The Indian rupee may slide to 82 per dollar this year on account of hawkish US Federal Reserve and global recessionary fears, according to most of the six forex market Moneycontrol spoke to this month.

Wider trade deficits, narrowing India-US interest rate differential and the possibility of rising crude oil prices are also set to keep the rupee under pressure, they said.

However, faced with dwindling forex reserves, the Reserve Bank of India (RBI) may not be aggressive in defending the Indian currency and allow it to catch up with other emerging market (EM) currencies that have dropped more.

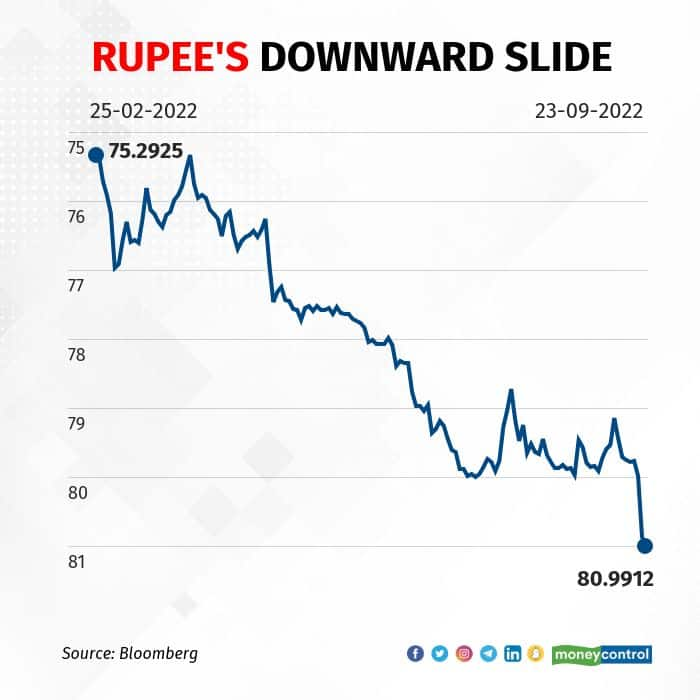

On September 23, the rupee hit yet another record low of 81.26 a dollar in intraday trade, down from 80.87 in the previous session, which was the worst close in the last seven months, according to Bloomberg data.

The rupee has depreciated 1.8 percent this month, so far, and lost 2.4 percent in July-September, data showed. The rupee is down 8.1 percent since January but has fared better than some of its EM peers like the Chinese yuan and the Korean won, which have dropped by 10.43 percent and 15.63 percent, respectively, against the dollar in the same period, according to Bloomberg data.

“A hawkish Fed and recessionary conditions in Europe and China are going to hurt EM currencies. Therefore, till December we could see the rupee trade at 82 levels,” said Anindya Banerjee, vice president - currency derivatives & interest rate derivatives at Kotak Securities.

Europe and China, Banerjee said, are the two of the three largest economic blocks that are facing recessionary conditions. EM economies, including India, have a deep interlink on the trade front with them, he added. A major economic slowdown can not only hurt growth but also impact portfolio flows into India, warned Banerjee.

The rupee has been under pressure since the Russia-Ukraine war began in late February. The war accentuated concerns of inflation across economies amid supply-side constraints. Central banks have begun to hike interest rates aggressively to quell inflationary pressures. This, analysts say, could slow down global growth and spark a recession.

US inflation, for example, rose to 8.3 percent in August, significantly higher than the Fed’s 2 percent target range. The Fed raised interest rates by 75 basis points (bps) to 3-3.25 percent on September 21 and signalled cumulative rate hikes worth 125 bps in 2022 alone. The Fed has raised rates by 300 bps so far in 2022. One bps equals one-hundredth of a percentage point.

The Bank of England has also hiked its base rate by 50 bps to a 14-year high of 2.25 percent. This was the seventh consecutive hike by the central bank, which stated that the UK is already in a recession.

Tighter policy rates and fears of recession have led to a stronger dollar as investors shun risk assets for safe-haven investments. Foreign investors have already pulled out $20.19 billion from India’s debt and equity market so far in 2022, according to data by National Securities Depositories Ltd.

“Widening interest rate differentials and withdrawal of global liquidity, along with persistently elevated inflation, are expected to weigh across risk assets,” said Upasna Bhardwaj, chief economist at Kotak Mahindra Bank. “Against this backdrop of strong US dollar, aided by Fed upping its stance against inflation and weaker Chinese yuan, the EM currencies are likely to remain under pressure.”

Bhardwaj said there is “visible room for rupee depreciation” going forward. She expects the rupee to trade within 79 to 83 per dollar for the rest of FY23.

Also watch: Why The Fed’s Dot Plot Is Spooking Experts And What The Latest Fed Rate Hike Means For India

Odds stacked up against the rupee“Apart from the stronger dollar, the mismatch between dollar demand supply and the widening twin deficit will be the biggest hurdle for rupee strength,” said Dilip Parmar, a research analyst at HDFC Securities. “So, far RBI has managed to neutralise the flows and rupee but if the global economy sinks we will definitely feel the heat which could be rupee negative.”

He expects the rupee to trade in a range of 79 to 82 per dollar in October-December.

According to Anil Bhansali, head of treasury at Finrex Treasury advisors, a higher trade deficit in India would result in a wider current account deficit going forward. This is the key risk to the rupee as imports would be costlier leaving India vulnerable to imported inflation, he said.

India’s merchandise trade deficit in August more than doubled to $28.68 billion from the same period year ago, driven by a sharp jump in imports while exports shrunk. The deficit stood at $11.71 billion in August 2021.

RBI intervention to be less aggressiveAnother reason why the rupee could be under pressure is the likelihood of a less-aggressive intervention by the RBI, said analysts. This could be to allow the rupee to play catch up with other EM peers and protect the fast-depleting foreign exchange reserves, said experts.

The RBI is responsible for maintaining the rupee’s stability. Whenever the rupee has depreciated significantly, the RBI has stepped into the market by selling dollars from its forex kitty. The central bank sold net $19.05 billion in the spot market in July, RBI data shows. India’s foreign exchange reserves have fallen to $550.87 billion as of September 9 from an all-time high of $642.4 billion last year.

“Considering that forex reserves are down to around $550 billion, India’s import cover is currently for about 10 months. Thus, RBI intervention possibly may not turn out to be aggressive, though their interim presence may be felt in the market,” said Kunal Sodhani, vice president, global trading center at Shinhan Bank.

If the dollar is gaining strength globally, the rupee cannot be kept artificially higher and may have to align itself accordingly, added Sodhani.

Arnob Biswas, head of forex research at SMC Global Securities concurred.

“We don't think RBI will offload dollars aggressively to defend the rupee like other Asian central bankers are doing – either with large rate hikes or massive dollar spot selling,” said Biswas.

Most economists do not expect the RBI to be bothered by the narrowing interest rate differential between the India and US at this month’s monetary policy meeting on September 30 and follow the Fed’s aggressive rate hike path. The RBI is expected to hike rates by 35 to 50 bps this month.

CR Forex’s managing director Amit Pabari said the RBI will raise rates by “at least” 30 bps this month.

“Looking at the current fundamentals and global scenario, we expect it to depreciate further towards 81.50 in the near term, and by December 82-82.50 levels can be expected,” he added.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.