The Indian Banks’ Association (IBA) and other bank unions have agreed to a 17 percent hike for staffers for five years starting fiscal 2021-22, but this will have a negligible impact on PSU banks’ profitability or return ratios, analysts said.

The memorandum of understanding (MOU) was signed last week between the IBA, United Forum of Banks, and other unions as part of the 12th bipartite settlement.

The annual increase in salary and allowances will be at 17 percent of the annual pay slip expenses for FY22. This would amount to about Rs 12,449 crore for all public sector banks, including State Bank of India (SBI).

Also Read: IBA signs MOU with bank employee unions on wage revision

For context, PSU banks reported a healthy 57 per cent rise in net profit to around Rs 1 lakh crore in FY2023.

On the employees’ expenses side, the total wage bill of SBI alone stood at Rs 57,292 crore in FY23.

While the quantum of hike was higher than that in the previous wage hike cycle (15 percent), most banks have already been providing for the revised wages, assuming a hike of 14-15 percent, analysts at Kotak Institutional Equities said.

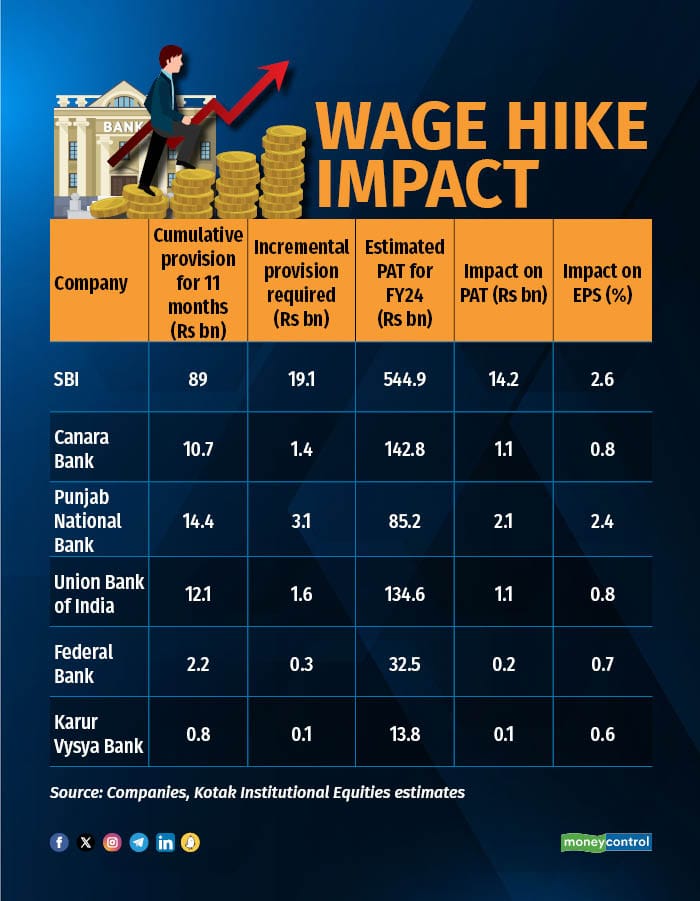

As a result of the agreement, banks will be required to make one-time provisions for arrears of wages for the past 11 months (November 2022 to September 2023) and arrears of retirement benefits (pension and gratuity).

“In our estimate, the impact of wage arrears is unlikely to be material,” Kotak added.

Based on its preliminary estimates, the one-time provision for wage arrears adds to the overall cost (FY24) for banks by 0-2 percent.

Consequently, it will have an impact of 0-3 percent on FY24 earnings per share (EPS) for banks under its coverage.

“While the impact of higher retirement benefits is difficult to quantify, it is unlikely to be material either. Thus, this additional cost will be absorbed by banks without a noticeable dent in profitability,” the domestic brokerage added.

The banks under its coverage include SBI, Bank of Baroda, Canara Bank, Punjab National Bank, Union Bank of India, Federal Bank and Karur Vysya Bank.

Growth Drivers

According to analysts, state-run lenders’ robust credit growth and improving profitability allow them to absorb the wage hike without breaking much sweat.

The key monitorable for the sector is the pressure on the margins front, and not incremental employee costs, which anyways was largely factored in.

“The pressures on margins will continue going into H2 FY24, with cost of funds yet to peak. Most banks are likely to exit FY24 with net interest margins (NIMs) broadly similar to or marginally lower than FY23,” Axis Securities said.

Also Read: Why Madhu Kela, Vikas Khemani and N Jayakumar are bullish on PSU banks

However, credit growth momentum will continue to remain healthy, primarily led by retail and SME segments.

“We believe banks will continue to focus on deposit mobilization, keeping competitive intensity high. Deposit mobilization remains a key lever to support a bank’s superior credit growth,” it added.

The recent announcement of increase in risk weight for unsecured lending categories of personal loans and credit card receivables could potentially slow down growth in these segments in the near term.

However, the RBI’s recent upward revision in GDP growth estimates provides much-needed tailwind for systemic credit growth in the near term, as per analysts at ICICI Securities.

The domestic banking sector is also well placed with regard to asset quality.

“Slippages are expected to moderate and recoveries are to remain healthy, which in turn, will improve asset quality further across the sector. Current valuations are very attractive as compared to the market. Hence, we maintain the overweight stance on the sector,” Axis Securities added.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.