The Good Glamm Group (GGG), a content-to-commerce unicorn, is set to buy out a 100 percent stake in portfolio brands Organic Harvest and Sirona, giving an exit to their respective founders by the end of next year. This comes at a time when the beauty and personal care unicorn is looking to consolidate operations across brands and turn profitable.

The Prosus Ventures-backed firm had acquired a majority stake in femtech brand Sirona and organic skin and hair care brand Organic Harvest at 2021 end and 2022, respectively.

Organic Harvest was founded in 2013 by Rahul Agarwal, while Sirona was co-founded by Deep Bajaj and Mohit Bajaj in 2014.

“Between the end of this year and the end of next year, Sirona and Organic Harvest founders will also exit. And by next year we will own 100 percent of all three brands – Moms Co, Sirona and Organic Harvest. St Botanica we already own 100 percent,” Darpan Sanghvi, Group Founder and CEO, The Good Glamm Group, told Moneycontrol.

Sanghvi added, “We were very clear that we always would need the help of the brand founders to help us initially scale and pass on the DNA of the brand to our team. For different brands, this period of transition was defined between 1-3 years and deal structures were created accordingly.”

The founders have a clear structure on who is going to be exiting when, after how much time etc., Sanghvi explained.

Recently, mother and baby care brand Moms Co.’s founders Malika Sadani and Mohit Sadani exited from parent company GGG. According to media reports, GGG earlier held a 75 percent stake in the brand, which was then extended to 90 percent, while the founders continued to hold the remaining 10 percent, which they are expected to divest in the next one year. Moms Co. was the largest direct-to-customer (D2C) brand acquisition, costing GGG Rs. 500 crore.

The majority stake in Sirona was acquired for Rs. 100 crore and the Organic Harvest deal happened at an undisclosed amount though GGG then said that it would further invest Rs 75 crore to grow the latter. Organic Harvest recently had a branding and packaging change too.

Since GGG became a unicorn in 2021 at a valuation of $1.2 billion after raising $150 million in its Series D round co-led by Prosus Ventures (Naspers), Warburg Pincus, with participation from Alteria Capital and existing investors L’Occitane, Bessemer Venture Partners, Amazon, Ascent Capital and the Mankekar Family Office; had acquired around 12 brands across its four verticals including product and content companies.

Usually the deal structure offered by GGG typically is 30-40 per cent in cash, about 30 per cent in stock and the remaining 30 per cent in future earn-outs based on the performance of the brand in the next couple of years.

Sanghvi explained, “The Media and Creator founders have got stock in the parent entity. The brand founders were all incentivised to grow the revenues of their respective brands and their earn outs were based on the revenue of their respective brands.”

He added, "However, a lot of the brand founders also invested capital separately back into the Good Glamm parent and they will also see an upside during the IPO.”

Unlike the popular roll-up e-commerce model, where a firm picks brands from various segments of the lifestyle category, GGG wants to build a house of brands and is focused on including a bunch of related brands in the beauty and personal care space. Beyond this, the content platforms acquired will enable digital distribution channels for the brand, Sanghvi explained.

Now, GGG also plans to enter international markets and launch a men’s grooming section. Sanghvi declined to divulge more details on this.

GGG currently has four verticals: The Good Brand Co, including all its beauty product brands like BabyChakra, St. Botanica, MyGlamm etc; The Good Media Co, involving media platforms like ScoopWhoop, POPxo, MissMalini, Tweak India; The Good Creator Co, which is about social media and influencer platforms, where in the company recently acquired video commerce platform Bulbul and The Good Community, a community built around its various brands and needs of members.

The Good Glamm Group's four key verticals and CEOs heading them.

The Good Glamm Group's four key verticals and CEOs heading them.

Lower customer acquisition costs

“Our biggest challenge with the D2C segment was there was not much difference between the brands. Between a Lakme, Sugar, Colorbar or a MyGlamm, except for price there is very little product-level differentiation. And even if there was a difference, the other folks were very quick to copy it. There’s no IP or moats like old-school brands such as HUL, which has a massive distribution network,” an investor in GGG said, seeking anonymity.

The investor added, “In this case, we found that distribution through their content-to-commerce strategy. These content platforms are across different demographics, bringing huge traffic. This covered a large section of society making their customer acquisition cost (CAC) very low.”

“We are a digital FMCG conglomerate. The other acquisitions of content and influencer platforms were to fuel digital distribution channels and not for revenue,” Sanghvi said.

According to Sanghvi, over 70 percent of GGG’s new customers are from content platforms.

“Our CAC is the lowest in the country at $1.5 per customer due to the content flywheel we have. Earlier it used to be a little under $1 but now is at $1.5. The sector average is around $7 per customer. Our scale has stabilised to 500,000 new customers a month,” Sanghvi said.

Of Good Glamm Group’s 200 million monthly active users, 20 million are registered users and 12 million are transacted users. It also has 2,000 offline touchpoints.

Not just digital-first D2C brands, GGG has also been trying to acquire offline mainstream brands. As per media reports it was in talks to acquire the consumer care business of Raymond Group, which has brands such as Park Avenue and Kamasutra. The deal reportedly didn’t materialise after a disagreement on the price of Rs 3,000 crore sought for the cash-and-stock deal.

Without referring to the deal, Sanghvi said, “On the offline FMCG brand side, yes, we are firm believers that being omnichannel is very important. If we can find a good brand that has strong offline distribution, which can be leveraged by all our DTC brands, then we would love to consider that for an M&A. Currently, we don't have a target.”

Path to profitability

The startup had IPO plans for the end of 2023, which got delayed to at least the end of 2024 given the market conditions and the state of its financials.

Sanghvi said, “The year 2022 was a year of consolidation for us. In 2021, we had 11 acquisitions, now we have started centralising everything. For instance on the brand side, we now have a centralised supply chain, R&D team, finance team etc.”

He added, “This year (2023) is going to be about achieving profitability. All the brands have grown 2-4X since we acquired them. They have all come to a good scale now.”

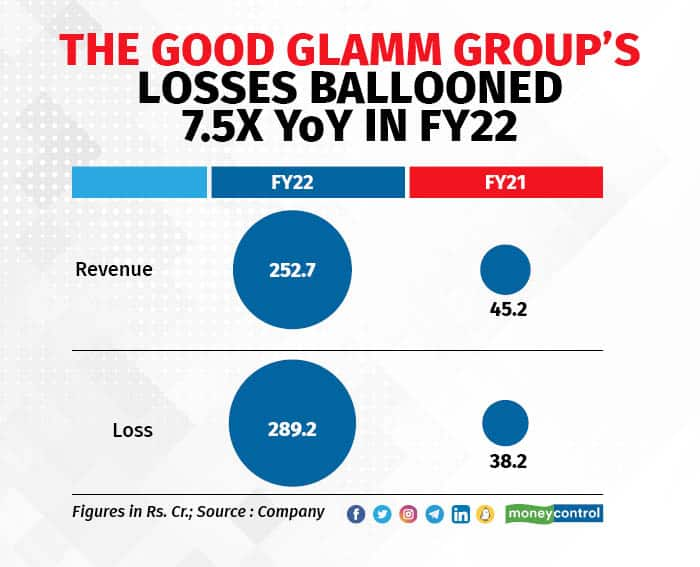

According to Tracxn, The Good Glamm Group’s revenue grew from Rs 45.2 crores in FY21 to Rs 252.7 crores in FY22. Meanwhile, losses, too, ballooned 7.5X from Rs 38.2 crore in FY21 to Rs 289.2 crore in FY22.

Without sharing the expected run rate for FY23, Sanghvi said that revenue is likely to go up manifold. Though this fiscal year won’t be profitable, the startup hopes to break even and be profitable by FY24.

GGG is seriously considering its IPO prospects to give lucrative returns to founders who joined the company through acquisitions.

“We need to have a common content-to-commerce vision with the founders and brands we are acquiring. Then we create a structure for them, wherein they become a part of the parent company. And as the parent group has its IPO, they’ll see big value being created for them,” he said.

“But for an IPO, you have to be really predictable as a company. Public market investors appreciate predictability. We want to have at least a few thousand crores in revenue by the time we get listed,” Sanghvi said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.