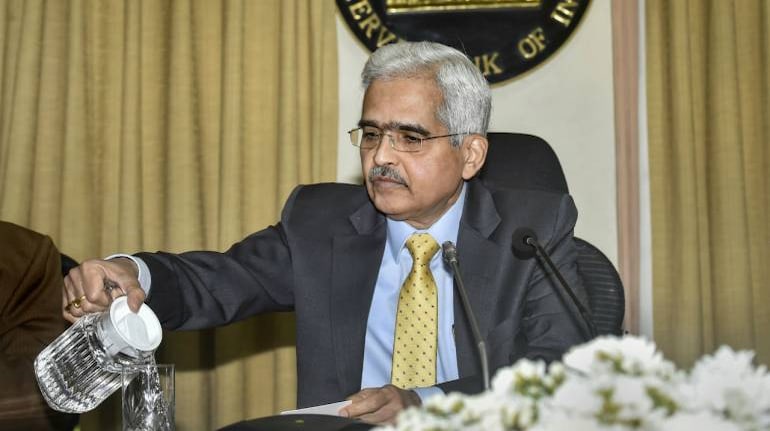

The Reserve Bank of India (RBI) has announced measures to address concerns over the financial system.

This should ease the liquidity freeze in the bond markets and bring down the yields. This should also reverse the mark-to-market losses seen by investors in the recent past.

Liquidity enhancement measures by RBI for money marketsMurthy Nagarajan, Head – Fixed Income, Tata Asset Management was of the view that the “RBI has gone for a 75 basis points of repo rate cut and 90 basis point cut in reverse repo. Along with CRR cut of 1 percent which should release 1.37, long term repo of Rs 1 lakh crore and MSF facility of 1 percent releasing 1.37 lakh, the total additional liquidity injection is Rs 3.74 lakh. This is RBI’s response to the adverse macro economic situation due to the novel coronavirus".

Navneet Munot, ED & CIO, SBI Mutual Fund, holds the view that the "measures targeted at giving relief to almost all borrowers to tide over these difficult times, relaxation on asset quality classification, capital adequacy, marginal standing facility and infusing massive liquidity to de-freeze the corporate bond and CP market will go a long way in easing financial stress".

Impact of RBI's relaxation measuresThe Reserve Bank announced liquidity enhancement measures for banks to tide over lockdown pains. This liquidity is to be deployed in corporate bonds, commercial papers and non-convertible debentures.

The RBI also relaxed valuation norms for these new investments, stating that “investments made by the banks under this facility will be classified as held-to-maturity (HTM)".

This will be instead of the regular mark-to-market norms for three months. This will save banks from hair cut pains on their liquidity investments, market experts feel.

Cue for mutual fundsThe mutual fund (MF) industry was sagged with bad loans since IL&FS crisis — that created a dent in NAV of its debt funds. Perturbed, the Securities and Exchange Board of India (Sebi) responded in 2019 by moving whole scale to mark-to-market valuations for all securities — short and long durations.

During the coronavirus meltdown, bond yields of best triple AAA rated securities has worsened by up to 200 basis points. The RBI's measure of Held to Maturity (HTM) eases banks from down-marking as per MTM norms.

MFs may take a cue from these RBI measures and approach Sebi for a temporary relaxation from mark-to-market valuation for short term debt instruments and instead value on amortisation basis i.e. based on remaining part of purchase value. Whether MFs and SEBI get into action mode on lines RBI during COVID-19 times, will get seen in the coming weeks, an investment expert said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.