Most banking and financial stocks fell on May 22, dragging the Indian stock market down after RBI Governor Shaktikanta Das announced an extension of loan moratorium by three months. The deadline for the earlier moratorium was May 31.

Governor Das had announced a three-month moratorium for all term loan repayments between March 1 and May 31 at his last address in April.

The loan moratorium will be extended till August 31, says RBI governor Shaktikanta Das. This makes it a six-month moratorium. He added that the lending institutions are being permitted to restore the margins for working capital to the origin level by March 31, 2021.

"The surprise move by the RBI to reduce repo rate to 4 percent from 4.4 percent followed by an extension of the loan moratorium by another three months is a welcome step and can provide solace to the ailing economy whereby EMI burden for the borrowers would be somewhat lowered and would also allow them to defer EMI payments by another three months. For corporate borrowers too, the increase in group exposure limit of banks to 30 percent from 25 percent will bring some relief," said Rajesh Agarwal, Head of Research at Aum Capital.

"The fall in bold yield after the announcement is positive news, the committee's decision to continue with its accommodative stance is further good news but the point remains that even after so much of liquidity, the banks are reluctant to take additional risk and that has resulted in a muted credit growth," he added.

Sensex closed the day 260 points, or 0.84 percent, lower at 30,672.59 while Nifty finished with a loss of 67 points, or 0.74 percent, at 9,039.25.

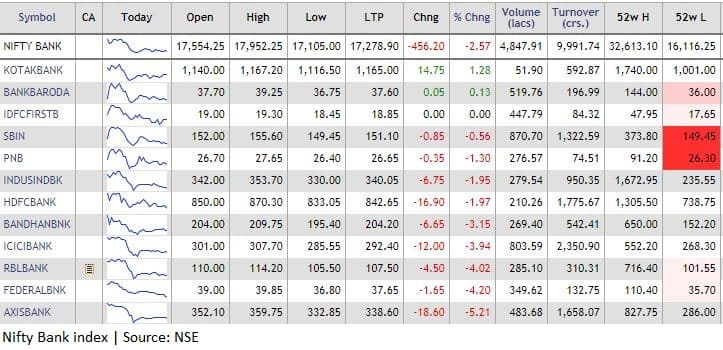

Bank Nifty fell 2.57 percent to 17,278.90 with 9 stocks in the red, 2 n the green and one unchanged. Shares of SBI hit a 52-week low in intraday trade.

"RBI, which has been proactive in recent times, has risen to the occasion by advancing the policy meet to cut policy rates by 40bp. Also, the unequivocal statement that monetary policy will continue to be accommodative till growth revives sends positive signals. The fact that the central bank has refrained from giving a GDP growth figure is a reflection of the complexity in giving projections with the present growth models," said VK Vijayakumar- Chief Investment Strategist at Geojit Financial Services.

"Extension of the moratorium announced earlier by another 3 months is a relief. A takeaway from the policy announcement is that the stress in the banking sector will continue," he added.

While the RBI governor Shaktikanta Das announced that the three-month term loan moratorium has been extended till August 31, it is to be noted that individual banks have the right to take a decision on whether this will be allowed for all borrowers. It is only an enabling provision and not a mandate.

Check our complete coverage on RBI's May 22 announcements hereDisclaimer: The above report is compiled from information available on public platforms. Moneycontrol advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.