In a surprise move, the State Bank of India (SBI) has hiked its effective home loan rate by 20 basis points for new borrowers by widening the spread over its repo rate-linked external benchmark rate. (100 bps=1 percentage point)

This move comes at a time when the bank has reduced its marginal cost of funds-based lending rate (MCLR) across tenures by 15 bps, with effect from May 10. A month ago, the public sector behemoth slashed its repo-linked external benchmark rate (EBR) by 75 basis points, following the Reserve Bank of India’s (RBI) policy action. The increase in effective home loan rates, which comes in the backdrop of a benign interest rate environment, is effective May 1.

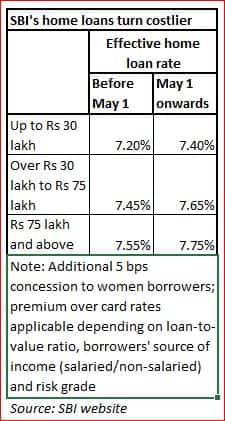

The spreads over the external benchmark rate, which ranged from 15-50 bps across loan amount brackets prior to May 1, have widened to 35-70 bps now. For example, for loans up to Rs 30 lakh, the minimum effective rate will now be 7.4 percent (7.35 percent for women) against 7.20 percent (7.15 percent for women) prior to May 1. Its repo-linked EBR remains unchanged at 7.05 percent.

“The bank might have taken this step to protect its income as the repo rate has dropped substantially, but at the same time the cost of deposits has not gone down as much,” said a senior industry official who spoke on condition of anonymity. However, this mark-up revision will not affect existing borrowers. “The widened spread will be effective prospectively for new home loan customers. This is because components of the spread, barring credit risk premium, mentioned in the home loan agreement cannot be altered for at least three years once the contract is signed,” he added.

From October 1, 2019, all banks have had to mandatorily link their new, floating-rate retail loans to an external benchmark to ensure better transmission of policy rates and greater transparency. Most banks have picked repo rate as their external benchmark. SBI passed on the entire 75 bps repo cut announced by RBI on March 27 to their borrowers promptly from April 1. On the other hand, its one-year MCLR – to which its home loans are linked – fell 35 bps on April 10 and a further 15 bps effective May 10. Even if MCLR-linked and repo-linked home loan rates were to be comparable, the latter hold the edge due to greater transparency they offer – banks have no choice but to pass on entire repo rate revisions to their customers.

“There is no communication from the bank so far on the reasons for this increase in mark-up. It needs to clarify the rationale behind this move at a time when we are in a supremely benign interest rate environment,” said an industry-watcher who did not wish to be named.

SBI had not responded to Moneycontrol’s emails and messages at the time of publishing this story.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.