On Wednesday, February 15, the Reserve Bank of India released a list of applicants that have received in-principle approval to operate as payment aggregators. Some firms have been asked to reapply and some are still under review.

While more than 185 fintech businesses and startups submitted their applications for a license to operate a payment aggregator in the regulator’s stringent screening procedure, around 32 received the go-ahead, about 28 are under review and four being rejected.

The companies that have been granted permission to function as payment aggregators in India would be directly under the ambit of the RBI.

What is a PA License?

A Payments Aggregator, or PA, license, allows companies to provide payment services for merchants (online businesses or e-commerce firms) by accepting payment instruments from customers.

As part of the process, PAs pool the funds received from customers and transfer them to merchants after a certain time period.

To protect the welfare of citizens and businesses, the RBI released PA guideline in March 2020 wherein it was highlighted that the payment gateways need a license to acquire merchants and provide them with digital payment acceptance solutions.

The main eligibility to comply with RBI guidelines and receive the “In-Principle authorisation to act as a payment aggregator,” a fintech firm must have had a net worth of Rs 15 crore by March 2021, Rs 25 crore by March 2023, and Rs 25 crore at all times thereafter.

Industry experts believe that one of the significant reasons from a consumer point of view is the trust factor, as PAs are directly monitored by the RBI.

“RBI has clearly stated and has advised consumers (e-commerce companies) to deal with existing PAs who have been granted in-principle authorisation or whose application is under process. So this clearly means loss of business if a company doesn’t receive the nod,” said a payment aggregator on condition of anonymity.

Another significant reason for bringing in the license application is to curb PAs from getting into KYC (Know Your Customer)-related issues and undertaking any dealings with cryptocurrency exchanges and Chinese gaming apps.

“Companies like Cashfree and Zaakpay came under the RBI’s scanner for KYC issues and other crypto deals…This license is also significant for the regulator to put checks at the very beginning,” said the payment aggregator cited above.

While the license approval process is stringent, multiple industry experts believe that the PA license will bring more transparency, standardization and trust within India’s fintech ecosystem.

Is the PA license rejection by RBI a red flag?

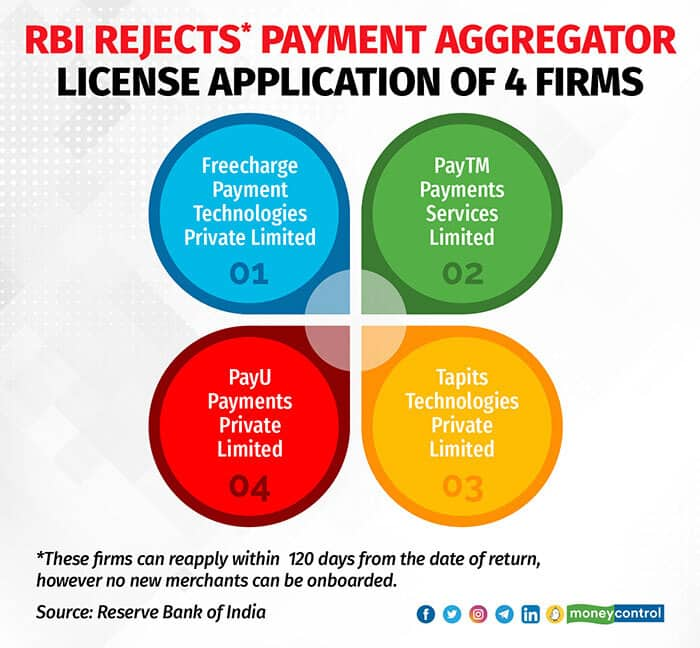

Applications of four entities--Paytm Payments Services Ltd, PayU Payments Pvt Ltd, Freecharge Payment Technologies Pvt Ltd, and Tapits Technologies Pvt Ltd--have been returned by the RBI.

“The rejections, if you see, are basically returns. RBI has returned the license and has given 120 days to reapply. The reason could simply be that there were some minor errors in the applications too,” said a payment aggregator.

Sources said that there were some companies that applied for the license without having a required net worth of Rs 15 crore.

“The companies thought that they can apply and then raise funds to show the net worth; those companies got their applications returned,” the person quoted above said.

Similarly, some applied for two independent entities in India while only one received in-principle approval.

“Worldline Group had applied to the Reserve Bank of India (RBI) to act as a PA pursuant to Guidelines on Regulation of Payment Aggregators and Payment Gateways dated March 17, 2020, for its two independent entities in India – Worldline ePayments India Private Limited and Worldline India Private Limited,” said WorldLine India’s official spokesperson in a statement.

“Subsequently, it was decided to consolidate the payment aggregation business and continue with one single PA application for Worldline ePayments India Private Limited. Accordingly, PA application for Worldline India Private Limited was withdrawn,” the statement said.

RBI also mentioned in the list that the companies whose applications are returned are permitted to apply within 120 days from the date of return. Thus, they can continue business subject to the condition that no new merchants should be onboarded until advised otherwise.

“This is an in-principle approval only; this means that these companies come under RBI’s watch and will be regulated. If there are any issues the RBI has the authority to not give the final license. No one in India has received the final license to operate as PAs yet,” said the payment aggregator quoted above.

Scrutiny Post-ApprovalWithin the list of firms that receive an in-principle nod, Cashfree and Razorpay were marked and told that no new merchants were to be on-boarded until they were advised otherwise.

Moneycontrol first reported that the Fintech unicorn Razorpay paused the onboarding of new online merchants to comply with a communication that it received from the RBI.

Sources say that every player has to submit a systematic audit report to get the full license. One of the changes is to convert from a nodal account to an escrow account, apart from other systematic upgrades.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.