Weekly options contracts are in the line of fire after market regulator SEBI announced last month that it was open to reviewing them. The trigger for the relook was the explosive growth in derivatives volumes over the last few years—particularly options volumes—as retail investors came to view them as a route to easy riches.

Within the options segment, it is the weekly options contracts that are seeing the most activity as it offers the promise of huge upside with limited downside risk (as far as option buyers are concerned).

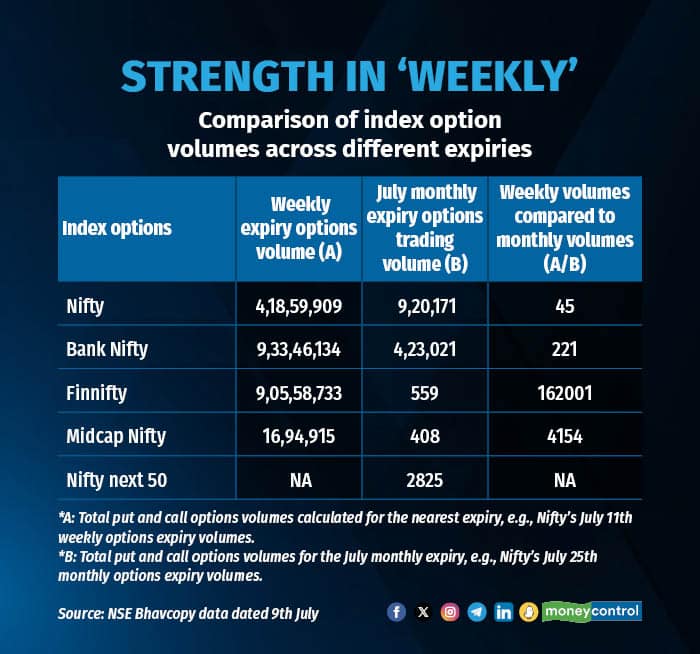

Based on NSE’s options data released on July 9, the weekly expiry volumes for various indices are significantly higher than the July monthly volumes. For instance, Nifty and Bank Nifty weekly options volumes are 45 and 221 times their monthly expiry options volumes, respectively. Interestingly, for Finnifty, the weekly options volumes are over a lakh times greater than the monthly expiry volumes.

Midcap Nifty's weekly options volumes are also significantly higher, almost 4000 times the monthly volumes.

Comparing weekly options volumes to monthly volumes helps to understand which index options are more susceptible to speculative activity and may be potential candidates for SEBI’s review. In the recent past, Midcap and Finnifty indices have witnessed significant volatility and spikes on expiry days.

Yesterday, Moneycontrol reported that the Working Committee on Futures and Options has recommended increasing the minimum lot size of derivative contracts, restricting weekly options to only one expiry per stock exchange per week, and limiting the number of strike prices for options contracts.

These measures aim to curb the unbridled rise in derivatives volumes. Other Proposals include fewer strike prices., upfront collection of option premiums from option buyers, Intra-day monitoring of position limits and further increasing margin requirements closer to expiry.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.