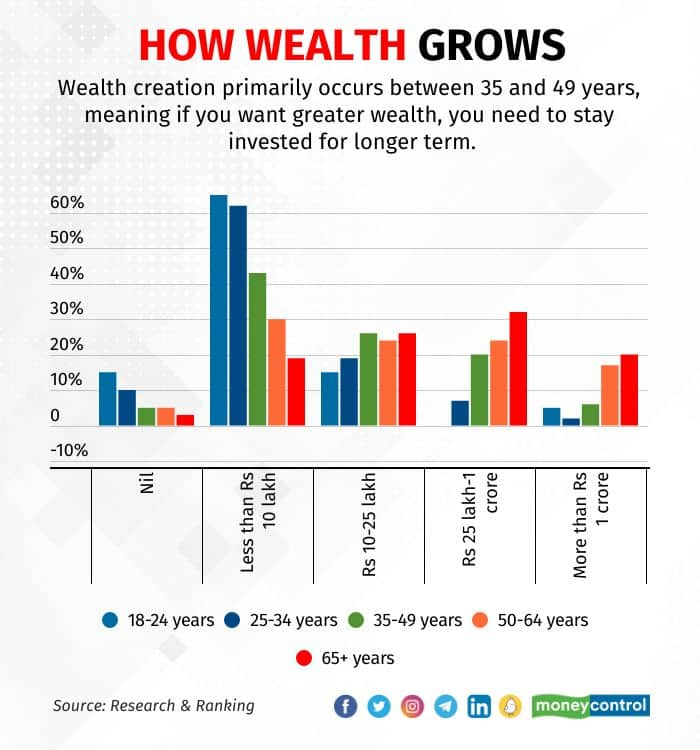

The number of investors with asset portfolios worth at least Rs 1 crore sees a notable surge after the age of 50, highlighting that for accumulating greater wealth one needs to stay invested for the longer term. Also, the process of wealth creation undergoes a substantial acceleration primarily between 35 and 49 years.

Further, as investors get older, they are more comfortable investing by taking a lump-sum approach.

These are the findings of a survey conducted by Research & Ranking, a Securities and Exchange Board of India-registered investment advisory firm, involving 2,000 respondents.

DIY investors

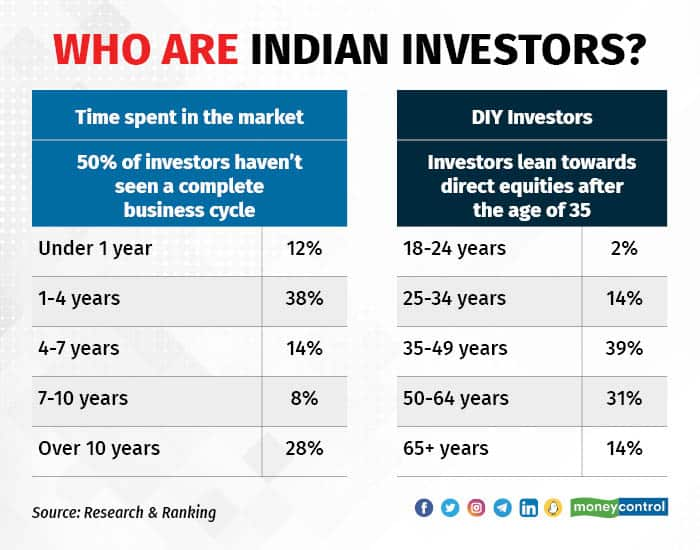

Highlighting the inexperience among Indian investors, the study showed that about 50 percent of investors have spent less than four years in the equity market, with 12 percent falling under the category of having experience of less than one year.

This implies that one investor out of every two is yet to witness a complete business cycle. A business cycle is an interval of expansion followed by a recession in economic activity, which economists estimate to be around five and a half years.

“Discount brokerages, tech-powered investing platforms, affordable high-speed internet, the explosion in entities providing financial education, rising incomes and higher aspirations have empowered a substantial swathe of our citizens to emerge as first-generation investors,” said Manish Goel, Founder and Director of Research & Ranking.

Also read | RBI MPC Meeting: Soon, banks to issue Rupay prepaid forex cards

The survey further highlighted that Indian investors lean towards direct equities after the age of 35, driven by substantial investible funds and a heightened sense of responsibility.

“Contrary to conventional investing norms that suggest reducing equity exposure with age, we can observe a noteworthy number of senior citizens directly investing in equities,” Research & Ranking said in the report.

Further, 58 percent of respondents identified as long-term investors, committed to holding their stocks for a minimum of three years.

About 57 percent leaned towards investing a lump sum in equity, while 43 percent preferred to take the measured and disciplined route of investing through systematic investment plans (SIPs), steadily building their portfolio over time.

Reality check

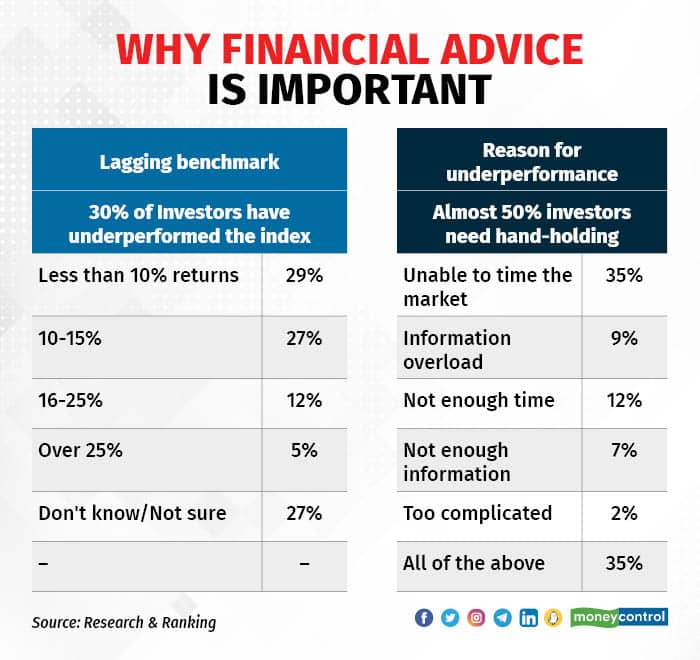

The survey also highlighted that while most individuals prefer to go the do-it-yourself route, around 56 percent of investors confessed to having achieved a compound annual growth rate of less than 10 percent or being uncertain about their performance.

To be sure, the Nifty 50 index has delivered 11.2 percent returns between April 2, 2018, and March 31, 2023. This means almost one out of three investors have admitted that they underperformed the index. The underperformance could be higher as 27 percent aren’t aware of their returns.

Also read | RBI panel proposes measures to improve customer services at banks

The survey further underscored the need for a financial advisor, as 35 percent of the respondents found themselves grappling with uncertainties surrounding optimal buying and selling decisions, as well as the selection of suitable investment opportunities.

An additional 12 percent of investors find themselves constrained by time limitations.

Additionally, 57 percent of those surveyed said they are diligently investing in equity, driven by the goal of achieving early retirement or constructing a robust retirement corpus.

Moreover, a significant 25 percent of respondents had a desire for a lifestyle upgrade.

India-Bharat divide

The survey showed that investors from metro cities are more experienced with the vagaries of the market, with 57 percent of respondents from these cities saying that they have had the privilege of witnessing at least one complete business cycle.

As per experts, exposure to the ups and downs of the market equips investors with the knowledge and wisdom necessary to make informed investment decisions.

Also read | Debt mutual funds 2.0: Life after removal of long-term indexation benefit

As per the survey, the divergence in the proportion of investors between non-metros and metros is most prominent within the 25-34 age group, with non-metro investors commanding a larger share.

However, in higher age groups, this gap gradually diminishes, as there was a higher proportion of metro investors, particularly within the 50-64 age group.

“This observation leads to a compelling inference: the next surge of investors is likely to emerge from non-metro areas,” Research & Ranking said in the report.

The disparity between investors from metros and non-metros becomes significantly more pronounced when it comes to long-term investment compared to other styles of trading.

This observation highlighted that investors hailing from metro areas display a higher degree of comfort and inclination towards long-term investing strategies.

Further, as per the survey, investors from metros exuded a more bullish sentiment towards the stock market during the current fiscal year.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!