![Freshworks founder and CEO Girish Mathrubootham [Image: Facebook/rathnagirish]](https://images.moneycontrol.com/static-mcnews/2021/08/Freshworks-founder-and-CEO-Girish-Mathrubootham-770x433.jpg?impolicy=website&width=770&height=431)

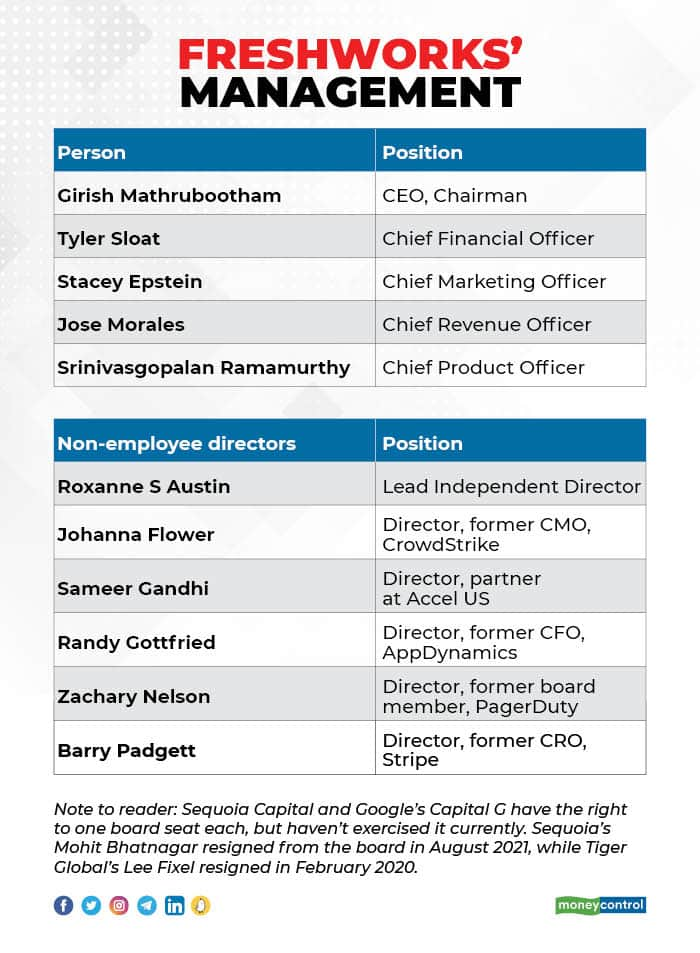

Software firm Freshworks, over the weekend, filed its documents to go public in the US, a landmark moment for India's software startup ecosystem. Freshworks' prospectus reveals a lot about a relatively little-known sector and business, compared to consumer peers heading to the stock markets such as Policybazaar or the recently-listed Zomato.

Here's a quick look at Freshworks' key numbers.

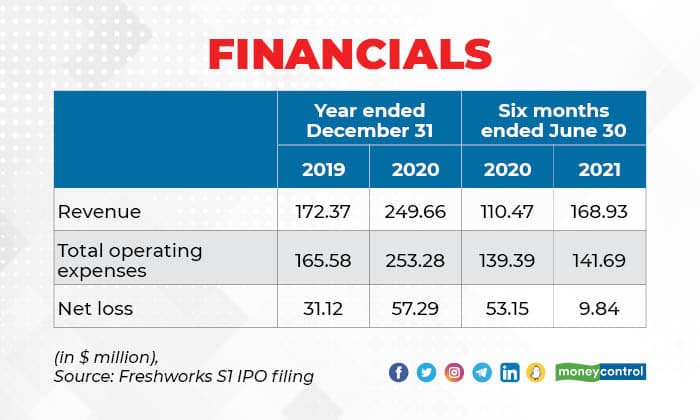

Freshworks lost around $10 million in the last six months with an annual revenue run rate of over $300 million

Freshworks lost around $10 million in the last six months with an annual revenue run rate of over $300 million

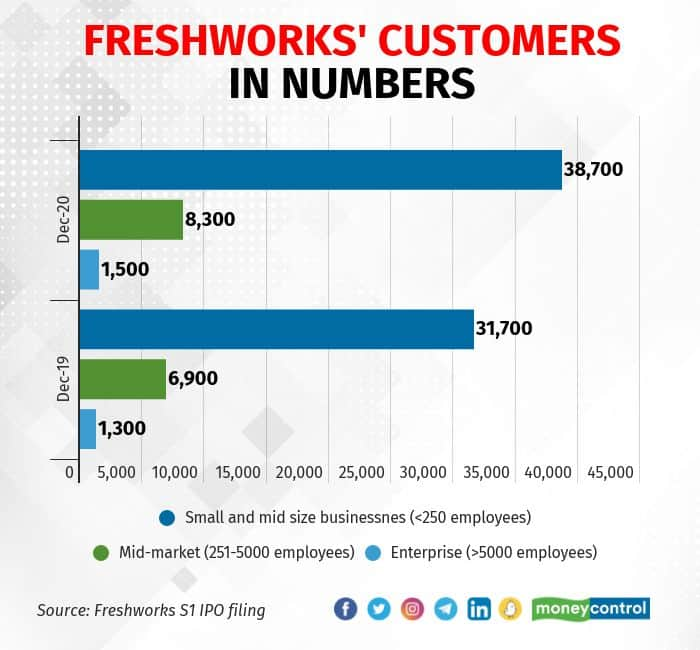

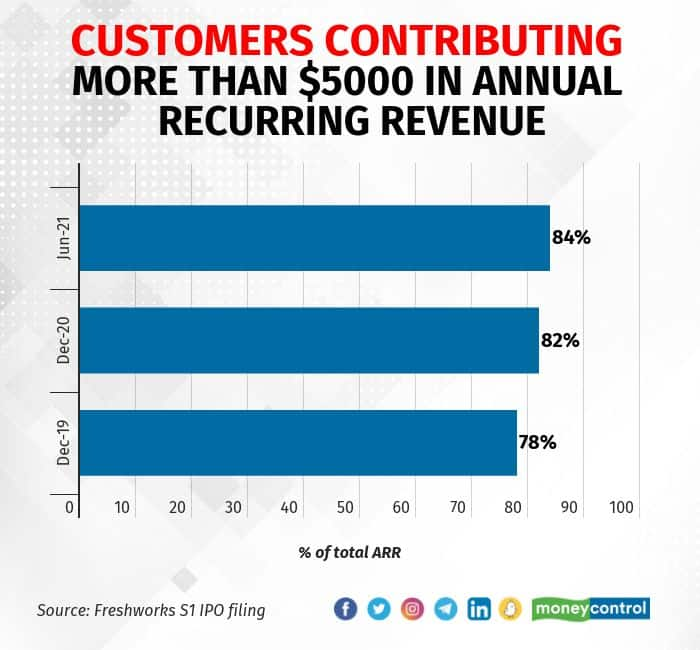

Freshworks' customers cut across categories, from large companies to mid-market firms. Getting large clients helps it grow business by cross-selling even without new clients

Freshworks' customers cut across categories, from large companies to mid-market firms. Getting large clients helps it grow business by cross-selling even without new clients

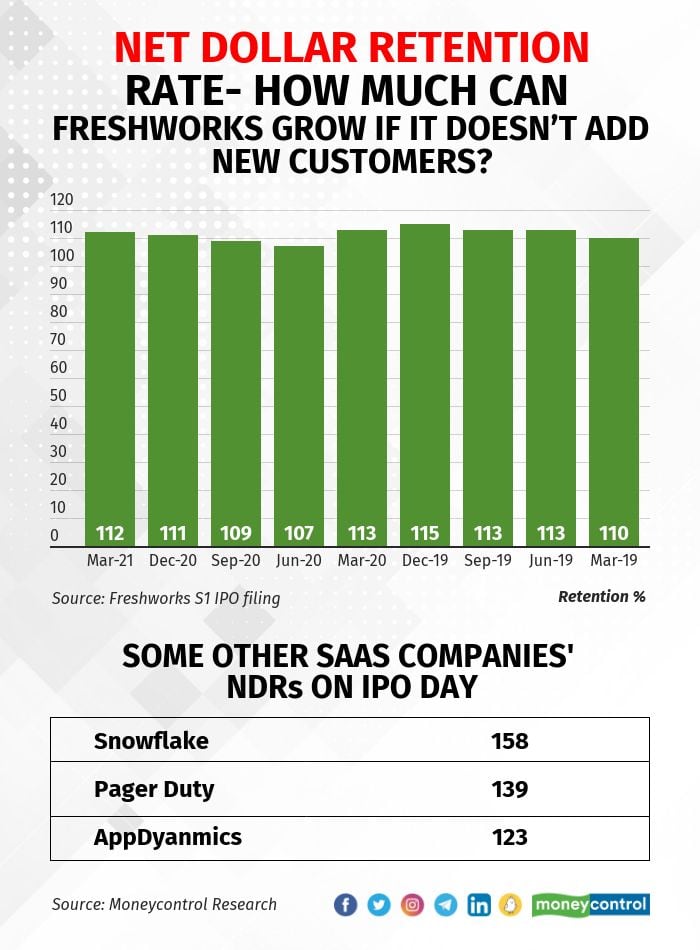

This key metric indicates how much Freshworks can grow if it doesn't add new customers. Cross-selling to large clients is a huge opportunity for SaaS companies

This key metric indicates how much Freshworks can grow if it doesn't add new customers. Cross-selling to large clients is a huge opportunity for SaaS companies

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.