IIFL Finance is set to open its Rs 300 crore non-convertible debenture (NCD) public issue, which comes with a green shoe option of Rs 1,200 crore, effectively making it a Rs 1,500 crore issue.

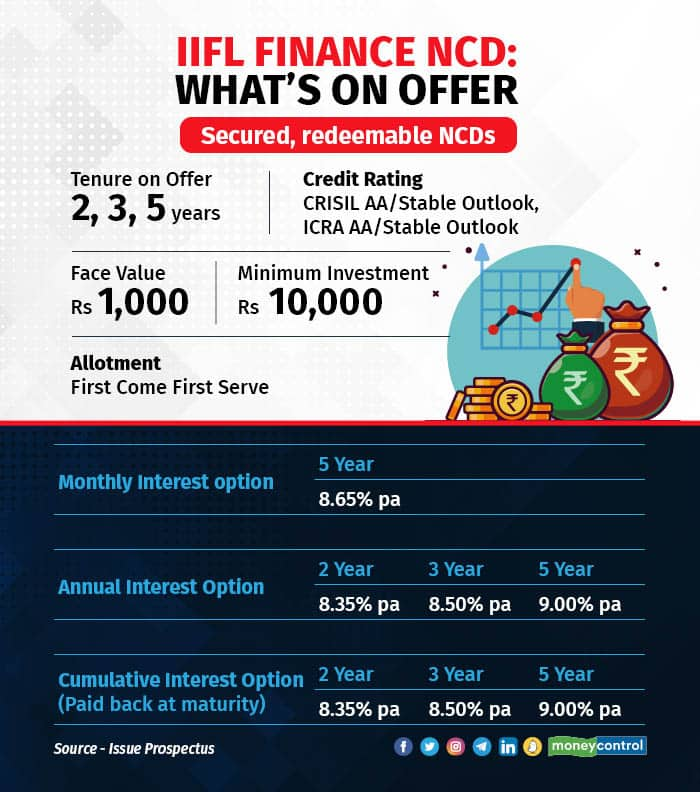

Investors will have an option of choosing from among seven debentures spread across tenures of 24 to 60 months. The coupon ranges from 8.35 to 9 percent a year, with annual and cumulative interest payouts. The monthly payout option is only for the 5-year debenture.

The NCDs come with a face value of Rs 1,000 and you can invest a minimum of Rs 10,000. A demat account is necessary for this issue.

Also read | RBI MPC: Deposit and lending rates remain on a steady path; life goes on as usual, for now

What’s good

With RBI pausing interest rate hikes, speculation is rife around a short-term peak in interest rates. In such a scenario, a 9 percent annual yield can look attractive. IIFL Finance has a diversified asset book with a return on equity (ROE) of around 20 percent, and consolidated annual revenue growth of around 15 percent over the last three financial years.

At 1.84 percent, the gross non-performing asset (NPA) level has improved over the last three years, and the net NPA level is comfortable at 1.08 percent. This gives comfort in terms of risk management of loan assets.

Its capital adequacy ratio of 20.4 percent has come off slightly over the last three years, but remains well above the 15 percent level prescribed by the RBI.

A majority of its loan assets are in the housing and gold loan segments, comprising roughly 66 percent of the assets under management. These loans are backed by physical assets. Good quality loan assets and low level of NPAs are positives for the NBFC’s cash flows.

What’s not

In its Rating Rationale, CRISIL talks of a relatively modest 1.4 percent return on assets in FY22.

Moreover, the financial services space, both lending and non-lending, is highly competitive, and unless costs are controlled, margins could remain under pressure.

Also read | Reaching that crorepati milestone hinges on your commitment to investing

What should you do?

According to Anup Bhaiya, Managing Director, Money Honey Financial Services, “One of the benefits of an NCD issue is that investors can get regular income with relative safety when the issue is from a good company. IIFL Finance is one of the larger NBFCs. If one believes that we are near the peak of the interest rate cycle, there is merit in looking at the longer tenure 5-year bond. This locks in high returns and also has a monthly payout option for those looking for regular income.”

In this, the long-term return for those in the highest tax bracket comes to around 6.2 percent post tax, and for those in lower tax brackets it is as high as 8 percent per annum, based on the old tax slabs.

While the five-year debenture works for regular income, the two-year bond yield, which is higher than bank fixed deposits of a similar tenure, can add to medium-term earnings in your debt portfolio. The bonds will be listed, which means you can exit early if you want to.

However, it is paramount that you understand risks related to NCD investments. Returns are not guaranteed, and in the extreme event of cash flow stress for the company, there is the possibility of a default, with even your capital at risk.

Your decision to invest should be based on your assessment of the company’s ability to fulfill its financial obligations over the time period of your investment.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!