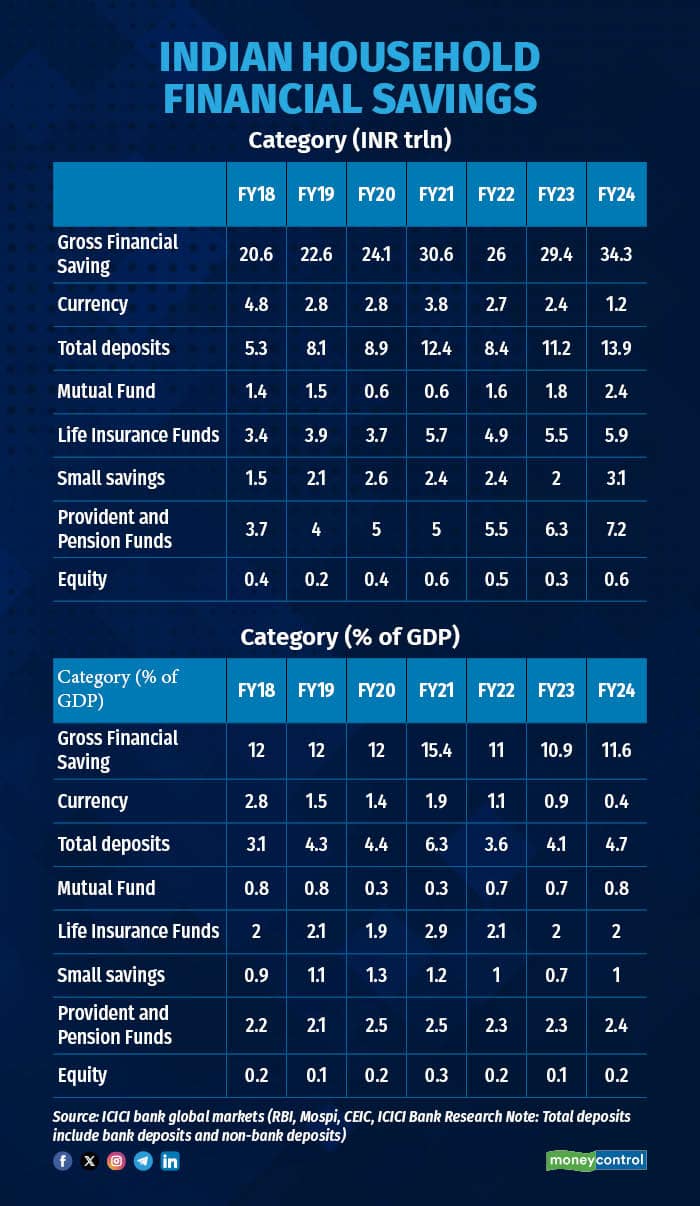

Even though there has been talk for long that household savings are moving from bank deposits to other financial products, especially to the capital market, data published by the ICICI Bank Global Market report for financial year 2023-24 seems to suggest that the share of total household deposits in GDP has increased sharply to 4.7 percent in FY24, from 4.1 percent in the year ago period. This despite the perceived stress in deposit mobilisation for banks.

The share of other financial products such as mutual funds, life insurance funds, provident funds to GDP, on the other hand, has only seen a marginal increase in FY24, over FY23 (see table).

Last year in July, then RBI Governor Shaktikanta Das raised a flag that household savings were moving to the capital markets and other financial products.

“While bank deposits continue to remain dominant as a percentage of financial assets owned by households, their share has been declining with households increasingly allocating their savings to mutual funds, insurance funds and pension funds,” Das said.

As per ICICI Bank's Global Market report, total deposits of households, which includes deposit of banks and non-bank deposits, stood at Rs 13.9 lakh crore at the end of FY24, which was sharply higher than Rs 11.2 lakh crore, representing an increase of 24 percent.

Compared with last year, gross financial savings at Rs 34.3 lakh crore (11.6 percent of GDP) is up by Rs 5 lakh crore over the FY23 inflow of Rs 29.4 lakh crore. The increase was seen due to Rs 2.7 lakh crore increase in deposit mobilisation in FY24.

While banks have seen a deposit inflow of Rs 14.3 lakh crore in the year, housing finance companies have seen an outflow of Rs 1.2 lakh crore which is explained by merger of HFC into a bank.

The report further explained that the lower demand for currency in the year at Rs 1.2 lakh crore as against Rs 2.4 lakh crore in FY23, and withdrawal of the Rs 2,000 note has contributed to deposit inflows into the banking system.

Increase in gross financial assets was also driven by products such as pension funds which have seen an increase in inflow to Rs 7.2 lakh crore FY24 (2.4 percent of GDP) from Rs 6.3 lakh crore (2.3 percent of GDP) last year and investments in mutual funds and equity which have increased to Rs 3 lakh crore from Rs 2.1 lakh crore in the previous year, report said.

Inflows into small savings schemes saw a pick-up to Rs 3.1 lakh crore from Rs 2 lakh crore in the previous year. Inflows into life insurance funds increased at a slightly lower pace to Rs 5.9 lakh crore in FY24 (2 percent of GDP) from Rs 5.5 lakh crore in FY23 (2 percent of GDP), report added.

On the other hand, households’ financial liabilities increased to Rs 18.8 lakh crore (6.4 percent of GDP) driven by a jump in liabilities with the banking sector which increased to Rs 18.8 lakh crore in the year as against Rs 12.5 lakh crore in FY23.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.