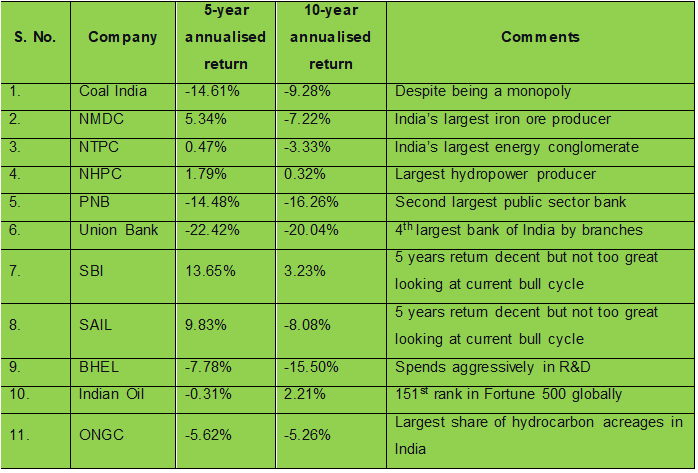

Glance through the following table. It displays the returns generated by a few PSUs (Public Sector Undertakings) in the last five and 10-year periods. All the returns are compounded annually, as on March 23, 2021. Most of them are Maharatnas or Navratnas.

Surprised at the performance?

You can look at the numbers of a few other PSUs as well. The results are not too different.

In my opinion, the following are the reasons for the dismal performance.

Lack of efficiencyYou might have visited a government department sometime in your life or might have heard stories. If that is the level of efficiency, how can you expect the company to grow? And if the company cannot grow, how can we expect its stock to perform?

There is a business behind every stock. When you purchase the stock, you actually purchase the business. Would you like to purchase an inefficient business?

Rampant corruption, which involves politicians most of the timeWhy do think cases such as those of Neerav Modi and Vijay Mallya happen with public sector banks and not private banks? I am sure you got the answer.

Let’s take an example of a scheme launched by the government a few years back – Jan Dhan Yojana. More than 41 crore accounts have been opened under Jan Dhan Yojana as of Feb 2021.

The idea was financial inclusion and to serve the unbanked. When this scheme was launched, the government banks were ‘ordered’ to implement it. When the bank executives approached the public, they realised that many of them did not have the required documents to open the account. This added to the efforts and the cost of opening accounts. But the public sector banks had to do what they were supposed to. Out of total 41.75 crore accounts, 40.48 crores have been opened by PSBs (Public Sector Banks) and just 1.27 crores by private banks.

Having said that, this scheme is expected to yield results in the long-run. It does benefit the underprivileged in the form of keeping the money safe in the banks (rather than keeping cash at home), earning some interest, access to life and medical insurance and other direct-benefits of the government schemes.

But as an investor, I have to look at what is an appropriate investment from growth point of view.

As a citizen I can be happy about the scheme, but as an investor I would stay away from companies which can get impacted negatively from any such government schemes.

Also, how many times have you heard a politician make a statement like “we are committed to grow investors’ wealth”. It may not be a politically correct thing to do. Therefore, stock appreciation is not the objective.

Government policies may be beneficial for the nation, but not for the companyJan Dhan Yojana was just one example. There can be more such cases in future and, as a stockholder, I will not be happy holding such companies.

The above views are more relevant for investors who look at fundamentals of a company before investing and invest for long-term (five-plus years).

Disclaimer: The above article is not stock advice. I (Anupam Roongta) do not own stocks of any of the companies mentioned in this article.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.