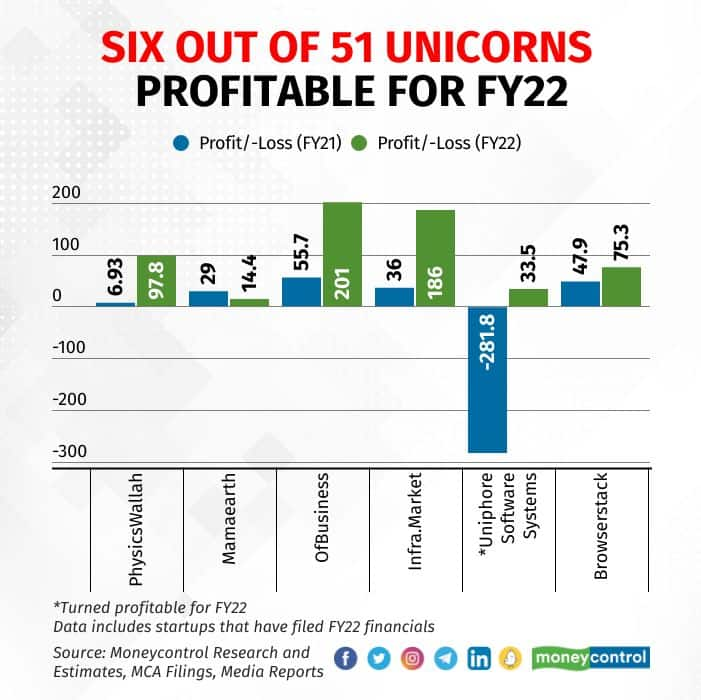

Only six of India’s 51 unicorns that have filed FY22 (2021-22) results with the Ministry of Corporate Affairs (MCA) were profitable as companies were prioritising growth over the last two years with billions of dollars flowing into the country’s startup ecosystem.

Demand for technology-led offerings surged due to Covid-19-induced stay-at-home restrictions, and in a bid to capitalise on that, most founders focused on ‘growth at all costs.’ While this helped most unicorns in registering strong revenue growth for the year, their expenses also swelled, resulting in mounting losses.

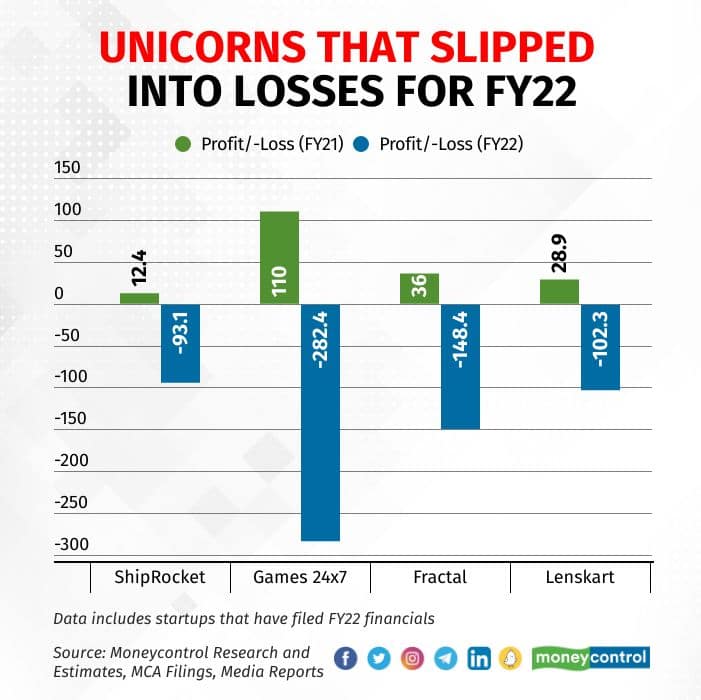

In FY21 (2020-21), as many as nine unicorns from the data set were profitable with three slipping into losses in FY22.

The data was compiled by collating information from regulatory filings, private market information portal Tracxn, and media reports. The data excludes listed unicorns such as Zomato, Paytm, and Delhivery among others. It also excludes Zerodha and Zoho as these companies cannot be technically called unicorns since they have not raised any external funding.

The data showed that as many as nine unicorns from the list were profitable in FY21 (2020-21), with three companies slipping into losses in FY22.

Among the 51 unicorns, OfBusiness had the highest profit of Rs 201 crore, which grew nearly fourfold from its previous year’s profit of Rs 56 crore. The company, which counts SoftBank, Tiger Global, and Alpha Wave Global, among others, as its backers, managed to register a 313 percent growth in revenue in FY22 over the previous year.

Infra.Market, a platform catering to the construction industry, was the only other unicorn with a profit of more than Rs 100 crore during the year. The Accel and Tiger Global-backed company’s profit grew fivefold in FY22 from a year earlier.

Here’s a look at others on the list:

SaaS companies seem to have figured out the key to investors’ hearts, thanks to their high gross margins. BrowserStack’s profit grew nearly 60 percent to Rs 75.3 crore, while Uniphore Software Systems turned a profit of Rs 33.5 crore from a loss of nearly Rs 282 crore in FY21.

Also Read: Indian unicorns sitting on lofty valuations with higher revenue multiples than global peers

“At a time when companies abroad have to save capital amid macroeconomic headwinds, they will outsource. Indian Saas companies become quite central in gaining from that,” said Anirudh Damani, managing partner at Artha Venture Fund, an early-stage VC.

However, some of these startups also slipped into losses in the latest financial year. Fractal Analytics reported a loss of almost Rs 150 crore in FY22 from a profit of Rs 36 crore in FY21.

Besides Fractal, e-commerce marketplace for eyewear Lenskart, online gaming company Games 24x7, and logistics aggregator Shiprocket reported a loss in FY22, against a profit in the previous year.

Mamaearth, meanwhile, saw its profit halving in FY22 to Rs 14 crore from nearly Rs 30 crore a year earlier.

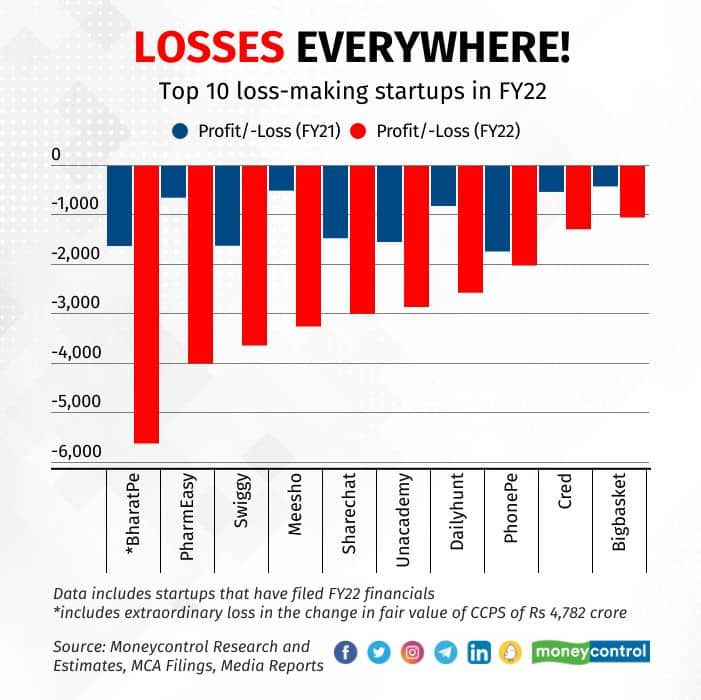

Losses everywhereNotably, none of the eight fintech unicorns in the group of 51 were profitable. BharatPe had the biggest loss of more than Rs 5,600 crore for FY22 but this was here.

Others posting big losses of Rs 3,000 crore or more included Pharmeasy, ShareChat, Udaan, Swiggy, and Meesho. Dailyhunt, PhonePe, and Unacademy recorded losses of more than Rs 2,000 crore for FY22, according to the data.

Barring PhysicsWallah, none of the five edtech unicorns from the dataset were profitable. While PhysicsWallah saw its profit ballooning nearly 14 times to Rs 97.8 crore, Unacademy, upGrad, LEAD, and Vedantu saw their losses widening, thanks to a sharp rise in employee and marketing expenses, the data showed.

“Education can offer you a contribution margin of 50-60 percent but most edtech players’ customer acquisition strategy requires them to spend heavily on marketing. By the time you reach the EBITDA (earnings before interest tax depreciation and amortisation) level, you become negative because you invest a lot of capital into growth. The challenge happens when you're not able to retain those customers and people,” said Vikram Gupta, founder, and managing partner at IvyCap Ventures, which has backed at least two edtech startups.

“But even loss-making startups can derive high multiples if their long-term profitability is secured. If your model doesn't care about the retention of the right people, for example, you become a leaky bucket as you keep investing in people and then you keep losing them. In the process, you will continue to be loss-making and not get a higher multiple because you haven't figured out a sustainable model yet,” Gupta said, talking about revenue multiple, a metric used by investors to gauge the value of equity with respect to the revenue of the company.

Robust growth in revenueOut of the 51 unicorns, only two companies --logitstics and trucking unicorn Blackbuck and online gaming company Games 24x7--saw their revenue decline in FY22 over FY21, according to the data set. The rest of the companies saw significant revenue growth during the year.

Groww registered the highest revenue growth in the dataset of more than 11 times during the year, as its operating revenue went past Rs 350 crore from a little over Rs 30 crore in FY21.

Besides Groww, edtech PhysicsWallah, fintech startups OneCard and CredAvenue, social commerce companies Dealshare and Meesho, manufacturing services marketplace Zetwerk, and business-to-business (B2B) online marketplace for construction materials OfBusiness, recorded a manifold revenue growth during the year.

Among specific sectors, fintech companies recorded the maximum growth in FY22. While Groww’s operating revenue grew the most, Pine Labs recorded the least revenue growth of 40 percent in FY22.

For FY22, B2B e-commerce company Udaan had the highest revenue of nearly Rs 10,000 crore. The company, backed by Lightspeed Ventures, Tencent, and DST Global, among others, posted a revenue of Rs 9,885 crore for the year. Udaan has raised a little over $1.5 billion to date from investors through equity or debt and has a revenue multiple of 2.44, among the lowest in the set. However, the company is also among the biggest loss-making entities and for FY22 had a loss of more than Rs 3,000 crore.

Other than Udaan, 19 companies reported revenue of more than Rs 1,000 crore for FY22. BigBasket, Swiggy, Zetwerk, and ElasticRun, were amongst the highest-grossing unicorns for the year, the data showed.

Health tech brand Cure.fit and online gaming company Mobile Premier League were the only two unicorns that witnessed single-digit revenue growth of a little over six and nine percent, respectively.

Going forward, growth is expected to slow, primarily because of a high base in FY22 and also because of macroeconomic headwinds that have hit consumer spending, according to startup founders and investors Moneycontrol spoke to. Moreover, founders have shifted focus to profitability from growth, anticipating a longer funding winter.

“We've got a big base in 2022 versus 2021. Businesses have still grown but it (revenue growth) may not be at the same pace as last year, especially because people have become more concerned about cash in the middle of the year. People are worrying that if I cannot raise the next round of capital, and I keep burning the way I'm burning, we won't survive,” said Damani of Artha Venture Partners.

[This is the second story of a two-part series from Moneycontrol on data of 51 unicorns who have filed their results for FY22. Read the first one here.]

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.