Also read: Startup Sages | Meet Professor Zerodha

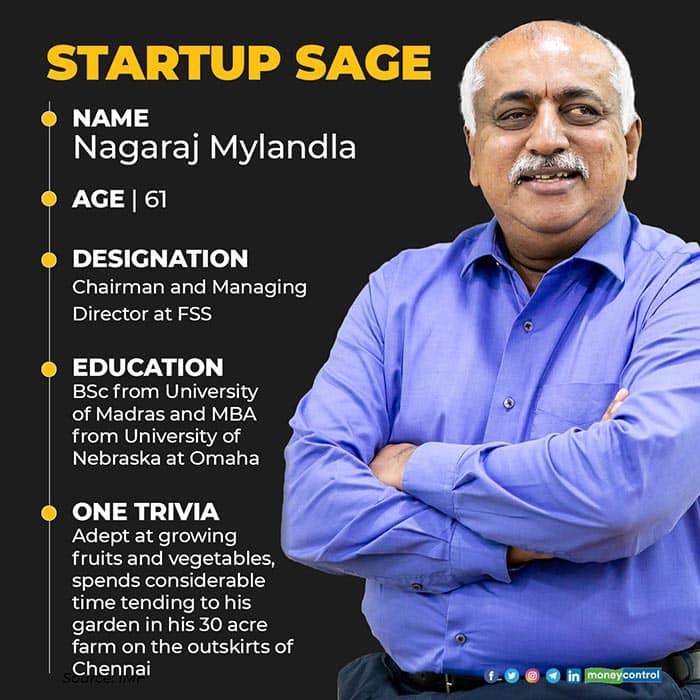

Humble beginningsFrom his early days as a banker with the Chennai-headquartered Indian Overseas Bank, Mylandla knew he had too much ambition and energy for the job he was doing. After 18 months, he left to pursue a business administration degree in Nebraska, the American state from where famous investor Warren Buffett comes from.Mylandla learnt a lot about technology in banking and saw a huge potential for it in India. As luck would have it, India was looking to shift to a core-banking system from the branch-led business. Indian banks needed technology to make the change.Mylandla started as an employee of ACI Corporation, an American banking technology giant, driving their business in India but he split and formed FSS in February 1991.Starting a company was the easy part but convincing banks with millions of customers to partner with a ‘startup’ for their technology layer was quite another.Seemingly innocuous information came in handy. Mylandla knew 12th or 14th floors were where the offices of deputy general managers (DGM) and GM, were. He would loiter around the corridors, hoping to meet the banks’ decision-makers.Hours spend pacing up and down the corridors, pestering executive assistants and waiting on couches of visitors lobby paid off. The country’s largest lender State Bank of India became his customer in 2000 and by 2007, the FSS client list had expanded to other Indian PSUs.

PSUs were later arrivals. It were the private banks that shaped writing FSS’s story. Mylandla’s timings were nothing but perfect.

As FSS was looking for business, players like HDFC Bank, Axis Bank (then UTI Bank) and ICICI Bank got their banking licences. As a startup, it is always easier to sell to one. HDFC Bank became one of FSS’s first customers in 1996.An older acquaintance with CN Ram, HDFC Bank’s then IT and digital head, helped him pitch to the bank and eventually convince its top leadership to give FSS a chance to build the technology layer for the lender.“We were a six-member team, we had to rapidly scale up our team to work on this project,” Mylandla said.

A year later, Axis Bank joined his list of customers and ICICI Bank, which had chosen another player, came to FSS in December 2000.The early 2000s saw rapid digitisation of the banking system in India, led by the private sector lenders. Technology players like FSS saw their business boom.“After those few initial years, it was all about scaling up to cater to the requirements of the banking ecosystem,” he said.The growth phaseToday, FSS is a professionally managed company but Mylandla has not forgotten the days when he had to run the business singlehandedly. Like a typical entrepreneur, he sweated it out in the driver’s seat to grab new business opportunities, ensured his customers were happy and hired the right set of people. Even if that meant wading through knee-deep water during Mumbai’s monsoon to reach office in Andheri or spending nights at bank headquarters to ensure that the system updates were carried out smoothly.“Today FSS is not dependent on me anymore for day-to-day operations but there was a time when I used to spend the nights at banks while deploying critical projects,” he said.FSS has three major verticals—services for government banks, private banks and new business within which fintech projects like Jio Payments Bank, Bajaj Finance and Airtel Payments Bank are housed.In terms of services, what started with ATMs has now expanded into card issuance, merchant acquisition, digital banking, payment processing and others. FSS powers digital payments across all forms from card payments to UPI, IMPS and even Aadhaar-based transactions. At a time when there is a buzz around the indigenisation of services, Mylandla is sure Indian companies can match the service and product innovation of global players.“We have faltered in our services but every time we have maintained transparency with our customers and ensured we came back quickly—it is this level of service which has helped us grow in this business,” he added.For Mylandla, integrity is the cornerstone of his business. Whenever there was talk of cutting corners or compromises to save money, he preferred to walk away, Mylandla said.“This is a characteristic I used to look for among my employees as well,” he said. Mylandla calls it holding on to his middle-class values.And that perhaps is the reason he is not impressed with the valuation-hungry startups. Fintechs surviving on external funding would last only as long as someone is willing to pump in more money, Mylandla said.There was a high chance of them getting gobbled up by banks or larger players like Visa and Mastercard. Unlike many other countries, banks in India are extremely strong, hence fintechs will only do well when they partner with them rather than compete with them.“I did not build FSS through external funding, I took money when banks themselves approached me,” he said.Into the futureMylandla is 66 and he lives on a 30-acre farm on the outskirts of Chennai, close to the city’s IT corridor. He spends his day growing vegetables, fruits and flowers. He continues to be the managing director of FSS but has reduced the number of executives who report directly to him.

His wife, Sharada, heads marketing, son Archit leads the transformation and strategy team. His daughter is settled in the United States and works with Tesla in San Francisco.The business has stabilised in India and the company wants to expand. FSS is already doing business in all the Gulf Cooperation Council member countries. It is now looking at Commonwealth countries in Africa and is has made a start with South Africa."The aim is to make FSS a global brand in the next five to six years,” Mylandla said.

From around 80 percent of the business volume coming from India, the target is to reduce the revenue share to 60 percent and get 40 percent of the business from outside.

Even on this growth path, Mylandla is careful about keeping the business clean. “Historically I have walked away from deals where integrity could not be maintained, even now I stick to that principle,” he said.

Global business could make the company consistent in terms of the revenue quarter on quarter. This is also the reason Mylandla hasn’t taken the company public. He is hoping once global banks start using his systems, there will be more consistency in his business through the year.

“Indian banks tend to give out purchase orders only towards the second half of the year, which makes my business consistent year-on-year but not quarter-wise,” he said.

A listing on the exchanges is not his top concern, being the next Infosys or TCS, in terms of the creation of software products, is.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.