Google is reviewing a Ministry of Electronics and Information Technology (MeitY) directive to block more than 200 loan and betting apps, which includes lending platforms like Kissht, PayU-backed LazyPay, KreditBee and Ola Avail Finance, according to sources close to the developments.

“Google has received a government request to restrict apps from the Play Store in India. It is currently evaluating the order and will restrict apps as appropriate after a thorough review,” said a source.

The MeitY directive was sent out to internet service providers and app stores on an “urgent” and “emergency” basis on February 5. The move came after a communication from the Ministry of Home Affairs.

Google declined to comment on the matter.

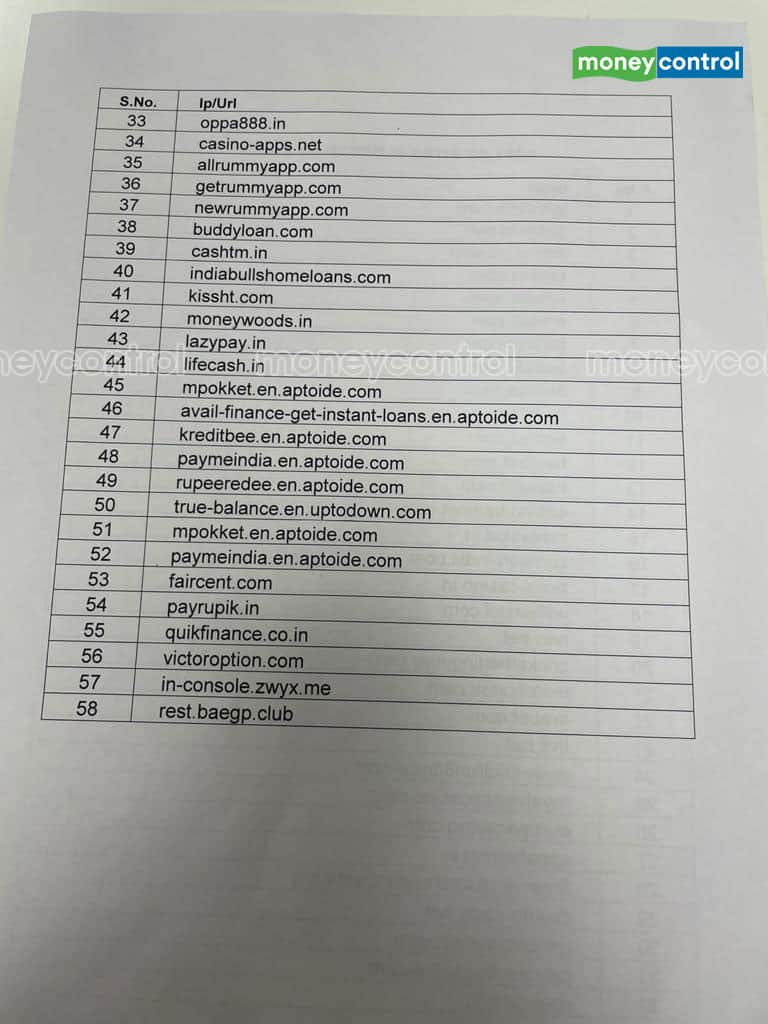

Some of the apps mentioned in the list are hosted in Aptoide, an online third party marketplace for mobile applications. Lending app Kreditbee has said that it this ban of Aptoide link is a favourable outcome for the firm.

"Aptoide is a third-party App Store, with which we have no formal or informal partnership. We are speculating that it’s a proxy app on Aptoide, and investigating this further. Blocking of the Aptoide link is a favourable outcome for us," Kreditbee said in an official statement.

Ola's Avail Finance did not respond to Moneycontrol's queries.

"The Kissht app is currently operating smoothly for our customers across India. While we haven't received any formal notification on the status of our app, we are aware of the development and are seeking clarity from the concerned authorities. We are hopeful that this will be resolved soon without interrupting services for our existing users," the company said.

According to industry sources, the MeitY list includes a host of prominent VC-backed lending platforms and not just fly-by-night operators which were spiked by an earlier directive in 2021.

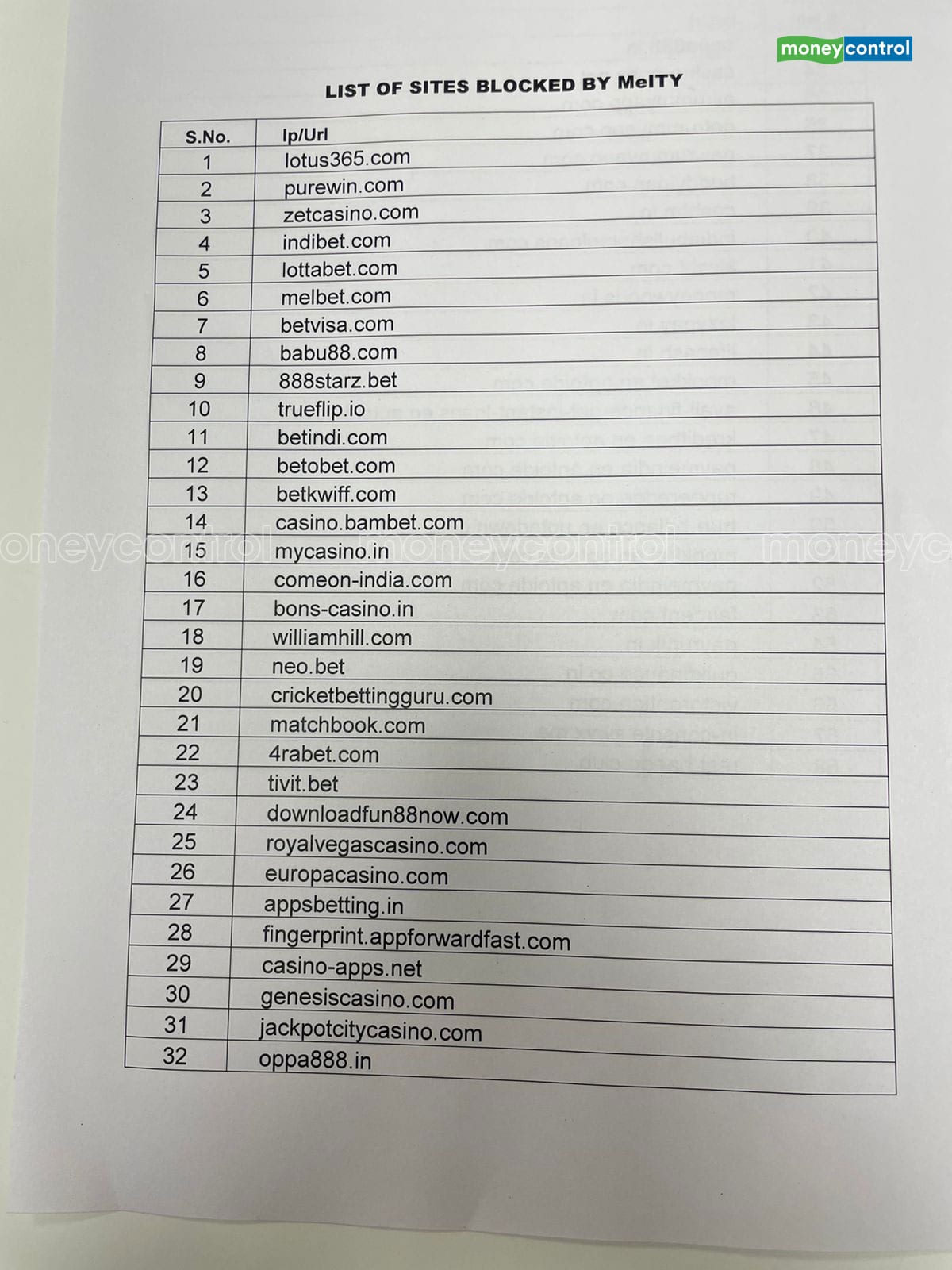

A partial list of the platforms in the MeitY directive has been accessed by Moneycontrol. It includes names such as Faircent, Indiabullshomeloans, Quick Finance, Lifecash, Moneywoods BuddyLoan, Cashtm, RupeeRedee, among others.

Multiple fintech executives that Moneycontrol spoke with said that they were aghast at the unilateral order and hoped that it was an unintended error by MeitY that would be rectified soon.

MeitY did not respond to Moneycontrol queries on the matter.

Meanwhile, industry bodies like the Fintech Association for Consumer Empowerment (FACE) and the Digital Lenders Association of India (DLAI) have gone into a huddle with their respective members and are trying to figure out the next steps, including making representations to the government.

It all began last weekend when MeitY began a process to ban and block 138 betting apps and 94 loan lending apps with alleged Chinese links on an 'urgent' and 'emergency' basis. According to a Prasar Bharti tweet, the MeitY acted on the suggestion of the Ministry of Home Affairs which flagged these apps.

“We are compliant in all aspects, what’s shocking is that there was no notification. We are guessing this is only a short-term glitch,” said a fintech founder whose startup is on Meity’s list of apps that got banned.

Investors and industry experts believe there could be several reasons for this, including a breach of digital lending guidelines and a lack of transparency by some apps.

“The RBI and all the regulators in fact are moving towards transparency for consumers, if any app or website is not following this might be in trouble,” said Prabhu Rangarajan, cofounder of M2P Fintech.

Many believe this could be due to a rise in consumer complaints.

“I think the ban is because of the complaints, they have all morphed into loan sharks, they call relatives, come home, morph images also sometimes, complaints from cyber cell may have been a trigger,” said a fintech founder.

Several fintech investors are worried as a result of this development.

“This is not going to have any immediate impact, however, this is definitely a setback for the growing industry,” said a fintech investor who has invested in more than 10 late-stage fintech firms.

“I’m not concerned about startups that have raised good money, they are fairly in a better position, however, this is a big hit for those newer ones who are trying to raise money and face this ban,” the investor quoted above said.

Kissht, PayU, and LazyPay have received no official communication from the government explaining why they have been blocked.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.