Mutual fund houses were flooded with inflows in their equity funds, largely in balanced funds category during the period under review.

According to the data on the Association of Mutual Funds in India website, in the last 11 months balanced funds have received inflows worth of Rs 74,000 crore. The AUM of this category has reached Rs 1.55 lakh crore as on November 2017.

Mutual fund officials said that since demonetisation, flows into fund schemes have been very robust, especially in balanced funds.

Also, with India's stock markets touching record highs, 2017 witnessed a trend where investors opted for schemes that offer asset allocations such as balanced funds.

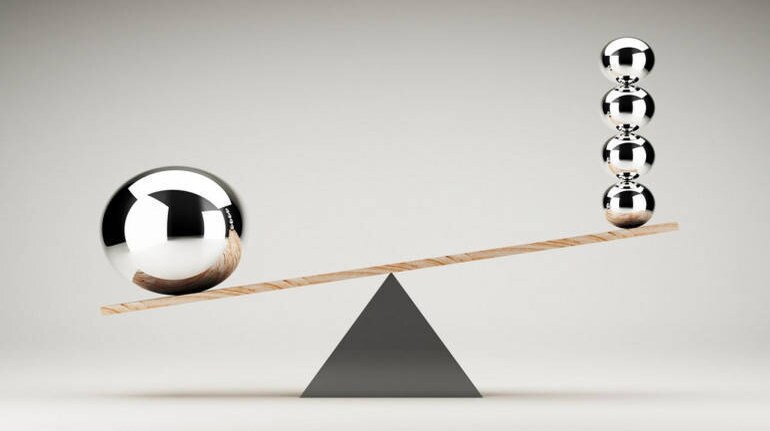

Balanced funds provide the best of equity and debt while equity savings schemes is a mix of equity, debt and arbitrage schemes. Equity savings schemes invest 30-35 per cent of the portfolio in equities and the remaining in debt and arbitrage.

These schemes are popular among retail investors because of the debt portion that brings some stability in the returns of these schemes.

According to mutual fund distributors, in the last 11 months, 50 percent of the inflows received in the mutual fund industry were parked in balanced funds. The rest of the money has gone in to equity saving schemes and in large, mid and small cap categories.

However, within the balanced category of funds, the subset of balanced advantage funds, which were largely open-ended equity-oriented schemes, have put up a strong show in 2017.

Since, these schemes allocate funds to equity, debt instruments and arbitrage on a daily basis, given the market levels they provide comfort to investors from volatility.

In terms of average returns, equity-oriented balanced funds have given an average returns of around 21 percent in the last one year.

Market experts expect balanced funds to continue to be the theme of 2018 as well.

"Coming year will be materially more rewarding for the balanced fund investor because the rebalancing that happens in balanced funds and the extreme volatility that we have seen in the interim and the rebalancing will translate into superior returns, said Dhirendra Kumar, Chief Executive Officer, Value Research.

Follow @HimadriBuchDiscover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.