Stock and mutual fund investment platform Upstox's user base has crossed 10 million, doubling from 5 million six months ago and ahead of rival Zerodha's 9 million.

In an interview to Moneycontrol on May 4, Upstox co-founder Shrini Vishwanath said half of the numbers—5 million—are active users. Zerodha has an active user base of over 6.2 million. Groww, which started as a mutual fund investment platform and then diversified to stocks and futures and options, has 20 million customers, driven largely by its mutual fund investment user base.

Angel One, previously Angel Broking, one of the early retail broking houses in the country that was set up in 1996, has over 9.21 million users. Paytm Money has 0.85 million trading accounts and 9 million registered mutual fund investors.

India had 89.7 million active demat accounts, as per reported data for FY22.

Moneycontrol wrote in September 2021 that Upstox was eyeing 10 million users by the end of the fiscal year 2022. Vishwanath said the growth momentum would continue in FY23 as well.

"We have been growing at a rate of almost 3x year-on-year for the past three years. We do expect that to continue," he said.

At this rate, Upstox expects to have a user base of anywhere between 25 and 30 million by the end of FY23. In the next four to five years, the company is aiming to onboard 200-300 million customers.

The company wants to be a wealth management platform and will look at adding more products to allow customers to manage all investments.

“Our larger ambition is to be more than just a broker investor platform. We want to be a strong wealth management platform. We want to be in a position that whether it's a savings account, credit card, fixed deposit, or a loan, we want them to come to Upstox,” Vishwanath added.

The period between April 2020 and the end of 2021 was that of substantial growth for online stock investment platforms led by increased retail investor interest.

Stock markets gave investors higher returns during most of the last two years as compared to other investment avenues.

However, in the past few months, stock markets globally have seen a slump and subdued investment activity.

"There has been a global economic slump that's been there for the last couple of months. It's hard to tell whether or not that's going to last or have a meaningful impact,” Vishwanath said.

Also read: LIC IPO: How to apply online on Zerodha, Paytm, Upstox, Groww

IPO activity, too, slowed down but with the much-awaited LIC offer opening on May 4, more retail investors are expected to head to the market.

"LIC is one of the largest IPOs that we've ever seen. So, we do think that it should attract a lot of clients coming into the market. Maybe it may not be as big as if they had gone public around seven months ago but it will still be a net positive for the economy and consumer,” Vishwanath said.

A number of companies that planned to go public were waiting for LIC’s IPO to test the waters and then launch their offerings. However, it would take some time for IPO activity to return to the previous year’s pace, he said.

“When it comes to the other private companies looking to go public, it is going to be a little bit of a wait and watch scenario. We probably have to wait for one or two quarters to see how the economy goes. But, definitely by the end of the year, and by next year, we should see a lot more IPO activity,” he said.

The Tiger Global and Ratan Tata-backed company was founded in 2009 as RSKV Securities. Founded by Ravi Kumar, Kavitha Subramanian and Viswanath, the company entered retail broking in 2011 and rebranded to Upstox in 2016.

Moneycontrol reported in November 2021 that Upstox garnered a $24.7 million investment from Tiger Global as part of a larger round. While the quantum of the total fundraise is not known, Moneycontrol learns that the company’s valuation now stands anywhere between $3-3.5 billion.

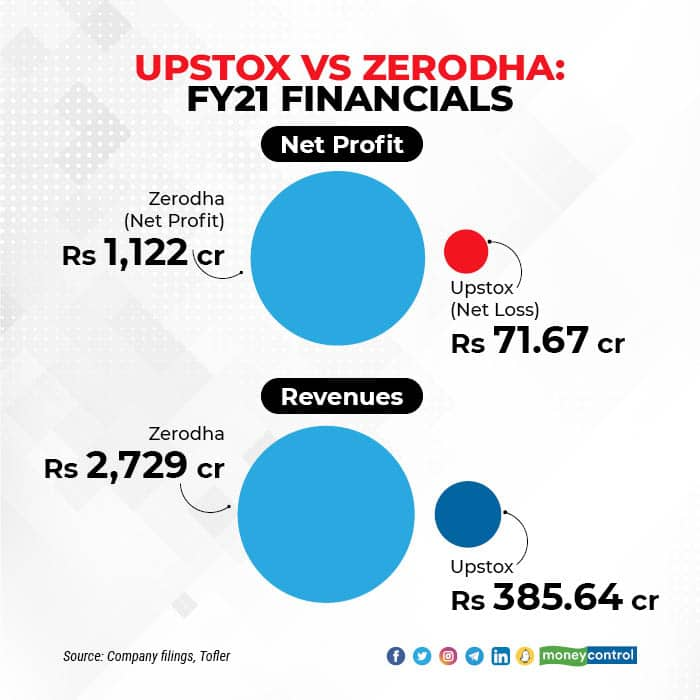

When it comes to the company's financials, Upstox reported a loss of Rs 71.67 crore in FY21, as compared to Zerodha's profit of Rs 1,122 crore. Revenues rose 3x year-on-year to Rs 385.64 crore in the same year.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.