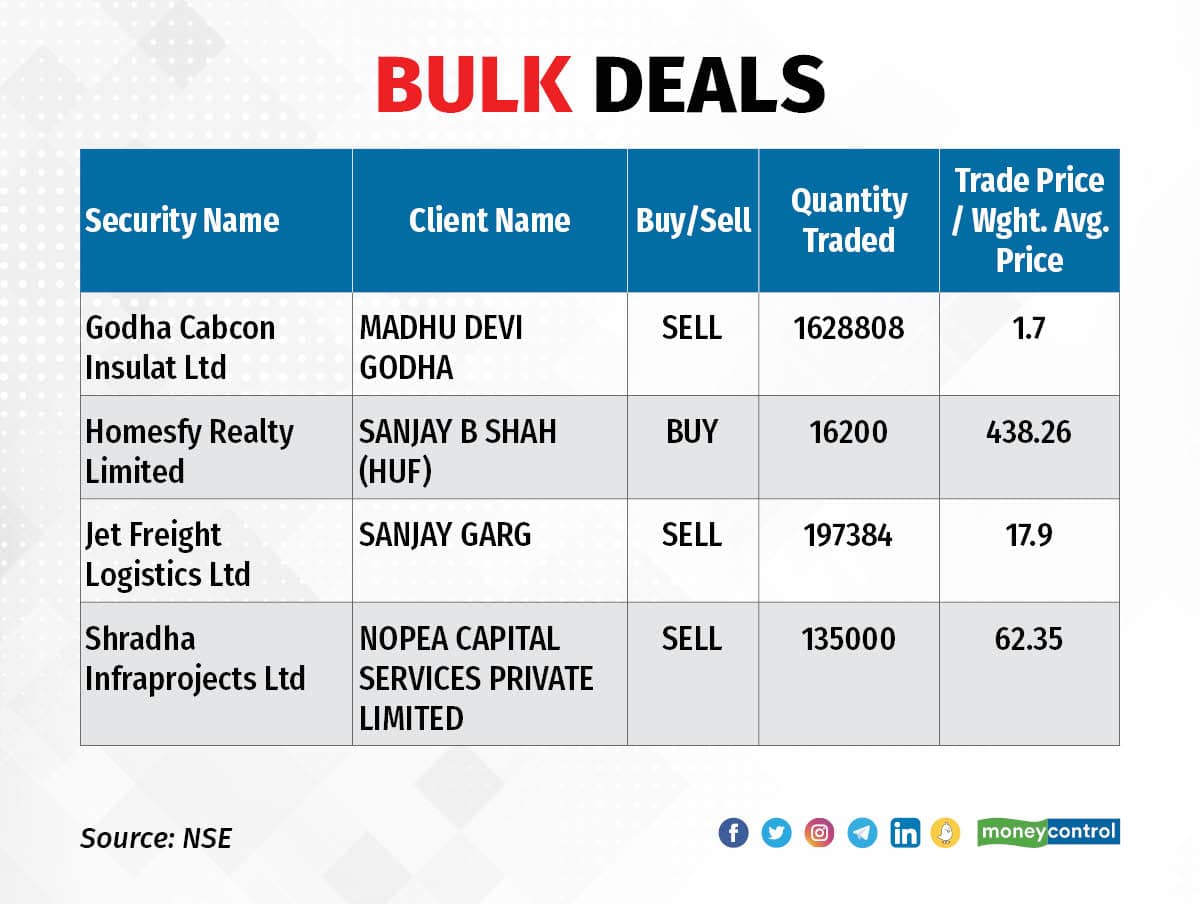

(For more bulk deals, click here)

Results on January 27 and January 28

Bajaj Finance, Vedanta, Aarti Drugs, Aditya Birla Sun Life AMC, CMS Info Systems, Glenmark Life Sciences, Godfrey Phillips India, Sterlite Technologies, Zenotech Laboratories, and AIA Engineering will be in focus ahead of quarterly earnings on January 27.

NTPC, Bharat Electronics, CARE Ratings, DCB Bank, Five-Star Business Finance, Gujarat Ambuja Exports, Heranba Industries, Kajaria Ceramics, Vedant Fashions, Radiant Cash Management Services, and Zen Technologies will be in focus ahead of quarterly earnings on January 28.

Stocks in the news

Tata Motors: The Tata Group company has had a healthy show for December FY23 quarter, beating analysts' expectations on all fronts with returning to profits. Consolidated profit for the quarter stood at Rs 2,958 crore against loss of Rs 1,516 crore in same period last year on better topline as well as operating performance. Revenue from operations at Rs 88,489 crore for the quarter grew by 22.5 percent over corresponding period last fiscal, with better realisation at JLR as well as standalone businesses. At the operating level, EBITDA at Rs 9,853 crore surged 33 percent YoY on strong show of JLR and standalone business, with margin expansion of 90 bps YoY at 11.1 percent for the quarter aided by standalone business. The company remains cautiously optimistic on the demand situation despite global uncertainties.

Dr Reddy's Laboratories: The pharma company clocked a massive 77 percent year-on-year growth in consolidated profit at Rs 1,247 crore for quarter ended December FY23, driven by strong US business. Consolidated revenue from operations at Rs 6,770 crore for the quarter grew by 27.3 percent over the corresponding period in the last fiscal with US business rising 64 percent, India showing 10 percent and emerging markets 14 percent growth YoY. On the operating front, EBITDA surged 55 percent YoY to Rs 1,966 crore with 5 percentage points expansion in margin at 29 percent for the quarter.

Adani Enterprises: The Adani Group company will launch its follow-on public offer of Rs 20,000 crore on January 27. The closing date will be January 31, with a price band of Rs 3,112-3,276 per share. The company has raised close to Rs 6,000 crore from anchor investors. It has received Rs 2,992.4 crore from anchor investors ahead of the FPO, which is half of the amount of the total anchor book launched. The remaining amount will be payable by anchor investors later in one or more subsequent calls.

LTIMindtree: The IT services provider has partnered with Duck Creek Technologies, and Microsoft to build a cloud migration solution for insurers. The solution will enable insurers to migrate their on-premises core systems to the cloud in a quick and efficient manner.

DLF: The real estate developer has registered a 37 percent year-on-year growth in consolidated profit at Rs 519 crore for quarter ended December FY23 on a low base and lower finance cost. It had an exceptional loss of Rs 224.4 crore in Q3FY22. Revenue from operations at Rs 1,495 crore for the quarter fell by 3.5 percent compared to same period last fiscal, but new sales bookings at Rs 2,507 crore increased by 24 percent YoY. At the operating level, EBITDA fell by 8.5 percent YoY to Rs 477.2 crore and margin declined by 170 bps YoY to 31.9 percent for the quarter.

Ceat: The tyre maker has reported consolidated profit of Rs 35.4 crore for quarter ended December FY23, against loss of Rs 20 crore in same period last year, supported by strong operating performance. Consolidated revenue at Rs 2,727 crore grew by 13 percent over a year-ago period, led by domestic demand as the company remains cautious about international markets that are getting impacted by recessionary trends. At the operating level, EBITDA surged 77 percent YoY to Rs 237.6 crore for the quarter and margin rose by more than 3 percentage points to 8.7 percent compared to year-ago period.

Amara Raja Batteries: The industrial and automotive battery maker registered a 53 percent year-on-year growth in consolidated profit at Rs 221.9 crore for quarter ended December FY23, backed by health topline and operating performance. Revenue grew by 11.5 percent to Rs 2,638 crore compared to year-ago period, driven by healthy volume growth in the automotive sector in both OEM and Aftermarket segments.

SJVN: The company has sold its entire stake in the Bhutanese joint venture company Kholongchhu Hydro Energy (KHEL) as per the directions received from the Government of India. The transaction cost is Rs 354.71 crore. The entire stake of the company was brought by the JV partner Druk Green Power Corporation, Bhutan.

Tata Elxsi: The design and technology services provider has clocked a 29 percent year-on-year growth in profit at Rs 194.7 crore for quarter ended FY23 despite lower operating margin, supported by revenue and other income. Revenue for the quarter increased by 29 percent to Rs 817.7 crore compared to same period last fiscal.

Fund Flow

Foreign institutional investors (FII) have net sold shares worth Rs 2,393.94 crore, whereas domestic institutional investors (DII) have net bought shares worth Rs 1,378.49 crore on January 25, as per provisional data available on the NSE.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Disclaimer: Moneycontrol is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!