HCL Tech Q3 Results highlights: We are very less dependent on H-1B visas, says CEO C Vijayakumar

-330

January 13, 2025· 21:07 IST

Delta Corp posts 3.62% jump in consolidated net profit

Delta Corp Ltd on January 13 reported a 3.62 percent jump in consolidated net profit at Rs 35.73 crore in the third quarter of the current fiscal year, compared to Rs 34.48 crore in the year-ago period, the gaming and hospitality firm said in an exchange filing.

The company had reported a net profit of Rs 26.98 crore in the September quarter of FY25, the exchange filing showed.

The firm’s revenue declined 7.51 percent to Rs 194.33 crore in the reported quarter over Rs 210.13 crore in the same period of the previous financial year, the stock filing said.

-330

January 13, 2025· 20:53 IST

Anand Rathi Wealth posts 33% jump in net profit at Rs 77 crore in Q3

Anand Rathi Wealth Ltd on January 13 reported a 33.2 percent jump in consolidated net profit at Rs 77.3 crore in the third quarter of the current fiscal year, compared to Rs 58.04 crore in the year-ago period, the wealth management firm said in an exchange filing.

The company had reported a net profit of Rs 76.3 crore in the September quarter of FY25, the exchange filing showed.

The firm’s revenue from operations jumped 26.6 percent to Rs 237 crore in the reported quarter over Rs 187.2 crore in the same period of the previous financial year, the stock filing said.

-330

January 13, 2025· 20:32 IST

Former Google Pay VP Ambarish Kenghe joins Angel One as Group CEO

Ambarish Kenghe has joined stockbroking firm Angel One's Group as Chief Executive Officer after a six-year stint at Google Pay. Read more

-330

January 13, 2025· 20:20 IST

Angel One's net profit jumps 8% to Rs 281 crore in December quarter

Angel One on January 13 reported an 8.1 percent jump in consolidated net profit at Rs 281.4 crore in the December 31st ended quarter of the current fiscal year, compared to Rs 260.3 crore in the year-ago period, the online trading and brokerage firm said in an exchange filing.

However, it registered a significant decline from the September quarter of FY25, when it reported a profit of Rs 423.3 crore, the exchange filing showed.

The firm’s revenue from operations jumped 19.2 percent to Rs 1,262.2 crore in the reported quarter over Rs 1,059 crore in the same period of the previous financial year, the stock filing said.

-330

January 13, 2025· 19:46 IST

Uttar Pradesh govt looks to privatise two power distribution firms

Uttar Pradesh is looking to privatise two of its four power distribution companies, a state government tender showed, as the country's most populous state grapples with power losses and a lack of sufficient transmission infrastructure.

The northern Indian state is inviting private companies to form partnerships with or privatise state-owned Dakshinanchal Vidyut Vitran Nigam and Purvanchal Vidyut Vitran Nigam, per the tender dated January 12.

A majority of state power distribution companies in India are suffering losses due to older power transmission systems and frequent power losses, prompting the government to bring in private players.

-330

January 13, 2025· 19:46 IST

AIG Hospitals to invest Rs 800 crore in new oncology centre

Multispecialty AIG Hospitals will be investing Rs 800 crore in a new dedicated oncology centre here.

The Board of AIG Hospitals has also approved the acquisition of Proton Beam Therapy system from Belgium-based IBA, a supplier of equipment and services in the field of proton therapy.

"The acquisition of the Proton Beam Therapy System and the strategic partnership with IBA represent a transformative step forward in our mission to provide cutting-edge, compassionate care," AIG Hospitals chairman Dr D Nageshwar Reddy said, in a press release.

-330

January 13, 2025· 19:29 IST

Delta Corp's net profit rises 3.6% to Rs 36 crore in Q3

Delta Corp's on January 13 reported a net profit of Rs 35.7 crore in the December quarter, up 3.6% compared to Rs 34.5 crore in the September quarter.

-330

January 13, 2025· 19:27 IST

80% of workforce in the US is local, we have the lowest dependency on H-1B among peers: HCLTech's chief people officer

-330

January 13, 2025· 19:27 IST

C Vijayakumar, CEO, HCLTech: A very large part of our $2.1 billion revenue has some sort of Gen AI part embedded in the deals

-330

January 13, 2025· 18:45 IST

Have ramped up our hiring engine, says HCLTech's chief people officer

Ramachandran Sundararajan, Chief People Officer, HCLTech: We have ramped up our hiring engine, don't expect any slack in that

-330

January 13, 2025· 18:43 IST

We are very less dependent on H-1B visas, says CEO C Vijayakumar

-330

January 13, 2025· 18:40 IST

HCLTech to add 1,000 freshers in March quarter

Ramachandran Sundararajan, Chief People Officer, HCLTech: We added 2,000 freshers in Q3 and total fresher intake in this fiscal is 6,000; we will add 1,000 more in Q4.

-330

January 13, 2025· 18:36 IST

Shiv Walia, HCLTech CFO: We reported our highest ever ebit margin and net profit in a quarter in Q3

-330

January 13, 2025· 18:35 IST

C Vijayakumar, CEO, HCLTech: Small deals are converting quickly while large deal conversion remains time consuming

-330

January 13, 2025· 18:34 IST

In 2025, clients are looking to improve their IT spends, says HCLTech CEO

We are confident of the pace of medium-term recovery. But Q4 will see planned contractual reductions, C Vijayakumar said

-330

January 13, 2025· 18:34 IST

HCLTech CEO C Vijayakumar: We are investing in repeatable high-impact Gen AI projects

HCLTech CEO C Vijayakumar: Deployed two Gen AI-based projects for our employees

-330

January 13, 2025· 18:33 IST

Cost of using LLMs have dropped significantly, says CEO

Cost of using LLMs have dropped by 85% from early 2023...Agentic AI is another big opportunity where we can enable our clients, said C Vijayakumar, CEO, HCLTech

-330

January 13, 2025· 18:32 IST

Both Americas and Europe order books are at an all-time high, says CEO

HCLTech CEO C Vijayakumar said both Americas and Europe order books are at an all-time high. "Saw strong growth in technology, retail and CPG verticals," he said.

-330

January 13, 2025· 18:30 IST

HCLTech won 12 deals in third quarter, says CEO

We have won 12 deals in the third quarter, HCLTech CEO C Vijayakumar said, adding that the tenure of signed deals is getting shorter. "We are seeing a sizeable number of deals getting singed in AI and Gen AI," he said.

-330

January 13, 2025· 18:26 IST

Q3 has always been a strong quarter for us given our portfolio mix, HCLTech CEO

-330

January 13, 2025· 18:18 IST

HCL Tech's revenue from operations rose 5% to Rs 29,890 crore in Q3

HCL Tech's revenue from operations rose 5 percent to Rs 29,890 crore in Q3 FY25 as against Rs 28,446 crore in Q3FY24. According to a Moneycontrol poll of nine brokerages, HCL Tech was pegged to deliver a revenue of Rs 30,135 crore and consolidated net profit of Rs 4,596 crore in the fiscal third quarter.

-330

January 13, 2025· 18:11 IST

HCLTech delivers another quarter of solid growth, says CEO

C Vijayakumar, CEO and MD, HCLTech : “HCLTech delivers another quarter of solid growth at 3.8% QoQ in constant currency and EBIT at 19.5%. I am pleased that this growth is powered by broad based performance across business lines as our clients

across verticals and geos reaffirm their confidence in our Digital and AI offerings. Our new deal bookings were healthy during the quarter at $2.1B with wins across services and software. We are positioning ourselves for a future that is transformative, with AI empowering businesses and employees. We continue to see growing demand for our AI led propositions across services and software offerings.”

-330

January 13, 2025· 18:01 IST

FY25 Revenue growth guidance rises 100 bps in lower end

-330

January 13, 2025· 17:58 IST

HCL Tech Q3 results: Net profit rises 5.5% to Rs 4,591 crore, Rs 18 dividend declared

IT firm HCL Technologies (HCLTech) on January 13 reported 5.5 percent on-year rise in net profit at Rs 4,591 crore for the quarter ended December 31, 2024, in line with the Street expectations. The IT firm declared interim dividend of Rs 18 per share. Read more

-330

January 13, 2025· 16:42 IST

Air India targets international long-haul market for growth with wide-body fleet expansion over 3-5 years

Air India plans to boost its international presence by optimising its fleet and network to connect passengers travelling to Southeast Asia, Europe and the Americas over the next 3 to 5 years, as part of its growth strategy and profitability blueprint, said Nipun Aggarwal, Chief Commercial and Transformation Officer, on January 10. Read more

-330

January 13, 2025· 16:07 IST

Retail inflation eases to four-month low of 5.22%

India’s inflation declined to a four-month low of 5.22 percent in December compared with 5.5 percent in the previous month, as food prices provided some reprieve, according to data released on January 14. Read more

-330

January 13, 2025· 16:03 IST

Rate cut is around the corner, RBI's easing cycle to begin in February: Crisil

A policy rate cut is around the corner and the central bank's easing cycle is expected to begin in February, Crisil has said in its latest note on macroeconomics. Read more

-330

January 13, 2025· 15:28 IST

WeWork India raises Rs 500 crore via rights issue

Office-sharing startup WeWork India has raised Rs 500 crore through a rights issue, the firm announced on January 13. The company said the funds will be used to repay debt, which would help the company in its path to go debt-free, and reduce its cost of capital. Read more

-330

January 13, 2025· 14:45 IST

Rupee dives 55 paise, deepest in nearly two years

The rupee logged its steepest fall in nearly two years, plunging 55 paise to hit a historic low of 86.59 against the US dollar during mid-session on Monday due to strengthening of the American currency and surging crude oil prices.

At the interbank foreign exchange, the rupee opened at 86.12 and fell to the lowest ever level of 86.59 against the greenback during mid-session, registering a loss of 55 paise from its previous close. The local unit however pared some losses and was later trading 46 paise down at 86.50 versus the dollar.

The fall of 55 paise, or 0.65 per cent, in one session was the steepest since February 6, 2023 when the unit had lost 68 paise.

-330

January 13, 2025· 14:40 IST

Stalin launches test drive of electric SUV designed, developed in TN

Tamil Nadu Chief Minister M K Stalin flagged off the test drive of Mahindra's electric SUV designed and developed in Tamil Nadu at an event held at the Secretariat here on Monday.

Mahindra launched its BE 6e priced at Rs 26.9 lakh (ex-showroom) and XEV 9e for Rs 30.5 lakh (ex-showroom) at Cheyyar and Chengalpattu in November 2024.

-330

January 13, 2025· 14:25 IST

Q3 Results News Live: HCLTech's con call at 7:30 pm

HCLTech, in a stock exchange filing on January 8, announced that it will declare its Q3 results on Monday, January 13. "The company will release its third-quarter fiscal 2025 results, for the period ending December 31, 2024, on Monday, January 13, 2025, after the closure of Indian stock markets," the filing stated. The company's senior management is scheduled to hold an audio conference call at 7:30 p.m. to discuss the results.

-330

January 13, 2025· 14:09 IST

Q3 Results News Live: A look at HCLTech's Q2 numbers

HCLTech reported a revenue of Rs 28,862 crore in Q2 of the current financial year, exceeding Bloomberg's estimate of Rs 28,637.2 crore. However, the company's net profit fell short of Bloomberg's projection of ₹5,111.7 crore, coming in at ₹4,237 crore for Q2FY25.

-330

January 13, 2025· 14:00 IST

TCS not worried about H-1B visas, over 50% of US workforce local, says CEO K Krithivasan

- Tata Consultancy Services (TCS) chief executive officer and managing director K Krithivasan said that the IT services behemoth is “not worried” about the ongoing discourse within incoming Trump administration in the US over H-1B visas.

- He added that more than half of its workforce in the US are locals, a region that contributes nearly 50 percent to TCS’ revenue. (Read More)

-330

January 13, 2025· 13:53 IST

Q3 Results News Live: HCLTech to Delta Corp, market waits for key earnings today

HCLTech takes the spotlight as several major companies are set to announce their quarterly results today. Alongside HCLTech, Angel One, Anand Rathi Wealth, and Delta Corp will also release their Q3 earnings after market hours. Stay tuned for the latest updates.

-330

January 13, 2025· 13:37 IST

Groww in talks to file for IPO, valuation pegged at $7-8 billion

- Stockbroking firm Groww has engaged in discussions with multiple investment bankers regarding its IPO, aiming to raise approximately $700 million at a valuation of $7-8 billion, sources told Moneycontrol.

- "Groww has engaged with investment bankers to start their IPO process. However, the timeline has not been decided yet. It will based on the market conditions," a source told Moneycontrol.

- The IPO comes less than a year after the firm completed moving the domicile of its holding company from US to India, joining the list of top fintech firms moving their bases back to home country amid favorable economic policies and expanding domestic market. (Read More)

-330

January 13, 2025· 12:58 IST

Laxmi Dental IPO Day 1 GMP Live: Laxmi Dental IPO's latest subscription numbers

- Qualified Institutional Buyers (QIBs) -- 0.00 times

- Non Institutional Investors(NIIS) -- 3.78 times

- Retail Individual Investors (RIIs) - 7.04 times

- Total - 2.35 times

- Source - BSE

-330

January 13, 2025· 12:15 IST

Laxmi Dental IPO Day 1 GMP Live: What you need to know about India's dental care market

India's dental care services market is valued at an estimated $3.4 billion in 2023 and is projected to grow at a CAGR of 12.6%, reaching $7.8 billion by 2030.

-330

January 13, 2025· 12:12 IST

Laxmi Dental IPO: Can the public issue lend a big smile to investors?

A play on cutting-edge dental products; long-term investors can consider it post the IPO at more reasonable valuations. (Read More)

-330

January 13, 2025· 11:43 IST

Laxmi Dental IPO Day 1 GMP Live: Laxmi Dental IPO fully subscribed - Check latest numbers

- Qualified Institutional Buyers (QIBs) - 0.00 times

- Non Institutional Investors(NIIS) -- 2.17 times

- Retail Individual Investors (RIIs) -- 4.79 times

- Total -- 1.46 times

-330

January 13, 2025· 11:26 IST

Laxmi Dental IPO Day 1 GMP Live: What you should know about Laxmi Dental

Laxmi Dental’s IPO comprises a fresh equity issuance amounting to Rs 138 crore and an Offer for Sale (OFS) of up to 1.31 crore equity shares by promoters Rajesh Vrajlal Khakhar and Sameer Kamlesh Merchant, along with other shareholders. According to the Red Herring Prospectus (RHP) filed on January 7, OrbiMed Asia II Mauritius Ltd, an investor, will also participate in the OFS. Laxmi Dental is a leading company in the B2C dental aligner market.

-330

January 13, 2025· 10:15 IST

Laxmi Dental IPO Day 1 GMP Live: Laxmi Dental IPO opens today - Check latest GMP

Laxmi Dental, supported by OrbiMed, is set to open its initial public offering (IPO) for public subscription today, Monday, January 13. Before the public share sale begins, the company has raised just over Rs 314 crore from anchor investors.

-330

January 13, 2025· 10:04 IST

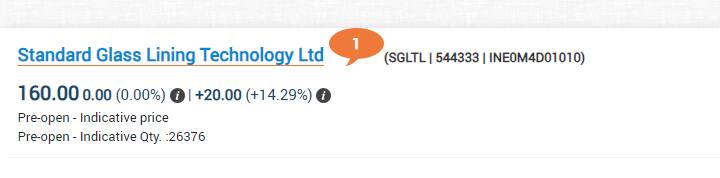

IPO GMP News Live: Standard Glass Lining stocks make D-street debut, shares list at Rs 176 on BSE

IPO GMP News Live: Standard Glass Lining stocks make D-street debut, shares list at Rs 176 on BSE

-330

January 13, 2025· 09:40 IST

Standard Glass Lining Share Price: What will Standard Glass Lining do with the IPO proceeds?

- The company intends to utilise the net proceeds from the offering for the following purposes:

- Funding the capital expenditure requirements of the Company for the purchase of machinery and equipment.

- Repaying or prepaying, either in full or in part, certain outstanding borrowings incurred by the Company.

- Investing in its wholly-owned material subsidiary, S2 Engineering Industry Private Limited, to facilitate the repayment or prepayment, either in full or in part, of its outstanding borrowings from banks and financial institutions.

- Investing in S2 Engineering Industry Private Limited to support its capital expenditure needs for the purchase of machinery and equipment.

-330

January 13, 2025· 09:37 IST

Standard Glass Lining Share Price: Uptick in pre-indicative prices of Standard Glass Lining stocks

-330

January 13, 2025· 09:30 IST

Standard Glass Lining Share Price: Standard Glass Lining revenue numbers

Standard Glass Lining Technology Limited experienced a 10% growth in revenue and a 12% increase in profit after tax (PAT) between the financial years ending on March 31, 2024, and March 31, 2023.

-330

January 13, 2025· 09:27 IST

IPO News Live: Landmark Immigration SME IPO set to open for subscription this week

Landmark Immigration, a company providing global education consultancy services for students seeking to study abroad, will be the third SME to open a public issue this week on January 16. The price band for the issue has been set between Rs 70 and Rs 72 per share. The company aims to raise Rs 40.32 crore through a completely fresh issue of shares. The offer will close on January 20.

-330

January 13, 2025· 09:23 IST

- The listing ceremony of Standard Glass Lining IPO has begun at the National Stock Exchange.

- You can track all the live updates here.

- For those interested in watching the ceremony, here is the live link

Listing ceremony of Standard Glass Lining Technology Limited will be starting soon at our exchange @nseindia. Watch the ceremony live!https://t.co/njnoBPG7DU#NSEIndia #listing #IPO #StockMarket #ShareMarket #StandardGlassLiningTechnologyLimited @ashishchauhan

— NSE India (@NSEIndia) January 13, 2025

-330

January 13, 2025· 09:13 IST

Standard Glass Lining Share Price: Pre-indicative prices are available for Standard Glass Lining

-330

January 13, 2025· 08:52 IST

Standard Glass Lining Share Price: What Anand Rathi has to say about Standard Glass Lining stocks

Narendra Solanki, Head of Fundamental Research - Investment Services at Anand Rathi Shares, noted that at the upper price band, the company is being valued at a Price-to-Earnings (P/E) ratio of 43.01x, with an EV/EBITDA of 30.08x and a market capitalization of Rs 27,928 million post-equity share issuance. The return on net worth stands at 20.74%. He suggested that investors consider holding the issue with a long-term perspective, depending on their risk appetite. (Read More)

-330

January 13, 2025· 08:44 IST

Standard Glass Lining Share Price: StoxBox gives 'HOLD' tag to Standard Glass Lining stocks

Prathamesh Masdekar, a Research Analyst at StoxBox, highlighted that Standard Glass Lining Technology is poised for a strong market debut. The company is one of the few in India providing end-to-end customised solutions for specialised engineering equipment used in the pharmaceutical and chemical sectors. Its extensive product portfolio includes over 65 offerings catering to the pharma and chemical industries, with an additional 15 products currently under development. Masdekar further stated, "The company aims to achieve 20% of its revenue from exports by 2026, compared to the current contribution of just 0.5%. Given this growth potential, we recommend that investors who have been allotted shares should consider holding their positions with a medium to long-term perspective."

-330

January 13, 2025· 08:41 IST

IPO News Live: Know all about Standard Glass Lining - company profile

- Standard Glass Lining Technology Limited, incorporated in September 2012, is a leading manufacturer of engineering equipment for the pharmaceutical and chemical sectors in India. The company has developed the capability to handle the entire production process in-house, ensuring quality and efficiency at every stage.

- Specializing in turnkey solutions, Standard Glass Lining Technology offers a comprehensive range of services, including design, engineering, manufacturing, assembly, installation, and the development of standard operating procedures for pharmaceutical and chemical manufacturers.

- The company's diverse product portfolio includes:

- Reaction Systems

- Storage, Separation, and Drying Systems

-330

January 13, 2025· 08:36 IST

IPO News Live: Laxmi Dental IPO opens for subscription today

- The first IPO to open this week, on January 13, is Laxmi Dental. This is also the only public issue from the mainboard segment. The dental products manufacturer aims to raise Rs 698 crore through the initial share sale, which consists of a fresh issuance of equity shares worth Rs 138 crore and an offer-for-sale (OFS) of 1.3 crore shares, valued at Rs 560.06 crore.

- The price band for the offering, which will close on January 15, has been set between Rs 407 and Rs 428 per share. Additionally, the company has already raised Rs 314.1 crore through the anchor book on January 10, a day before the IPO officially opened.

-330

January 13, 2025· 08:28 IST

Standard Glass Lining Share Price: What's the current grey market premium for Standard Glass Lining stocks

As of morning data by investorgain.com, the latest Grey Market Premium (GMP) for the Standard Glass Lining IPO is Rs 50. With the upper price band set at Rs 140 per share, the estimated listing price for the IPO is Rs 190 (cap price plus today's GMP). This indicates an expected percentage gain of 35.71% per share at the time of listing.

-330

January 13, 2025· 07:59 IST

IPO News Live: A look at this week's lineup

This week, a total of eight companies are set to debut on the stock exchanges, including three from the mainboard segment. (Read More)

-330

January 13, 2025· 07:31 IST

Oil hits more than 3-month high as US sanctions hit Russia exports

Oil prices hit their highest level in more than three months on Monday’s open, extending their rally on expectations that wider US sanctions will affect Russian crude supplies to the world’s top and third largest importers China and India. Brent crude futures climbed $1.35, or 1.69%, to $81.11 a barrel by 2339 GMT after hitting an intraday high of $81.44, the highest since August 27. (Read More)

-330

January 13, 2025· 07:19 IST

Standard Glass Lining Share Price: Stocks in focus today

Several stocks are expected to be in focus today These include Just Dial, PCBL, NCL Industries, Sunteck Realty, JSW Energy, Signature Global India, Sudarshan Pharma, Poly Medicure, ICICI Lombard General Insurance Company, Adani Wilmar, Indian Overseas Bank, Bank of Baroda, Ola Electric Mobility, and Standard Glass Lining Technology. These companies are likely to attract attention due to recent developments, market activity, or significant announcements. (Read More)

-330

January 13, 2025· 07:15 IST

Standard Glass Lining Share Price: Top key investors who participated in anchor book of Standard Glass Lining

Other notable investors who participated in the anchor book of Standard Glass Lining Technology include Clarus Capital, ICICI Prudential Mutual Fund, Tata Mutual Fund, Motilal Oswal Mutual Fund, 3P India Equity Fund, ITI Mutual Fund, and the Massachusetts Institute of Technology. These prominent entities have demonstrated their confidence in the company’s growth potential and industry prospects by investing through the anchor book mechanism.

-330

January 13, 2025· 07:03 IST

Standard Glass Lining Share Price: What happened in the anchor investment round of the IPO?

- Standard Glass Lining Technology, a company specialising in the production of engineering equipment for the pharmaceutical and chemical sectors, successfully raised Rs 123.01 crore through its anchor book on January 3, 2025. The funds were mobilized from a group of nine institutional investors as part of its Initial Public Offering (IPO) process.

- Among these investors, Amansa Holdings, owned by renowned investor Akash Prakash, emerged as the largest buyer. Amansa Holdings acquired 25 lakh shares in the anchor allotment, amounting to an investment of Rs 35 crore. Kotak Asset Management Company was the second-largest investor in the anchor book, purchasing over 14 lakh shares valued at more than Rs 20 crore.

-330

January 13, 2025· 06:43 IST

Standard Glass Lining Share Price: Who are the promoters of Standard Glass Lining

The promoters of Standard Glass Lining are a group of individuals and entities that have played a key role in the establishment and growth of the company. The promoters include Nageswara Rao Kandula, Kandula Krishna Veni, Kandula Ramakrishna, Venkata Mohana Rao Katragadda, and Kudaravalli Punna Rao. Additionally, M/s S2 Engineering Services is also a significant promoter of the company. Together, these promoters provide strategic guidance, leadership, and support to the company, leveraging their expertise and resources to drive its operations and business objectives.

-330

January 13, 2025· 06:42 IST

Standard Glass Lining Share Price: Who are the BRLMs and registrar of Standard Glass Lining IPO?

The Initial Public Offering (IPO) of Standard Glass Lining is being managed by IIFL Securities Ltd and Motilal Oswal Investment Advisors Limited, who are serving as the Book Running Lead Managers (BRLMs) for the issue. Their role involves overseeing the IPO process, ensuring compliance with regulations, and assisting the company in raising capital through the public offering. Additionally, KFin Technologies Limited has been appointed as the registrar for the IPO. The registrar's responsibilities include handling the allocation of shares, processing applications, and managing refund-related processes to ensure a smooth and efficient transaction for all participants.

-330

January 13, 2025· 06:41 IST

Standard Glass Lining Share Price: What's the price band for Standard Glass Lining IPO?

- The price band for the Initial Public Offering (IPO) of Standard Glass Lining has been set between Rs 133 and Rs 140 per equity share. Investors can apply for the IPO in minimum lot sizes, with one lot consisting of 107 shares. For retail investors, the minimum investment required to participate in the IPO is ₹14,980, calculated at the upper price band of Rs 140 per share.

- For Small Non-Institutional Investors (sNII), the minimum investment requirement is 14 lots, which translates to a total of 1,498 shares. At the upper price band of Rs 140 per share, this amounts to a minimum investment of Rs 2,09,720. For Big Non-Institutional Investors (bNII), the minimum investment is set at 67 lots, comprising 7,169 shares. At the same upper price band, the investment required amounts to Rs 10,03,660.

-330

January 13, 2025· 06:40 IST

Standard Glass Lining Share Price: When did the offer open for subscription?

The bidding process for the Initial Public Offering (IPO) of Standard Glass Lining commenced on January 6, 2025, and concluded on January 8, 2025. Following the successful closure of the bidding period, the allotment of shares was finalized on Thursday, January 9, 2025. Subsequently, the equity shares of Standard Glass Lining are set to be officially listed on the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE) on January 13, 2025 i.e. today.

-330

January 13, 2025· 06:38 IST

Standard Glass Lining Share Price: Stock market debut today

The Initial Public Offering (IPO) of Standard Glass Lining is a book-built issue with a total size of Rs 410.05 crore. The IPO comprises two components: a fresh issuance of 1.50 crore equity shares, amounting to Rs 210.00 crore, and an offer for sale (OFS) of 1.43 crore equity shares, aggregating to Rs 200.05 crores. The fresh issue represents the company’s efforts to raise capital, while the offer for sale allows existing shareholders to divest part of their holdings.