Life Insurance products, be it ULIPs or traditional endowment plans help inculcate a forced saving habit in you. Being long-term products, they ensure that you make a good amount of money that will help you to achieve your dreams. For traditional endowment plans, bonus declared by the insurer along with the regular premiums paid help in reaching the financial goal whereas market-linked returns offered under ULIPs help to create wealth for you.

Mahavir Chopra, Director - Health, Life & Strategic Initiatives - Coverfox.com said that today’s new age low-cost online ULIPs are one of the best tools for making money and getting an insurance cover through a single product. The low cost on ULIPs helps investors generate better returns than other investment products. “If you are an aggressive investor, you could go with equity funds and if you are a risk-averse investor, you can go with balanced or debt funds,” he said.

Among life insurance products, ULIP’s are the best investment tool to create wealth, especially the new age 4th Generation Ulips which over the years, have gone through several changes.

Here are some tips which you can help you create wealth by investing in ULIPs

Make use of the switching optionFor generating better returns and making money use the switching and premium redirection facility offered by ULIPs to your full advantage. “One should move his money into debt funds when the markets are climbing and into equities when the markets are down. Applying this strategy even 2 to 3 times in your investment horizon of 20 years will help in achieving your goals. Then, as the maturity period comes closer you can move to balanced funds and sit back and relax,” said Chopra.

Make a long-term investment and enjoy the benefit of Power of Compounding

Five year lock in period of ULIP ensures that there is long term orientation for investment. It helps the money grow as the power of compounding comes into picture if you are invested for a longer period say 10-15 years. It means that your money will be reinvested for the principal amount to grow year after year.

Santosh Agarwal- Head of Life Insurance, Policybazaar.com said if your investment is linked to any financial goal and you are serious about creating wealth it is advisable to stay invested for at least 10-15 years. The historical returns say ULIPs have generated 12-15% of return for the longer duration investment. “Now the new age ULIPs which are cost-effective and better version of the past ULIPs, the investor will surely get better returns out on the investment,” she said.

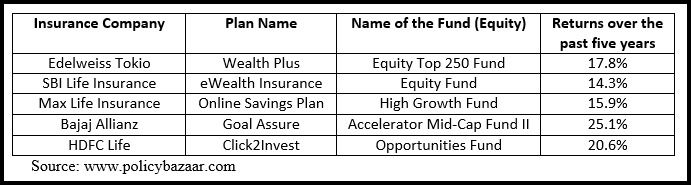

Below Data updated on 24th May 2018 shows ULIPs equity fund returns.

Investing money through ULIPs gives you a benefit of EEE taxation benefit where your money is not taxed from investment to making withdrawals. It also offers different fund options to investors such as equity funds, debt funds and balanced funds. “Equity funds provide far better returns than other funds if you stay invested for a longer term. However, the investment in equities comes with a clause higher the risk better the returns. Equity Funds investment through a ULIP can be a best option to create wealth for the future,” said Agarwal.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.