Often, the State Bank of India (SBI) is called the ‘elephant’ among Indian banks. That's because of its sheer size (total assets of Rs 43.6 lakh crore as of December) and market dominance.

In one of his interviews in 2010, former SBI Chairman O P Bhatt famously said his team at the bank showed that the elephant can dance, referring to the improvement in business at that point. A decade later, the elephant has shown it can dance, yet again!

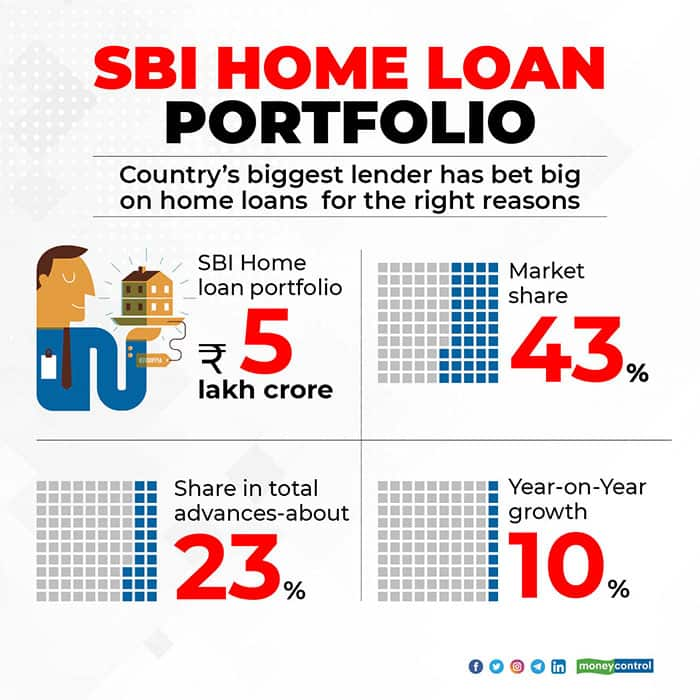

On Thursday, the country’s largest bank said it's home loan portfolio has crossed Rs 5 lakh crore in the home loan business. It now controls one-third of the home loan market in the country. Within SBI, home loans currently constitute over 23 percent of the total loan book and has the biggest share in domestic advances followed by infrastructure loans and industry loans.

There is a clear shift to safer retail loans. That's what any smart banker would do in a pandemic-hit market that was already facing an economic slowdown.

SBI has bet big on retail loans, and within that, home loans. In the next five years, the bank wants to double its home loan portfolio. That looks doable given the current momentum and track record. SBI began its home loan business in 2004 with a total portfolio of Rs17,000 crore.

A separate Real Estate and Housing Business Unit came into being in 2012 with a total portfolio of Rs one lakh crore. By 2014, SBI became a market leader in the home loan segment.

Its nearest mortgage loan competitors-- HDFC, ICICI Bank, and LIC Housing Finance—are still far below. According to SBI’s investor presentation, total home loan sanctions have grown by 25 percent in December compared with 7 percent in the previous month. One major reason for this could also be the stamp duty cuts in December which resulted in a spur in fresh loan disbursals. The year-on-year growth in this segment is about 10 percent.

SBI’s numbers are impressive for a state-owned bank that is traditionally perceived as less aggressive than its private-sector competitors and operate within the constraints of Government ownership.

SBI currently has a market share of 34 percent in the home loan market and is offering one of the lowest rates on home loans in the market at 6.8 percent. On average, the bank gets 1000 new home loan borrowers every single day and in recent years, has significantly ramped up its digital presence through the YONO App.

What works for the bank?

SBI is as aggressive in business approach as its private sector counterparts. Not just in home loans, but in other retail segments such as auto loans as well. In Auto loans, SBI has a market share of 33 percent at the end of December. Being the largest in the industry, SBI commands a leadership position and even sets the trend for competitors on pricing.

The recent management transition has so far worked well for the bank. The bank recently got two new managing directors (MDs)--Swaminathan Janakiraman and Aswini Kumar Tewari -- not long after it got a new Chairman, Dinesh Kumar Khara. The business approach and corporate governance standards are aggressive and efficient unlike some of its peers in the public sector.

"Their management style is impeccable. it is a well-oiled machine," said a senior banker requesting not to be named.

SBI has managed to grow its home loan book despite the Covid challenge. It has totally waived the processing fee till March 2021 for customers availing home loans in SBI approved projects, is looking at implementing AI, Cloud, Blockchain, machine learning to boost its businesses, and is gearing up to initiate a co-lending model to reach out to the unorganized sector.

Also, SBI is engaging in collaboration with builders so that it can offer more choices of homes to home buyers. The bank is consistently ingraining the latest technology into its operational and delivery platforms to make the home loan journey smoother for customers.

Home loans make even bigger sense for banks in the current market environment. This segment has the lowest default rate among categories. In SBI’s case, the gross NPAs is just 0.67 percent of the total book. Not just SBI, most lenders are now shifting to low-risk retail loans from lumpy corporate loans.

In November last year, ICICI Bank said it managed record home loan sales despite the pandemic challenges. Its loan portfolio crossed Rs 2 lakh crore in November. Unlike personal loans, which are largely unsecured, home loans are backed by collateral and are secured assets. Banks are also not keen to lend more to high-risk infrastructure projects—power and telecommunications—in particular, due to the fear of further addition of bad loans.

In Q3, the SBI has shown an overall improvement in business performance, most notably asset quality. The gross non-performing assets (NPA) as a percentage of gross advances at 4.77 percent in Q3FY21 declined 51 bps sequentially and the net NPA at 1.23 percent fell 36 bps Q-o-Q. All segments of loan books reported a decline in NPA Q-o-Q with NPA from the corporate book down 35 bps and retail 62 bps. However, one must note that on a proforma basis without reference to the Supreme Court interim order, the gross NPA would have been at 5.44 percent and net NPA at 1.81 percent in Q3FY21.

Still, for banks like SBI, the slippage trend is positive. The fresh slippages were sharply lower at Rs 237 crore for the quarter ended December 2020, compared with Rs 3,085 crore in the previous quarter, but proforma slippages for Q3FY21 were at Rs 2,073 crore and proforma slippages for nine months at Rs 16,461 crore, said SBI. Slippages ratio declined significantly to 0.04 percent at the end of December quarter 2020, compared with 0.46 percent in Q2FY21 and 2.94 percent in Q3FY20, the bank added.

The NPA numbers have cheered the investors.

With its sharp retail focus, a likely uptick in the economy, and a smooth management transition, SBI is likely to continue as an outlier among PSBs, most of which are laggards.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.