Just when it seemed that the Chinese equity markets were on a rebound, they hit a speed-breaker, yet again.

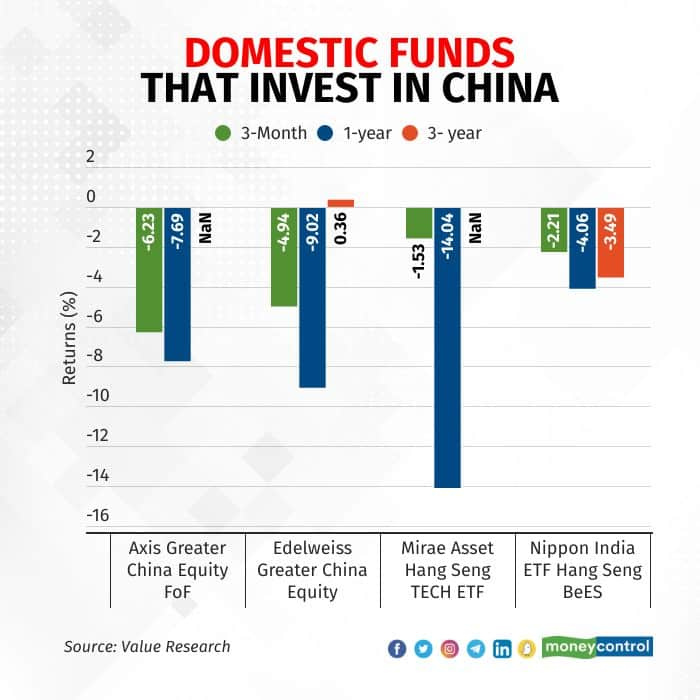

China-focussed mutual fund schemes in India have fallen again. Axis Greater China Equity Fund of Fund is down 6.23 percent since the start of the year, Edelweiss Greater China Equity has fallen 4.94 percent, and Nippon India ETF Hang Seng BeES is down 2.21 percent.

What went wrong?

At the turn of this year, it was expected that China’s economic growth momentum would be sustained with coronavirus infections having peaked in the country, supporting investor sentiment and market performance.

However, things didn’t pan out well for China-focussed schemes.

There are four funds in India that focus on China. Aside from the Axis, Edelweiss and Nippon funds, there is the Mirae Asset Hang Seng TECH ETF.

Since the start of 2022, headwinds such as the property downturn, Covid-19 flare-ups, policy restrictions, and the deceleration of export growth due to the global slowdown had affected the Chinese economy significantly and, in turn, the markets.

Also read | ITR filing: Salaried tax-payer? Know how to choose between forms ITR-1 and ITR-2

“The pickup in the China market since October last year was driven by the reopening of the economy after Covid-19-led lockdowns,” said Niranjan Avasthi, senior vice president at Edelweiss Mutual Fund. “The recent underperformance is due to concerns about the ongoing pace of China’s economic recovery in the coming quarters.”

Till mid-January, China-focussed funds had gained up to 40 percent compared to the preceding three months. This was after a 30-40 percent fall in their net asset value (NAV) from January 2022 to the end of October. Experts had predicted that things would improve from thereon for China-focussed funds in India.

However, there was more gloom than good news for investors in China-focussed equity schemes in 2023.

On a yearly basis, the data is even more depressing. Due to the lukewarm returns, the assets under management (AUM) of China-focussed funds have remained static over the past year. The AUM of such funds inched lower to Rs 2,028 crore at the end of May 2023 from Rs 2,072 crore at the end of June 2022.

Apart from tepid returns, intermittent limitations and restrictions on overseas investments haven’t helped either.

Also read | Equity mutual fund inflows halve to Rs 3,240 crore in May, SIP book hits record high

Questions over China growth

According to Nomura Group’s latest report, China’s post-Covid recovery has been rapidly losing steam. Following the scrapping of the zero-Covid policy on December 7, 2022, and the attainment of herd immunity in January 2023, the Chinese economy staged a decent rebound, led by the release of pent-up demand for in-person services and, to a lesser extent, for new homes.

“However, activity data in April and high-frequency data in May show that the recovery has been losing steam, due partly to weak confidence among consumers and business investors. As disappointment kicks in, we see a rising risk of slower activity growth, rising unemployment, persistent disinflation, falling market interest rates, and a weaker currency,” Nomura said.

Also read | IIFL Finance NCD issue opens today: Should you invest?

The brokerage slashed its 2023 and 2024 annual GDP growth forecasts for China to 5.5 percent and 4.2 percent, respectively, from 5.9 percent and 4.4 percent.

Avasthi of Edelweiss said China’s economy is expected to gradually recover, led by the government’s efforts to drive reforms and prioritise growth with an accommodative and pro-business stance.

What experts say

According to Rushabh Desai, founder of Rupee With Rushabh Investment Services, China's growth is expected to be a little slow this year and it will take more time in terms of recovery.

“China is in a great risk-reward place at this point, but when that risk will turn into reward only time will tell. China funds can be in the satellite portfolio only as a tactical bet. So currently, whoever is invested and is in the negative territory or with flat returns, my suggestion would be not to redeem, and just wait it out. China investment would need at least six-seven years of time horizon,” he said.

Experts believe global diversification should be a key element in everyone’s portfolio, with 5-10 percent allocation depending on one’s risk appetite.

“China is clearly on a tightening regulatory path on a longer-term basis. Short-term they have taken steps to pacify foreign investors, but on a long term, they are becoming more and more stringent in their policies,” said Vikas Gupta, chief executive officer of OmniScience Capital. “Therefore, there is uncertainty regarding regulations and most institutional investors are not willing to buy into the China story. Additionally, there is heightened geopolitical risk, which is compounded by noises about Taiwan.”

Gupta said most investors don’t need to look at China right now.

Also read | MC explains: Why smaller FDs work better than one large FD

For those who wish to invest abroad, it’s best to stick to the time-tested US markets, as and when the window of opportunity to invest there opens up. Other than that, country-specific investments are risky unless one understands the economy well.

Also, when it comes to China, there is the additional risk of strict government controls that can manifest anytime. The government’s actions are also somewhat unpredictable. These risks must be understood – although it’s a high-growth market – before investing in China-specific funds.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.