Despite the continuing threat of Covid-19, the new global threat in Monkeypox, and the Indian rupee plunging against the dollar, many Indians are still travelling overseas. Airports are crowded and flights are full.

Be that as it may, the one thing you need to sort out before travelling is how much money to carry. And more importantly, in what form you should carry that money. After all, we’ve come a long way from bulky travellers’ cheques and wallets stuffed with cash.

There are two options: cash (yes, it’s still very much on the table, just not tons of it) and a forex card. Moneycontrol recommends that you carry a bit of both. But before we explain why, let’s take a look at what forex cards offer. And why they are a necessary travel companion.

What is a forex card?

A forex card works just like a debit card. It comes loaded with the foreign currency of your choice. When you buy any item abroad, you only have to swipe it at the checkout counter; the money will be debited and the forex balance on your card will reduce.

Most banks, including Axis Bank, HDFC Bank, ICICI Bank, Kotak Mahindra Bank, RBL Bank and so on, offer forex cards. Travel firms and money exchangers such as Thomas Cook and BookMyForex also offer forex cards.

Earlier, forex cards were mostly single currency cards. You could just load your card with a single foreign currency. But times have changed. These days, most banks issue multi-currency cards. For instance, HDFC Bank loads up to 22 different currencies on its forex card. Axis Bank’s forex card can come loaded with up to 16 foreign currencies, while a forex card from BookMyForex supports 14 major currencies.

You just need to tell your bank how much money in specific currencies you want loaded on your card, and it’s done. “This helps customers plan multi-country travel using a single forex card,” says Angshuman Chatterjee, Head Products and Portfolio for Commercial Payments Solutions, Prepaid Instruments and Debit Cards, HDFC Bank.

Should I use my debit and credit cards while traveling abroad?

If you’re thinking of using your debit and credit cards on your travels, you might want to revisit that thought because you have to pay hefty charges when you use these cards abroad. For instance, when you swipe a credit or debit card abroad, some issuers charge you a foreign currency conversion fee (up to 3-3.5% of the transaction value) and a foreign transaction charge (around 2.5 percent to 3.5 percent, again on the transaction value).

What’s more, every time you withdraw money from an ATM abroad using your debit or credit card, you have to pay a withdrawal fee of 1 to 4 percent on the amount withdrawn to the bank.

The new-age global Rupee travel cards, loaded with Indian rupees, are being issued by some neo-banks. But although they are accepted in 180 countries, Rupee travel cards are yet to become popular.

You’ll find everything you wanted to know about Rupee travel cards but were afraid to ask here.

Forex from the bank, money changers or airport?

You can buy forex cards from banks, online portals and airport counters of authorised forex companies. “Buying foreign currency from the airport is the most expensive, so avoid it,” says Sudarshan Motwani, CEO and co-founder of BookMyForex.com.

While buying foreign currency, Deepesh Varma, Senior Vice-President – Foreign Exchange, Thomas Cook (India), insist that you only go to licensed firms as they provide genuine currency notes, thus safeguarding customers from avoidable difficulties in foreign destinations.

“You can buy the currency from banks, but not all foreign currencies are easily available with bank branches when you visit,” says Motwani. To overcome this challenge, Kotak Mahindra Bank has launched doorstep delivery of foreign currencies to existing bank customers. The customer needs to place an order for the foreign currency to be delivered on the bank’s mobile application.

“We recommend that the traveller purchase foreign currency and a forex card from the same bank from a convenience perspective, because you can negotiate the exchange rate,” says Satheesh Krishnamurthy, EVP & Head, Private, Premium Banking & Third Party Products, Axis Bank.

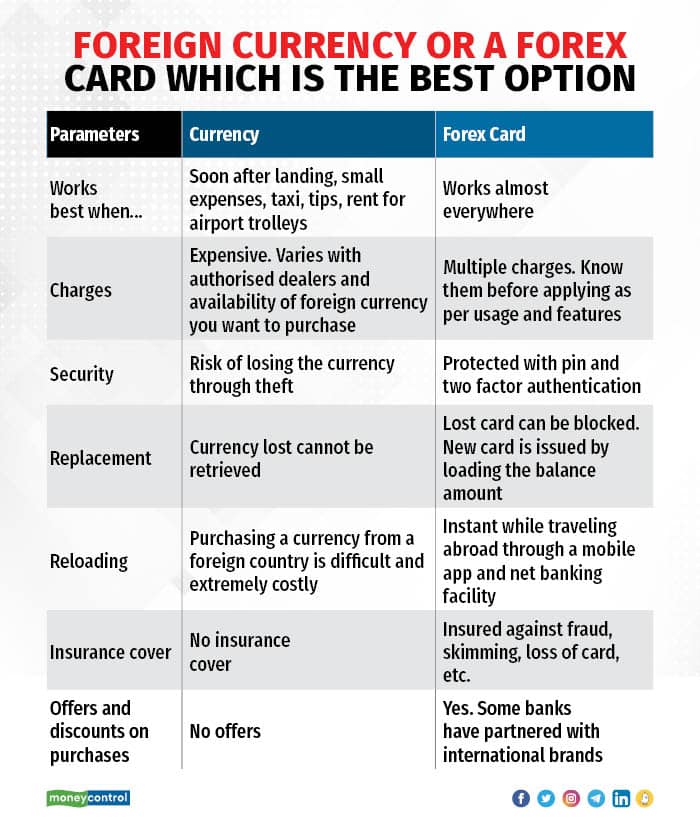

Should I carry a foreign currency or a forex card?

Carry both.

Many countries do not accept forex cards for small-ticket purchases such as buying train tickets, paying taxi fare, rent for airport trolleys, and so on. “For such immediate needs, we recommend having cash on hand; the cash component should be within 10 percent of the total forex value while traveling abroad,” says Varma.

Forex cards offer a range of benefits, including transacting digitally to load and reload. “Forex cards are widely accepted across the globe, offering customers ease of access to ATMs, point-of-sale machines, e-commerce purchases, and a tap and pay feature,” says Chatterjee. All this weighs in favour of the forex card as the better option while travelling abroad.

Moneycontrol suggests a 70:30 ratio. Take around 70% of your money requirements through a forex card and the rest in cash.

The usage of forex cards is restricted in some foreign countries. “The usage of forex cards is restricted in a few Office of Foreign Assets Control (OFAC) countries and other nations that are under international sanctions. The forex cards are freely accepted in other countries across the world such as Azerbaijan, Brazil, Peru, Indonesia, European nations, US, etc.,”explains Puneet Kapoor, President - Products, Alternate Channels & Customer Experience Delivery, Kotak Mahindra Bank.

The cost: foreign currency Vs a forex card

The charges to purchase foreign currency differ from bank to bank and based on the availability of foreign currency with the bank.

“The forex mark-up while buying forex cash depends on the supply and demand, it can start from 30-50 paise, and can go higher depending on the currency,” says Kapoor.

“Buying foreign currency bills can be expensive, and handling cash while travelling exposes you to the risk of theft. It is expensive as authorised dealers may add the cost of handling and storage of cash, and insurance of cash, says Amitabh Bhatnagar, Head, Trade and Forex and Diplomatic Segment, RBL Bank.

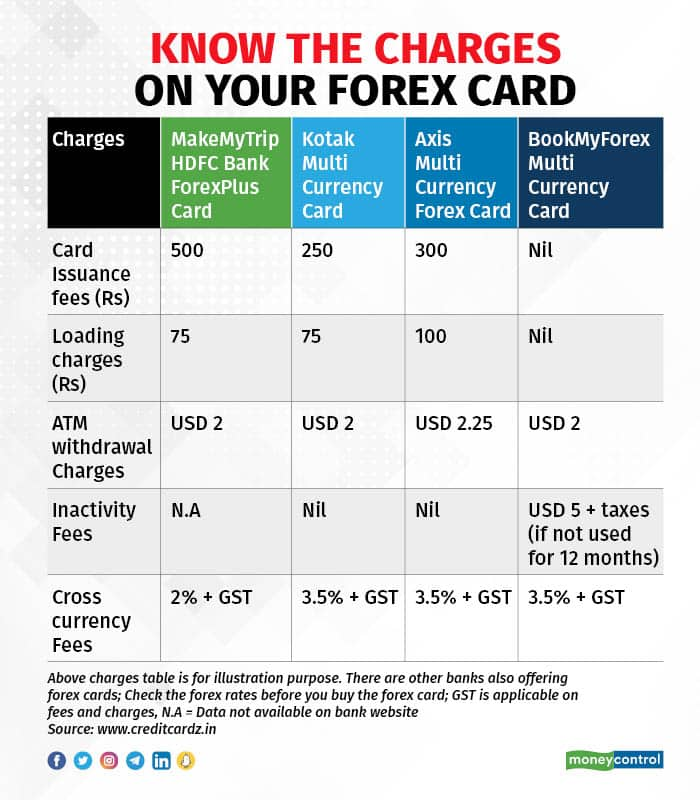

There are multiple charges on forex cards, which vary with the issuing bank. This includes an issuance charge, balance inquiry fees, loading fees, ATM withdrawal, cross currency charges, inactivity fees, etc. (see graphic).

“The price you’re paying for the foreign exchange is also an important element while loading the card,” says Bhatnagar. Users should be aware of these added costs other than the dollar cost, he adds. The charges per dollar may vary from one bank to another. The cost per dollar can range from Rs 80.5 per dollar to Rs 82 or more depending on how well you negotiate.

“There will always be 1 to 2 percent markup fees on interbank rates for conversion of currencies on forex cards,” says Krishnamurthy.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.