Outperformance from broader indices continued for the third consecutive week, ending on December 6. Mid- and smallcap indices rose more than 3 percent each amid positive cues and FIIs' support as they turned net buyers.

This week, BSE Sensex surged 1,906.33 points or 2.38 percent to end at 81,709.12, while the Nifty50 index added 546.7 points or 2.26 percent to close at 24,677.8.

The BSE Mid-cap Index, BSE Small-cap Index, and BSE Large-cap Index rose 3.5 percent, 3.3 percent, and 2.4 percent, respectively.

On the sectoral front, the Nifty Realty and PSU Bank indices added 5 percent each, Nifty Metal and Media added 4 percent each, and the Nifty IT index was up nearly 4 percent.

Foreign Institutional Investors (FIIs) turned net buyers in this week as they bought equities worth Rs 11,933.59 crore, while Domestic Institutional Investors (DII) bought equities worth Rs 1,792.47 crore.

"Despite a slump in Q2 growth rate, the market maintained a positive bias throughout the week as the core sector output in October and stability in service PMI data show signs of recovery. Further, a positive turnaround from FIIs to India in expectation of a dovish monetary policy by RBI supported the sentiment," said Vinod Nair, Head of Research, Geojit Financial Services

"RBI turns more realistic with a revision on its growth forecast for FY25. While boosting liquidity in the financial system by reducing CRR by 50 bps, RBI reiterates that maintaining macroeconomic stability remains crucial."

"Investors are now accumulating the momentum stocks as the expected pick-up in the government capex may provide some impetus to infra, capital goods, realty, cement, and metal industries in H2FY25. PSU banks outperformed amid a liquidity boost by RBI."

"The outlook for the February monetary policy meeting also turned positive as inflation is likely to moderate in Q4, supported by seasonal corrections in vegetable prices, kharif harvest arrivals, and anticipated rabi output. For the week ahead, the market direction will be influenced by the release of US payroll and US CPI inflation data, which will give some insights into the Fed's December meeting," he added.

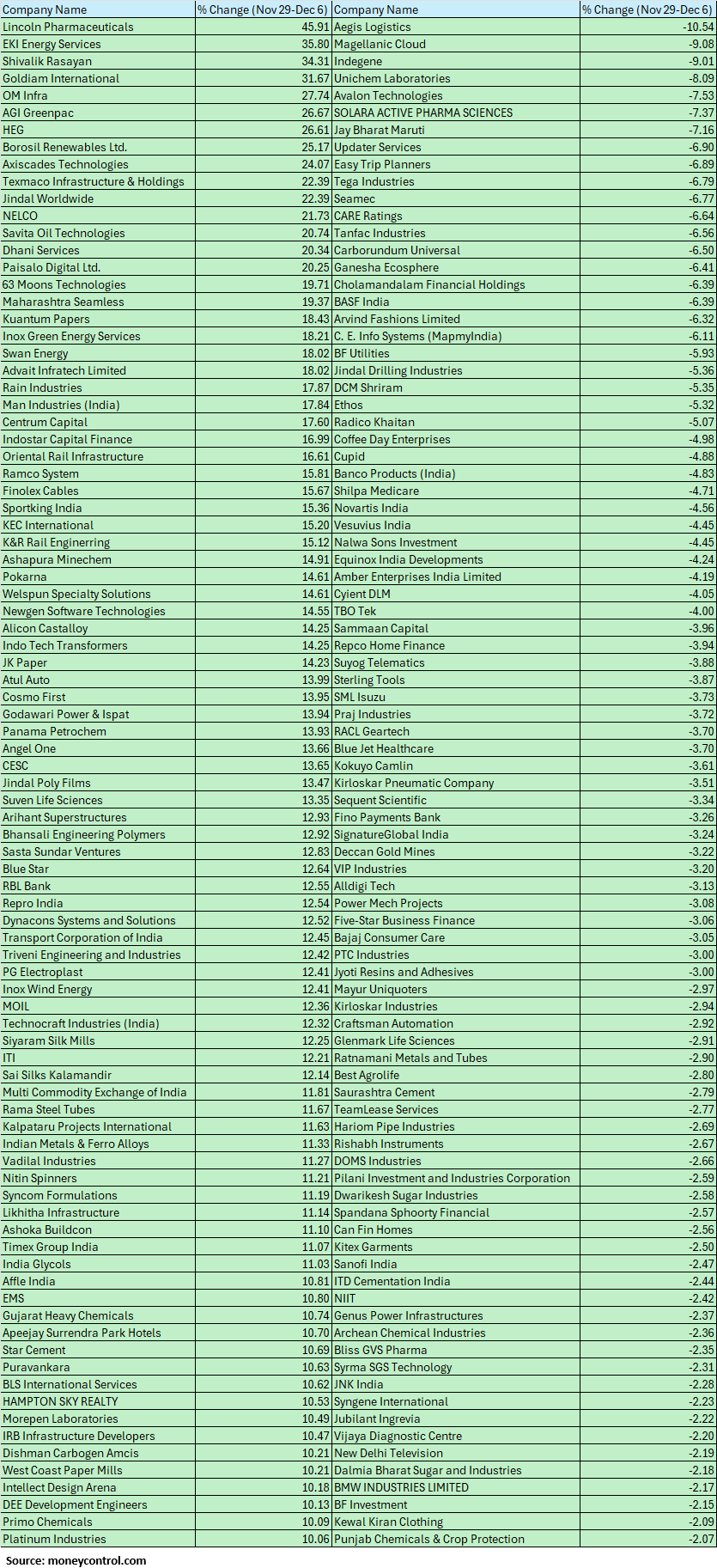

The BSE Small-cap index added 3.3 percent with Lincoln Pharmaceuticals, EKI Energy Services, Shivalik Rasayan, Goldiam International, OM Infra, AGI Greenpac, HEG, Borosil Renewables, Axiscades Technologies, Texmaco Infrastructure & Holdings, Jindal Worldwide, NELCO, Savita Oil Technologies, Dhani Services, Paisalo Digital adding 20-46 percent.

However, losers were Aegis Logistics, Magellanic Cloud,Indegene,Unichem Laboratories, Avalon Technologies, Solara Active Pharma, Jay Bharat Maruti.

Looking ahead, next week will see significant economic data releases, including GDP numbers from the US, Japan, and the UK, along with China’s CPI and PPI, and India’s CPI. On the domestic front, the primary market is gearing up for a dynamic week, with three mainline IPOs, including Vishal Mega Mart and Mobikwik, alongside five SME offerings set to open for public subscription.

Next week, we expect Nifty to maintain its gradual upmove, driven by the potential increase in liquidity post RBI’s CRR cut, positive news flows around government policies, and return of FII inflows.

Nagaraj Shetti, Senior Technical Research Analyst at HDFC SecuritiesThe near-term trend of the Nifty remains positive. Having moved above the crucial hurdle of 24400-24500 levels as per smaller and larger timeframe charts, there is a possibility of more upside in the coming week.

Further consolidation or minor weakness of early next week could be a buying opportunity. The next upside targets to be watched around 25000-25200 levels for the next couple of weeks. Immediate support is at 24525.

Osho Krishnan, Sr. Analyst, Technical & Derivatives of - Angel OneTechnically, the support base now shifts upward towards 24500 on an intermediate basis, which is likely to cushion any intra-week blips, followed by a sacrosanct support zone placed from the 24350-24250 zone. On the higher end of the spectrum, 24800 followed by 25000-25100 is likely to be seen as the next potential resistance for the benchmark index in the upcoming week.

The recent developments have certainly improved market sentiment, as key indices have shown a strong resurgence and have gained significant traction. However, given the current movements, it is advisable not to become overly aggressive. Instead, waiting for dips could be a more prudent strategy at this time. Simultaneously, staying abreast with global developments, along with being selective with stock preferences, is advisable

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.