The S&P BSE Sensex closed flat with a slight positive bias for the week ended November 17 even after a big booster provided by Moody’s Investors Service on Friday. But, there was plenty of action seen in small and midcap stocks.

Although, bears remained in control of D-Street for the most part of the week, back-to-back rallies on Thursday and Friday helped pare losses. The S&P BSE Sensex hit a low of 32,683.59 on Wednesday before closing the week at 33,342.80, up 659 points.

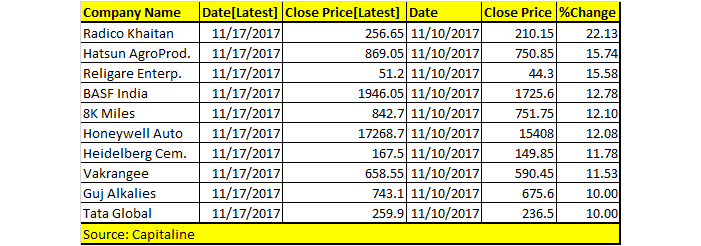

The index closed on a flat note but there plenty of action seen in the S&P BSE 500 index. Ten stocks rose in the range of 10-22 percent in just 5 trading days which include names like Radico Khaitan which rallied 22 percent, followed by Hatsun Agro which surged 15 percent, and Religare Enterprises was up by 15.5 percent in the same period.

The last time Moody’s upgraded India was in 2004 to Baa3, moving India to an ‘Investment Grade Destination’. Ratings Below BBB(-)/ Baa3 are indicative of Junk status.

After Moody’s upgrade of India’s sovereign debt rating, all eyes are on other global rating agencies such as Fitch as S&P.

But, experts feel that they are unlikely to make a move in the near term and wait until fiscal deficit situations get into a comfortable situation which is why it is said that rating changes move with a lag.

The Nifty came closer to its crucial resistance level of 10,300 after slipping below 10,100 last week in intraday trade. Investors are advised to tread with caution and build aggressive longs only when Nifty50 is able to take out 10350-10411 on closing basis.

Among the Nifty50 names, SBI led the rally from the front, rallying 7.6 percent, followed by ICICI Bank which rose 4.4 percent, M&M rallied 4.1 percent, HUL & Bajaj Finance gained 2 percent each for the week ended November 17.

On the sectoral front, Realty, Banks, Financial Services emerged as winners while pharma, metals, infrastructure, media, and IT closed with losses in the range of 2.9 percent.

Technically speaking, the current price action on the Nifty weekly chart has formed a candlestick pattern that resembles a Bullish Hammer which suggests that momentum on the upside is likely to continue.

“In the coming week if Nifty trades and close above 10336 level then it is likely to test 10409 – 10481 - 10566 levels. However, if Nifty trades and close below 10231 level then it can test 10158 – 10085 - 10000 levels,” Arpit Jain, AVP at Arihant Capital Markets told Moneycontrol.

“Broadly, the undertone in the market has turned positive and any pullback in the range of 10255 – 10204 – 10123 should be used to go long, with a stop loss of 10066 for a target 10400 - 10600 levels in a couple of weeks,” he said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.