It’s safe to assume that when students leave Indian shores to study abroad, much of their money matters have already been sorted out.

The course fees have been paid for, either through parents’ savings or an education loans, at least for the first one or two years. The accommodation has been taken care of or at least the funds for is have been earmarked. New clothes would have been bought, especially winter wear. These are the basics.

But things could go off track. Events such as currency fluctuations or unexpected expenses are beyond your control. These unforeseen expenses can derail their well-crafted budgets.

Also read: Planning to apply for education loans? Know the do’s and don’ts

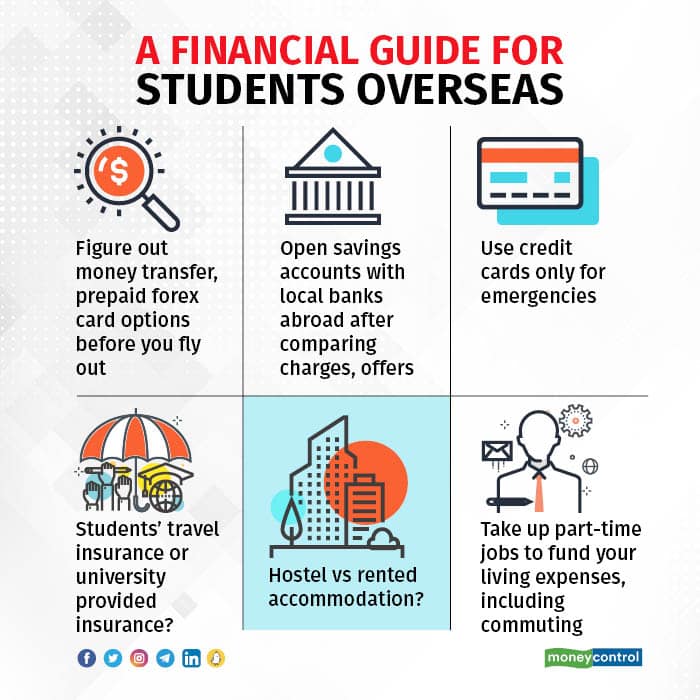

Here are some tips that you can use to ensure that your stay in a foreign country does not run into financial hiccups.

Get prepaid cards, local bank accounts for regular spends

Let’s face it. You need money when you live abroad. To buy you groceries if you’re living in a rented accommodation, to pay for canteen food if you are living in a hostel, for your commute to the college, and impulse spending for an occasional movie outing.

Identify and activate your spending tools; banks accounts to which your parents can transfer funds from India, prepaid cards, credit cards and so on.

For your recurring and other expenses, you can open bank accounts with local banks in the country you are studying in, say experts. “Choose the bank that is most convenient for you. Typically, many banks do visit campuses during freshers’ orientation sessions and offer freebies to students to get them to open accounts. You can use the debit card linked to the account for spending,” says Nisreen Mamaji, Founder and CEO, Moneyworks Financial Services.

Mamaji has, over the years, advised her clients and their children who go abroad to pursue higher education. She adds: “Students should also carry an international card issued in India before they fly out. This can come in handy during emergencies or if there is a delay in money getting transferred abroad. Parents should also shop around for the most competitive forex rates every time they make a transfer,” explains Mamaji.

A prepaid forex card is also a must in your wallet. They offer convenience, besides lower transaction charges compared to credit cards. “Sometimes, money transfer from India could get delayed, which could result in children being stranded abroad without money for a couple of days. Prepaid forex cards come in handy during such times,” she adds.

Use credit cards sparingly

A credit card can be of immense help especially during emergencies or unexpected, but unavoidable, expenses. “For instance, an unplanned, university-mandated trip could come up which parents may not be have budgeted for. You can use the credit card and parents will have 30 more days to arrange for the funds and clear the credit card bills (from India),” says Mamaji.

You might not be eligible for one immediately after moving overseas due to lack of credit history, so you might have to obtain an international credit card – or an add-on along with your parents’ cards - before flying out.

However, ensure that you use your credit card prudently, especially if you are paying for it, abroad. A default due to overspending will affect credit history of your parents in India. If you are using your own credit card issued in your destination country, a default or delayed bill payment will dent your credit score, affecting your chances of securing credit later. It could also be a black mark if you intend to settle down in that country.

Buy adequate health insurance

You ought to have adequate health insurance to take care of medical emergencies or even evacuation, if required. You have to consider options offered by your university, through tie-ups with local insurers, or buy a policy from Indian insurance companies before leaving Indian shores.

Dhaval Mehta, Founder, TNI Career Counselling, believes that students are better off with a policy offered through their universities. "They tend to be tailor-made for overseas students in those universities and offer comprehensive coverage," he says. Some universities, in fact, insist on students buying insurance covers from insurers they have teamed up with.

However, overseas student travel insurance policies offered by Indian insurers are usually cheaper and also cover losses during your trip to your destination country like loss of baggage and passport, flight delays or cancellations and so on.

Start by comparing features of the university-promoted policies with those of overseas student covers in India. The Indian travel policy must tick all the boxes to make sure it’s valid in your destination country. “Even if your university requires you to buy a policy through their tie-ups with local insurer, enquire whether you can buy an equivalent policy in India instead. In such cases, you might have to convince the university that you have adequate health insurance by furnishing your policy’s features and documents,” explains Nikhil Apte, Chief Product Officer - Product Factory (Health Insurance), Royal Sundaram General Insurance.

Also read: Why buying overseas student travel insurance is important

Look for cheaper accommodation, factor in travel expenses

Another important, non-discretionary expense is accommodation. “This would be one of the largest expenses, whether they are living within the campus or outside. In some universities and cities, there is no concept of campus with accommodation. So, you will have to spend on rent elsewhere. Students pursuing MBA, for instance, might have to stay in city centres for better networking opportunities. Then, they will have to spend on commuting to the campus and for various projects,” says Mayank Sharma, Country Head and Head of Global Partnerships, India, Prodigy Finance, a UK-headquartered education finance company.

You will have to compare the rent in your university hostels with accommodation options outside the campus. To start with, however, experts recommend staying in university dormitories on the campus in your first year, even if it turns out to be more expensive. “This is especially true if you are an undergraduate student. At that age, they are more likely to be comfortable staying on the campus. They can look for cheaper accommodation elsewhere in the subsequent years once they are familiar with the locality,” suggests Nisreen Mamaji.

Keep a tight grip on other living expenses

Besides course and accommodation fees, your living expenses budget will have to account for commuting expenses as also recurring expenses such as the cost of books, pens, calculators, regular grocery items, entertainment expenses and so on.

For commuting, student discounts on travel passes will come in handy. “However, suppose you are an MBA student who has to live in a locality that is not necessarily close to your university for the networking and paid internship opportunities it may offer. In such cases, your commuting expenses could be substantial,” explains Sharma.

You can fund these expenses by taking up part-time assignments, which are easily available in most countries subject to student visa restrictions, say experts.

But you should curb your urge to splurge. “Children should be taught to be prudent. For instance, they can plan their grocery shopping in advance and visit localities farther from their universities for cheaper bulk deals or supermarkets that offer discounts,” says Mamaji.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.